· Shares down, dollar ticks up as U.S. stimulus talks drag

Asian shares fell on Thursday and the dollar edged higher as investors fretted over the slow pace of U.S. stimulus talks and a surge in global cases of COVID-19.

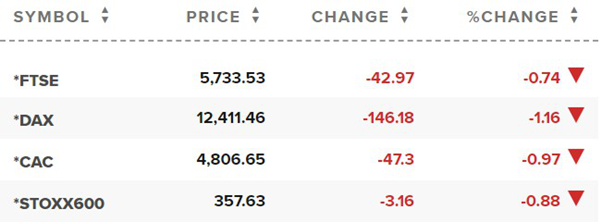

The falls in Asia looked set to continue in Europe, putting European shares on track for a fourth straight session in the red.

Global investor sentiment has taken a fresh hit after U.S. President Donald Trump accused Democrats on Wednesday of being unwilling to craft an acceptable compromise on fresh stimulus, following reports of progress earlier in the day.

It remains unclear whether stimulus negotiations would continue ahead of the U.S. presidential and congressional elections on Nov. 3.

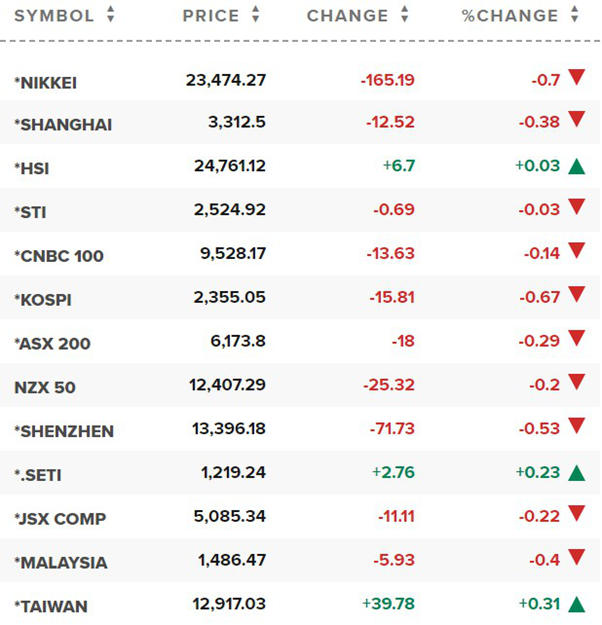

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.31%, while the Nikkei .N225 was 0.66% lower.

· Japan stocks end lower as firmer yen, U.S. political uncertainty weigh

Japanese shares ended weaker on Thursday, as a firmer yen threatened earnings of exporters and amid fears that agreement on a key U.S. stimulus bill will not be reached until after the presidential election on Nov. 3.

The Nikkei 225 Index ended down 0.70% at 23,474.27, while the broader Topix fell 1.09% to 1,619.79.

The yen jumped to a one-month high against the dollar on Wednesday as investors grew more concerned about stalled negotiations over a new round of U.S. fiscal stimulus.

Some traders are also reducing their exposure to riskier assets ahead of the U.S. elections, which could cap gains in Japanese shares. Rising COVID-19 cases in Europe and the United States also hurt sentiment.

· China stocks end lower as healthcare, industrials firms weigh

Chinese shares closed lower on Thursday, with healthcare and industrials stocks leading the declines, as investors looked past policymakers’ vow to balance the need for stable economic growth and preventing financial risks.

The blue-chip CSI300 index ended 0.3% lower at 4,777.98, while the Shanghai Composite Index shed 0.4% to 3,312.50.

The CSI300 healthcare index dropped 1.6% as vaccine makers retreated, while the CSI300 industrials shed 1.1%.

· European markets fall as U.S. stimulus talks drag on

European stocks opened in negative territory Thursday amid continuing uncertainty over U.S. coronavirus stimulus.

The pan-European Stoxx 600 dropped 0.9% in early trading, with autos shedding 1.5% to lead losses as all sectors and major bourses slid into the red.

U.S. stimulus talks remain in focus for global markets with uncertainty over whether a deal can be reached before the Nov. 3 presidential election. However, comments on stimulus talks from House Speaker Nancy Pelosi’s deputy chief of staff, Drew Hammill, offered some room for optimism Wednesday.

British Airways owner IAG posts 1.3 billion euro loss, cuts schedule

Reference: Reuters, CNBC