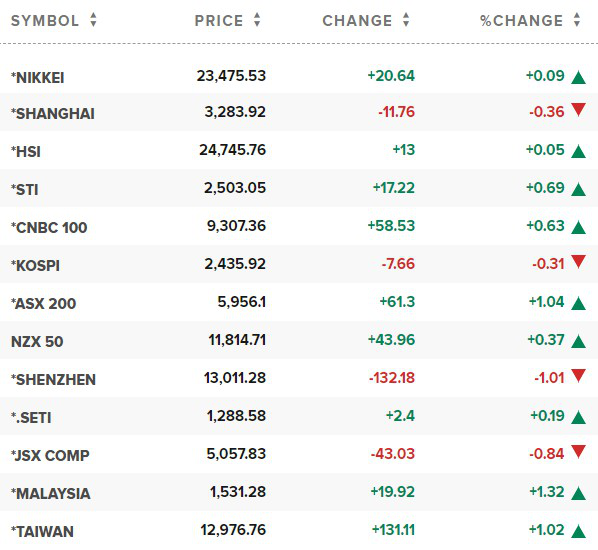

· Asian stocks edge higher as investors await Fed statement

Most Asian shares rose on Wednesday, extending a rally driven by upbeat Chinese and U.S. economic data, but investors showed little appetite for big bets as they awaited the Federal Reserve’s view on the economy at its policy meeting.

Following robust industrial output and retail sales data from China and higher U.S. factory production investors are focusing on the Fed’s policy statement due Wednesday, the first since Chair Jerome Powell announced an increased tolerance for higher inflation.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.4% higher. Australian shares gained 0.97% and Taiwan’s tech-heavy board added 1.02%.

· Japan shares end higher as investors eye Fed policy stance

Japanese stocks ended marginally higher on Wednesday on expectations that the U.S. Federal Reserve would reinforce its commitment to keeping rates low at a meeting later in the day.

The Nikkei 225 Index finished trade up 0.09% at 23,475.53, with the telecommunications and healthcare sectors leading gains. The broader Topix rose 0.21% to 1,644.35.

Many investors were on the sidelines ahead of the Fed’s policy statement. While no major change in policy is expected, the central bank is likely to emphasise that interest rates will remain low for an extended period, analysts said.

Market focus was also on the Bank of Japan’s policy decision, due on Thursday, with the central bank expected to leave its monetary easing stance unchanged.

· China shares snap rally as experimental vaccines stoke safety concerns

China stocks snapped a three-session rally to close lower on Wednesday, with consumer and healthcare shares leading losses, as experts were concerned over the safety of drugs used in experimental coronavirus vaccines in the country.

At the close, the Shanghai Composite index was down 0.36% at 3,283.92.

The blue-chip CSI300 index was down 0.66%, with its financial sector sub-index slipping 0.23%, while the real estate index closed 1% firmer.

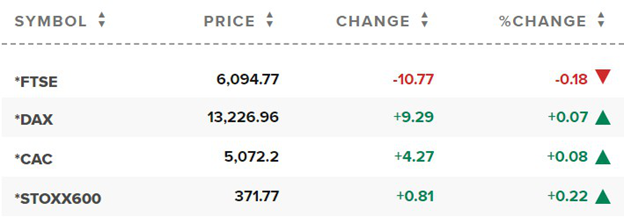

· European markets inch higher as investors await Fed outcome

European stocks were mostly higher Wednesday morning, as investors await the outcome of a two-day meeting of the U.S. Federal Reserve’s Federal Open Market Committee (FOMC).

The pan-European Stoxx 600 inched 0.3% above the flatline in early deals, retail stocks adding 1.4% while the travel and leisure sector fell 0.5%.

Reference: CNBC, Reuters