· Dollar wobbles as investors grow anxious about pandemic toll on U.S. economy

The U.S. dollar gave up brief early gains on Monday as mounting concerns about a slowing U.S. economic recovery from the coronavirus pandemic hobbled the currency after a brief rebound late last week.

The euro traded almost unchanged at $1.1768, coming off a low of $1.1741 touched earlier in the session, though it is still more than a cent below Friday’s two-year high of $1.1908.

The common currency hit a speed bump on some technical signs of being over-bought in the near-term, and with speculators’ long positions hitting a record level, said Minori Uchida, chief currency analyst at MUFG Bank.

U.S. bond yields have fallen to their lowest level since the pandemic-induced market turmoil in March, with the 10-year rate slipping to near 0.50%, undermining the yield attraction of the dollar.

U.S. bonds looked even less attractive when adjusted for inflation expectations, with the yield on inflation-protected U.S. 10-year Treasuries falling to a record low below minus 1%.

The dollar changed hands at 105.90 yen, giving up early gains to 106.44, which traders saw as an extension of Friday’s rebound from 4-1/2-month lows of 104.195 triggered in part by month-end buying.

Investors have reasons to worry about the U.S. outlook as policymakers have so far struggled to clinch a deal to pump more money into the world’s largest economy even as an expanded unemployment benefit, worth about $75 billion per month and accounting for nearly 5% of personal income, expired on Friday.

Traders are also keeping an eye on intensifying tensions between Washington and Beijing on many fronts, including trade, technology and geopolitics. Over recent days, U.S. President Donald Trump has threatened to ban TikTok, a popular video app run by China’s ByteDance.

Secretary of State Mike Pompeo said on Sunday Trump will take action shortly on Chinese software companies that are feeding data directly to the Beijing government, posing a risk to U.S. national security.

· Russian manufacturing activity shrinks faster in July: PMI

Activity in the Russian manufacturing sector shrank faster in July as the crisis sparked by the novel coronavirus and poor demand weighed, the Markit Purchasing Managers’ Index (PMI) survey showed on Monday.

The index’s headline reading fell to 48.4 from 49.4 the month before, remaining below the 50.0 mark that separates expansion from contraction for the 15th month in a row.

Having plunged to a record low of 31.3 in April, the first month of pandemic-related lockdowns in Russia, the headline PMI index has recovered steadily. The output component expanded in July for the second straight month.

· ADB sees pandemic slashing 2020 global remittances by over $100 billion

Remittances across the world could decline by $108.6 billion this year as job losses mount and employers trim payrolls amid a COVID-19 pandemic that has devastated economies, according to a report by the Asian Development Bank.

Money sent to Asia, where about a third of migrant workers worldwide come from, could fall by $54.3 billion, or about a fifth of baseline remittances, the Manila-based lender said in the report released on Monday.

Remittances to Asia and the Pacific, which amounted to $315 billion in 2019, help fuel the consumption-led growth for some of the region’s developing economies, including the Philippines.

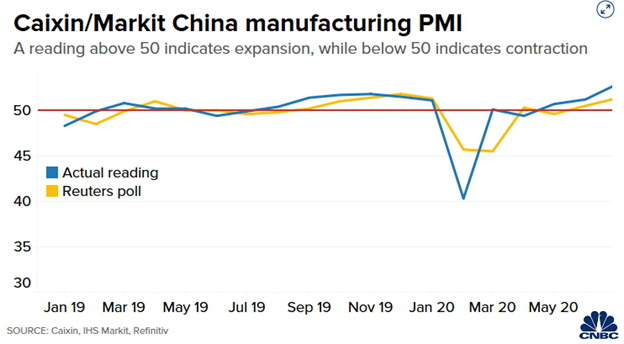

· A private survey showed China’s manufacturing activity expanded at the fastest pace in nearly a decade

The Caixin/Markit manufacturing Purchasing Managers’ Index (PMI) for China came in at 52.8 for July.

Economists polled by Reuters had expected Caixin/Markit manufacturing PMI to come in at 51.3 for July as compared to 51.2 for June.

The private survey showed that policy stimulus is helping the world’s second largest economy in its recovery from the pandemic, said Julian Evans-Pritchard, senior China economist at Capital Economics, a consultancy.

· U.S., China must ‘step up’ to lead in the coronavirus crisis or emerging economies may sink, experts say

Developing economies have spent far less on tackling the pandemic compared to developed countries, said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business.

The two largest economies in the world, the U.S. and China, have to “step up to the plate” and provide global leadership, during a time when the world’s poorest countries are in trouble, Rajan said.

Tharman Shanmugaratnam, a senior minister in Singapore and chairman of the country’s central bank, pointed out that most of the growth today — or about two-thirds of global growth — comes from the emerging world.

· Menon, who is executive director of investment strategy, wealth management Singapore at OCBC Bank, cited factors such as U.S.-China tension as well as upcoming economic data releases that are expected to bring a “mix of good news and bad news” as factors behind his view. He added that investors should brace themselves for “very choppy markets.”

· Hong Kong issues arrest warrant for U.S. citizen under new national security law

A U.S. citizen is among six pro-democracy activists to have arrest warrants issued for them by Hong Kong police for suspected violations under a new national security law, Chinese state media reported late Friday.

· Vietnam virus outbreak hits factories employing thousands in Danang epicenter

The coronavirus outbreak that began in the central city of Danang more than a week ago has spread to at least four factories in the city with a combined workforce of around 3,700, state media reported on Monday.

Four cases were found at the plants located at different industrial parks in the central city which collectively employ 77,000 people, the Lao Dong newspaper said

· Oil falls on supply glut fears as OPEC+ set to boost output

Oil prices fell on Monday on oversupply concerns as OPEC and its allies wind back production cuts in August and a rise in worldwide COVID-19 cases points to a slower pick-up in fuel demand.

Brent crude futures slid 26 cents, or 0.6%, to $43.26 a barrel by 0253 GMT. U.S. West Texas Intermediate (WTI) crude futures were down 29 cents, or 0.7%, at $39.98 a barrel.

Brent posted a fourth month of gains in July and U.S. crude posted a third as both rose from depths hit in April, when much of the world was in lockdown due to the coronavirus pandemic.

“Investors are worried about oversupply as the OPEC+ is due to start reducing production cuts this month and a recovery in oil prices from record lows is likely to encourage U.S. shale producers to ramp up output,” said Hiroyuki Kikukawa, general manager of research at Nissan Securities.

“Also, fears over a resurgence in the coronavirus cases are weighing on oil markets,” he said.

Reference: CNBC, Reuters