· Asia stocks mixed, dollar struggles to rally

Asian share markets were mixed on Monday as U.S. lawmakers struggled to hammer out a new stimulus plan amid a global surge of new coronavirus cases, though a squeeze on crowded short positions left the dollar clinging to a tentative bounce.

Sentiment was helped by a survey showing China’s factory activity expanded at the fastest pace in nearly a decade in July, with the Caixin/Markit PMI at 52.8.

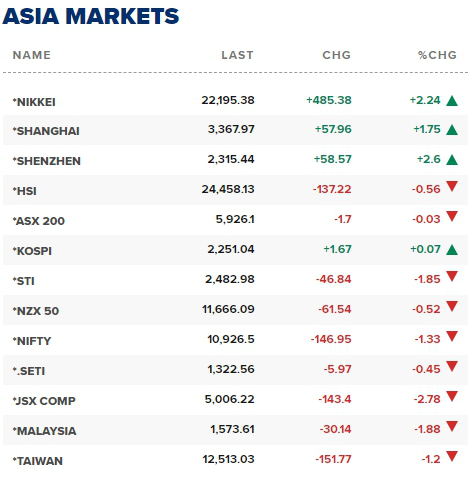

That lifted Chinese blue chips 1.22% .CSI300. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.05%, though that was from a six-month top.

Japan's Nikkei .N225 added 2.2% courtesy of a pullback in the yen, while South Korea shares .KS11 were flat.

E-Mini futures for the S&P 500 ESc1, EUROSTOXX 50 futures STXEc1 and FTSE futures FFIc1 were all little changed.

Investors were nervous at the lack of a new stimulus package in the United States with White House Chief of Staff Mark Meadows not optimistic on reaching agreement soon on a deal.

· Japan jumps 2% as Chinese economic data comes in above expectations; HSBC shares in Hong Kong sink

Stocks in Asia Pacific were mixed on Monday as U.S.-China tensions continue to heat up.

In Japan, the Nikkei 225 jumped 2.24% to close at 22,195.38, while the Topix index advanced 1.78% to end its trading day at 1,522.64. Those moves followed the nearly 3% tumble in Japanese stocks on Friday.

Mainland Chinese stocks were higher on the day, with the Shanghai composite up 1.75% to about 3,367.97 and the Shenzhen component rising 2.395% to around 13,964.56.

The Hang Seng index in Hong Kong shed 0.56% to close at 24,458.13. Hong Kong-listed shares of HSBC sank more than 4% after the bank on Monday reported a 65% plunge in its pre-tax profits for the first six months of 2020.

· European stocks mostly lower with U.S. stimulus talks, earnings season in focus

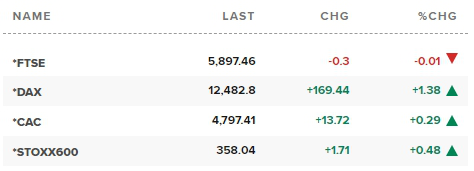

European stocks mostly inched lower Monday morning as another big week for corporate earnings kicked off, while U.S. lawmakers attempt to hammer out a new coronavirus aid package.

The pan-European Stoxx 600 slid 0.2% in early trade, with travel stocks shedding 1.8% to lead losses while chemicals and autos each added 0.6%.

European markets received a mixed handover from Asia Pacific, where Japanese and mainland Chinese stocks bounced after a private survey showed China’s manufacturing activity expanding by more than expected in July, while most indexes in the region slid into the red.

Reference: CNBC, Reuters