· · Dollar on course for worst month in decade as epidemic hobbles U.S. economy

The dollar slipped to two-year lows on Friday and is on track to post its biggest monthly decline in 10 years, as investors worried that a recovery in the U.S. economy would be hampered by the country’s struggle to stem the coronavirus epidemic.

Confidence in the U.S. currency was undermined further after U.S. President Donald Trump raised the possibility of delaying the nation’s November presidential election.

The dollar index fell to 92.597, a low last seen in May 2018, and is on course to post its steepest monthly fall since September 2010. It has fallen 4.9% so far this month.

The euro hit a two-year high of $1.1905 and last traded at $1.1883, having gained 5.8% so far in July, the biggest gain in a decade.

Against the yen, the dollar hit a 4 1/2-month low of 104.195 yen and last stood at 104.36, having lost 3.3% this month.

Likewise the British pound stood at $1.3122 after hitting a 4 1/2-month high of $1.3143.

· 10-year Treasury yield falls close to 0.52% after record GDP contraction

Treasury yields continued to move lower on Friday morning after a week where the Federal Reserve iterated a dovish message and held rates, and new data showed the U.S. economy shrank at a record pace.

At around 2:00 a.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, was lower at around 0.5233%, while the yield on the 30-year Treasury bond was lower at 1.1764%.

· Euro zone GDP plunged by a record 12.1% in the second quarter

The euro zone economy contracted by 12.1% in the second quarter of 2020, compared to the first three months of the year, according to preliminary data from the region’s statistics office.

Friday’s reading is the lowest since records began in 1995. The region’s largest economies contracted by two-digits during the period due to strict lockdown measures

brought about by the coronavirus pandemic. German GDP (gross domestic product) contracted by 10.1%; Italy’s sank by 12.4%; France’s fell by 13.8%; and Spain’s shrank by 18.5%.

The 19-member bloc that shares the euro currency had experienced a fall of 3.6% in GDP during the first quarter. Spain, Italy and France’s GDP rates dropped by over 5% during that period.

· China’s factory activity beats expectations in July and expands for the fifth month, official PMI shows

China’s factory activity expanded in July for the fifth month in a row and at a faster pace, beating analyst expectations despite disruptions from floods and a resurgence in coronavirus cases around the world.

The official manufacturing Purchasing Manager’s Index (PMI) rose to 51.1 in July from June’s 50.9, official data showed on Friday, marking the highest reading since March. Analysts had expected it to slow to 50.7.

The 50-point mark separates growth from contraction on a monthly basis.

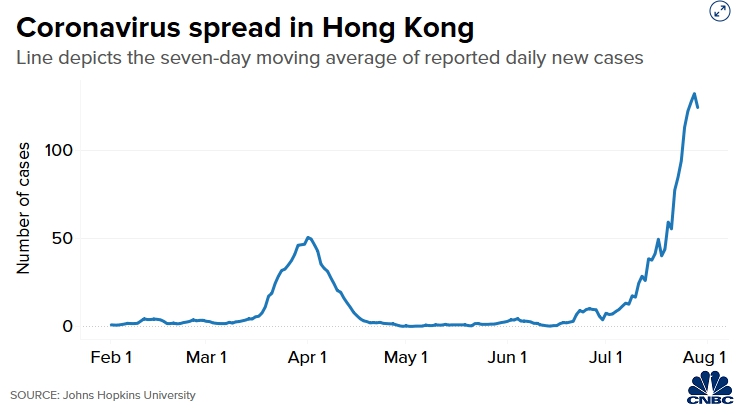

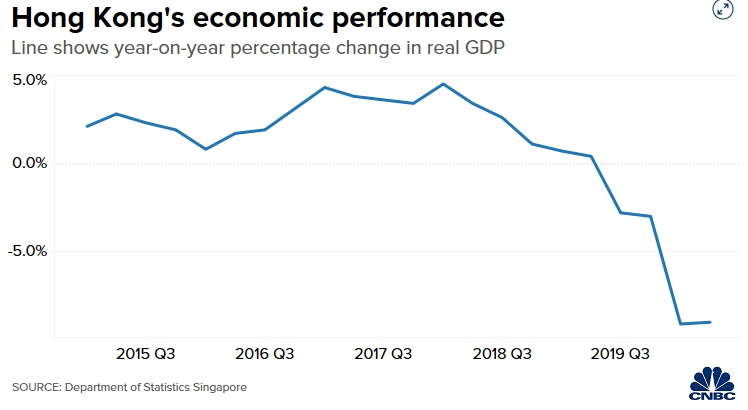

· Analysts cut Hong Kong forecasts as resurgence dims economic outlook

Several economists have downgraded their economic forecasts for Hong Kong as the Asian financial hub experiences a surge in coronavirus cases. The rise in new infections forced authorities to impose stricter social-distancing measures this week.

Hong Kong said Wednesday that advance estimates showed its economy contracted by 9% in the second quarter compared to a year ago. It was the fourth consecutive quarter of on-year contraction, according to official data.

The government said a renewed outbreak locally “clouded the near-term outlook for domestic economic activity.”

Economists concurred that the stricter social-distancing measures imposed after a recent uptick in cases will dampen any economic momentum. Some don’t agree with the government that recovery may come as soon as this year.

· Vietnam reports record rise in cases as infections jump in Danang

Vietnam reported 45 new cases in the city of Danang — making it the largest single-day increase in the country, Reuters reported Friday citing the health ministry. That brings the total number of cases in Vietnam to 509. There have been no deaths.

The new cases were patients aged between 27 to 87 and are linked to three hospitals and two clinics in Danang, a central coastal city.

· Oil on track for monthly gain as dollar supports

Oil prices rose on Friday and were on track for monthly gains, boosted by a weaker dollar in the face of continuing concerns over the recovery of the U.S. economy as the coronavirus ravages the world's biggest economy and oil consumer.

Brent crude was up 31 cents, or 0.7%, at $43.25 a barrel by 0831 GMT. On Thursday, Brent closed 1.9% down after touching its lowest since July 10.

U.S. crude gained 26 cents, or 0.6%, to $40.18 after dropping 3.3% in the previous session, also off lows not seen since July 10.

Reference: CNBC, Reuters