The gold market is seeing its best monthly performance in more than eight years and although there are strong expectations among retail investors for momentum to carry prices higher, sentiment is starting to shift among Wall Street analysts.

The latest Kitco News weekly gold survey showed that while the majority of Wall Street analysts are still bullish on gold prices next week, sentiment has fallen to its lowest level in nearly two months. In comparison, bullish sentiment in the survey hit a record high at the start of July.

Looking at the retail side, not only are investors bullish on gold but all-time highs are attracting new interest in the marketplace. Kitco’s online response from retail investors reached its highest level in more than 2 years.

While sentiment among analysts dropped in the latest survey, only a few participants are bearish on gold; many analysts see the potential for short-term correction, they note there are still strong fundamental reason why gold prices should push above $2,000 an ounce.

“Prices are overheating and $2,000 could be an attractive level where traders take some profits but global monetary policy and currency debasement will continue to support prices through the rest of the year,” said Eugen Weinberg head of commodity research at Commerzbank.

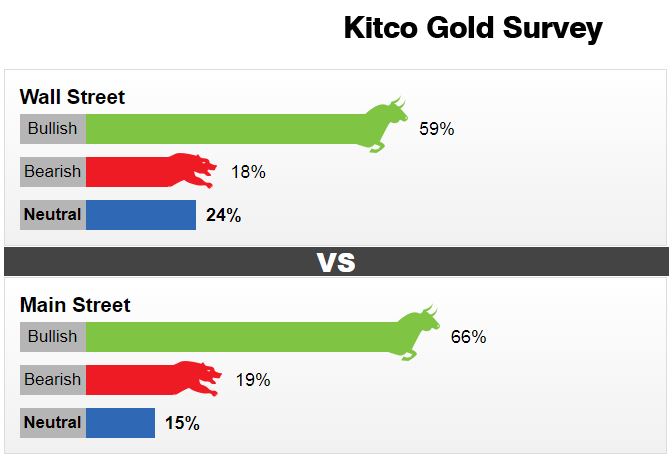

This week, 17 Wall Street professionals took part in this week’s poll, 10, or 59%, called for gold prices to rise. Three analysts, or 18%, predicted lower prices. Meanwhile, four analysts, or 24%, expected prices to trade sideways.

A total of 2,075 votes were cast in an online Main Street poll. Of these, 1,375 respondents, or 66%, looked for gold to rise in the next week. Another 385, or 19%, said lower, while 315 voters, or 15%, were neutral.

Both Wall Street and Main Street were expecting to see gold push higher for the current trading week and once again they have not been disappointed. As of 12 p.m. EDT, Friday, Comex December gold futures last traded at $1,990 an ounce, up nearly 5% compared to the previous week. This is the second consecutive week gold has rallied 5%.

George Gero, managing director at RBC Wealth Management, said that with the market’s strong momentum it is difficult to see gold prices going lower in the near-term.

“Right now gold is the only safe-haven for people with impaired currencies,” he said.

However, Gero added that it in the current environment gold will be a difficult trade as volatility increases with record high prices. He said that investors need to be more strategic looking to buy on dips and take profits on rallies.

Phillip Streible, chief market strategist at Blue Line Futures is also recommending investors buy dips. He added that the market’s current shallow corrections is an indication of underlying strength.

“I don’t think you should buy the breakout above $2,000 he said. You run the risk of buying at the top,” he said. “Look to buy on dips around $1,900.”

For neutral analysts, they said that the $2,000 represents a major barrier in the near-term.

“Gold could surprise markets by smashing into the psychological $2000 level next week,” said Lukman Otunuga, senior research analyst at FXTM. “However, the precious metal look heavily overbought and may need to retrace before challenging this all-time high.”

For the bears in the marketplace, they said that gold is becoming a crowded trade.

“The world wants to be long,” said Frank McGhee, precious metals dealer at Alliance Financial.

Reference: Kitco