Gold falls below $1,500 as it is dragged into the global market rout

· Gold has been swept up in the broad market sell-off to fall below $1,500 on Monday, down $200 from its peak early last week.

· The precious metal hit a low of $1,456.8, its lowest level since Nov 27, and traded below its 200-day moving average level of $1,497.4 for the first time since Dec 20, 2018 on an intraday basis.

· By mid-afternoon in Europe, spot gold was trading at $1,472.3, while stock markets around the world continued to tumble at an alarming pace.

· Gold typically performs well during market sell-offs owing to its traditional role as a so-called “safe haven,” but it has not been immune to this past week’s global stock market plunge as the coronavirus pandemic takes hold.

· Analysts are attributing the historic fall over the past week to a “dash for cash” as investors abandon all asset classes in favor of parking their money and cutting losses.

· Adrian Ash, head of research at online trading platform BullionVault, told CNBC on Monday that markets were seeing a “dash for cash” and projected further downward price momentum in the short term. He said the usual consumer demand for jewelry remained absent, and many funds and investors were closing out positions and take profits from the metal’s surge in recent months.

However, he highlighted that there remained high demand for gold as a long-term value asset, with BullionVault experiencing the heaviest two-week inflow into gold since the aftermath of U.S. President Donald Trump’s election in November 2016.

· Platinum plunged nearly 27% on Monday to its weakest level since 2002, while gold dived over 5% as investors unloaded precious metals in exchange for cash after a second emergency U.S. rate cut failed to quell coronavirus fears across markets.

· Palladium dropped 5.3% to $1,711.50 per ounce, the lowest since end-August, while silver slumped 10.9% to $13.09, a level last seen in 2009.

· By 1700 GMT, platinum was down 13.2% at $661 per ounce, on track for its biggest one-day decline on record, while gold slipped 1.4% to $1,508.44 per ounce. U.S. gold futures were 0.3% lower at $1,512.50 per ounce.

· Gold also broke below the 200-day moving average, which is regarded as a bearish sign.

· Precious metals joined a wider market sell-off as the coronavirus continued to spread rapidly, with some investors obliged to sell assets to cover margin calls.

· U.S. government bonds yields fell, stock markets tumbled and oil prices dropped 10%.

· “On top of that we have industrial components weighing on the likes of silver, platinum and palladium,” McKay said.

· Central banks in Japan, Australia and New Zealand joined the U.S. Federal Reserve in announcing dramatic monetary easing in a coordinated effort not seen since the 2008 financial crisis.

· On the physical demand side, activity remained subdued in major Asian hubs last week due to virus outbreak, especially in the world’s biggest gold consumer, China.

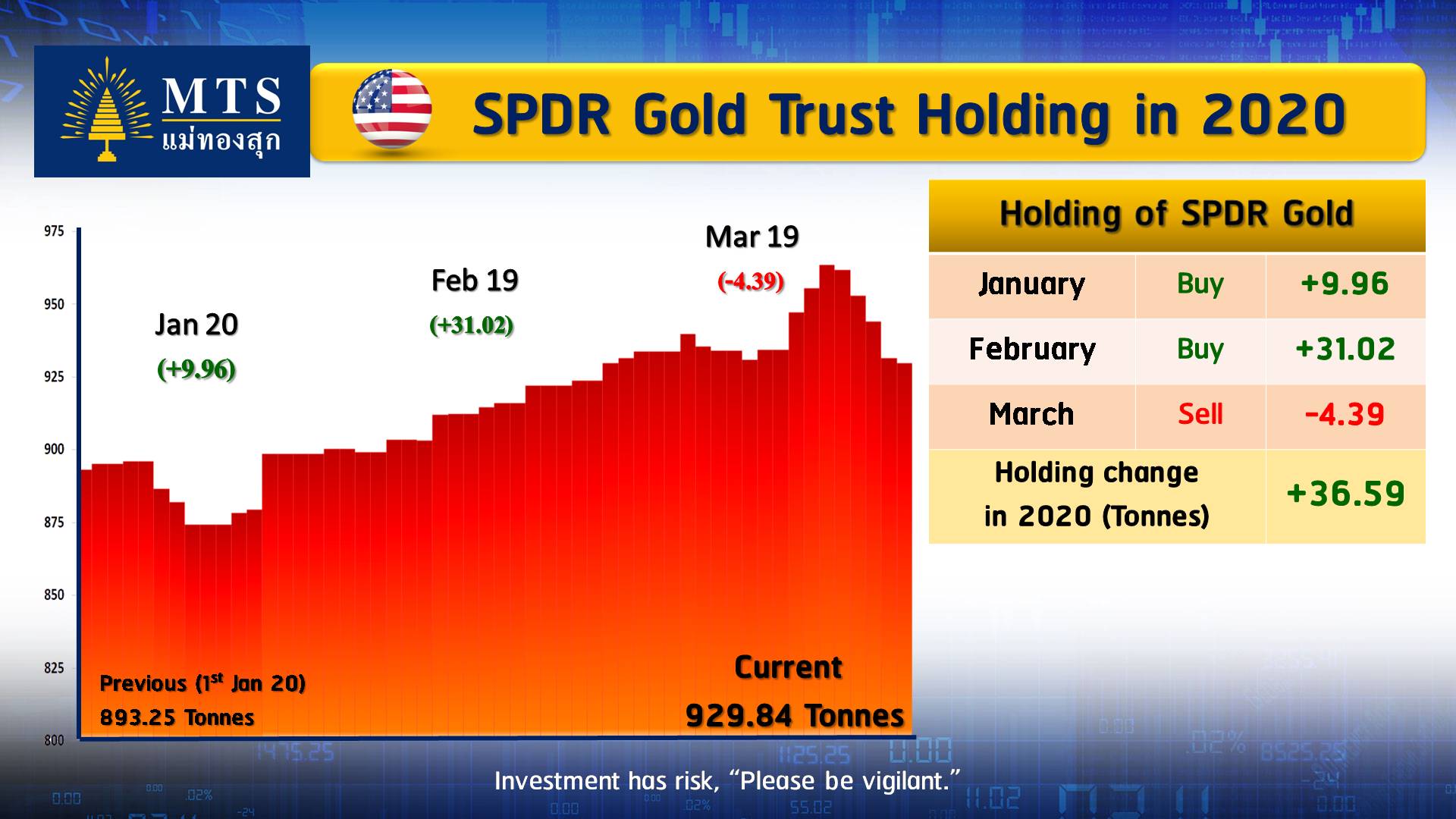

· Holdings in the SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, fell to 929.84 tonnes on Monday.

Reference: CNBC, Reuters