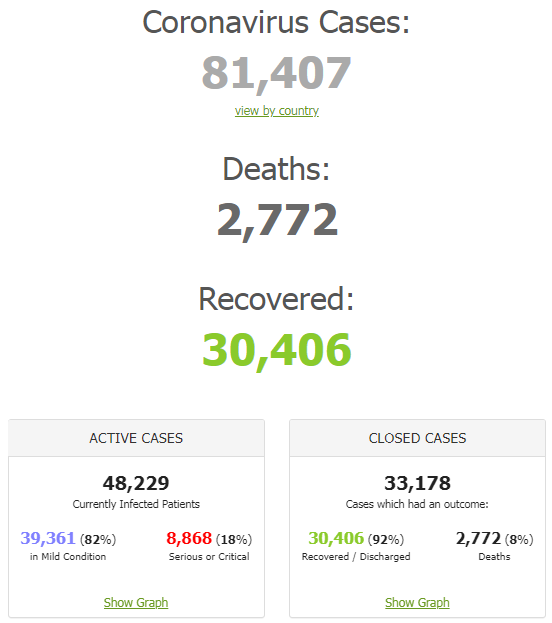

- Confirmed Cases and Deaths by Country, Territory, or Conveyance

The novel coronavirus COVID-19 is affecting 48 countries and territories around the world and 1 international conveyance (the "Diamond Princess" cruise ship harbored in Yokohama, Japan).

- New coronavirus cases outside China exceeded those in China for the first time, WHO says

The number of daily new COVID-19 cases outside China exceeded those inside the country for the first time, the World Health Organization announced Wednesday.

Outside of China, there are now 2,790 cases of the coronavirus across 37 countries, including 44 deaths as of Wednesday morning, according to a transcript of remarks from Tedros Adhanom Ghebreyesus, director-general of WHO.

“The sudden increases of cases in Italy, the Islamic Republic of Iran and the Republic of Korea are deeply concerning,” Tedros said. “Yesterday, the number of new cases reported outside China exceeded the number of new cases in China for the first time.”

He didn’t give specific figures for Tuesday’s count of new cases.

- US confirms new case

U.S. Health and Human Services Secretary Alex Azar confirmed a new case of the coronavirus in the U.S. “Coming into this hearing, I was informed that we have a 15th confirmed case, the epidemiology of which we are still discerning,” he testified before a House panel. The new case brings the total number of cases in the U.S. to 60. The CDC has separated out 45 confirmed infections in people evacuated from a cruise ship in Japan or from Wuhan, China from its official case count.

- Germany ‘heading for epidemic’ as virus spreads faster outside China

Germany said it was heading for a coronavirus epidemic and could no longer trace all cases, as the number of new infections inside China, where the outbreak originated, was for the first time overtaken by those elsewhere. Germany, which has around 20 cases, said it was already impossible to trace all chains of infection, and Health Minister Jens Spahn urged regional authorities, hospitals and employers to review their pandemic planning. “Large numbers of people have had contact with the patients, and that is a big change to the 16 patients we had until now where the chain could be traced back to the origin in China,” he said.

- IMF, World Bank considering scaling back meetings or holding them remotely

The International Monetary Fund and the World Bank could hold their April Spring Meetings remotely or even scale them back amid the growing coronavirus outbreak, Reuters reported, citing sources.

The Spring Meetings are scheduled for April 17 to 19, and 10,000 government officials and other delegates globally are set to gather in Washington D.C.

- Booking Holdings warns coronavirus will hit Q1 revenue

Online travel giant Booking Holdings said the outbreak of coronavirus will damp travel demand and drive down sales in the first quarter. The company, which operates Booking.com, airfare-search site Kayak.com and others said its revenue could fall by as much as 9% on the year in the first quarter. It expects travel bookings to drop by 10% to 15%. “The coronavirus has had a significant and negative impact across our business during the 1st quarter. It is not possible to predict where, and to what degree, outbreaks of the coronavirus will disrupt travel patterns,” the company said in an earnings filing. The company said its forecast included wider ranges than usual because of the “high level of uncertainty in forecasting the coronavirus and its associated impact on the company and the travel industry generally.”

- Coronavirus causes Moody’s to slash global vehicle sales forecast for 2020

Investor Service is slashing its global vehicle sales forecast as the coronavirus outbreak reduces demand and disrupts automotive supply chains. The firm now expects global auto sales to slump 2.5% in 2020 instead of a 0.9% drop previously expected. Moody’s cited the COVID-19 epidemic as well as stricter emissions regulations for the overall decline in vehicle sales from 90.3 million to 88 million.

- Trump puts Mike Pence in charge of response to coronavirus, says US risk ‘remains very low’

Vice President Mike Pence will be put in charge of the U.S. response to the deadly coronavirus outbreak, President Donald Trump announced Wednesday in an address from the White House.

Trump, in a rare appearance in the White House briefing room, maintained that the risk to the U.S. from the virus “remains very low,” amid global fears that a pandemic could be imminent.

Trump announced the news conference in a tweet Wednesday morning, shortly after returning from a state visit to India where he downplayed the threat of the virus to the U.S. “We’re really down to probably 10” cases, Trump told reporters there.

The president also sowed some confusion in India, when he said “we’re very close to a vaccine” — a claim that the White House said was made in reference to the Ebola virus, not the coronavirus.

· Dollar flat as virus drives choppy trade in stocks, Treasuries

The dollar was little changed on Wednesday as coronavirus headlines sapped sentiment, with the greenback weakening after gaining earlier along with a rise in U.S. stocks.

The dollar index =USD was 0.073% higher at 99.083. The S&P 500 index .SPX touched a session low as investor jitters were stirred on news that the new coronavirus could spread to New York.

The number of new coronavirus infections inside China - the source of the outbreak - was for the first time overtaken by fresh cases elsewhere on Wednesday.

The coronavirus fears drove a rally in U.S. bonds, pushing the benchmark 10-year Treasury yield US10YT=RR to a record low for a second consecutive day.

Despite the move in yields, dollar trading remained range-bound. Against the Japanese yen JPY=, a safe-haven asset which typically moves in step with yields, the dollar was 0.24% stronger at 110.44.

Against the euro the dollar was 0.03% weaker at 1.0882 EUR=.

The dollar was also helped as investors scaled back expectations that the U.S. Federal Reserve would signal more policy easing in response to the spread of the coronavirus outside of China.

· 10-year Treasury yield drops to new record low of 1.3%

The 10-year Treasury yield turned lower after an initial bump higher, falling to a new record low amid heightened fears about the fast-spreading coronavirus and its effect on the global economy. The yield on the benchmark 10-year Treasury note, which moves inversely to price, fell four basis points to a 1.302%, just below its last record low reached on Tuesday of 1.307%. The benchmark yield was about 3 basis points higher earlier in the session. The yield on the 30-year Treasury bond was also lower at 1.807%, near its record low. Investors sought the safety of U.S. government debt and fled riskier assets on fears that the deadly coronavirus will disrupt the global economy growth. The S&P 500 posted back-to-back losses of more than 3% this week, suffering its biggest two-day plunge since 2015.

The two-year yield hit a low of 1.136% on Wednesday, its lowest level since February 2017. The short-duration rate is the most sensitive to the Federal Reserve’s monetary policy expectations. Traders have increasingly priced in a rate reduction at the central bank’s April meeting.

The fed funds futures market is assigning a near 60% chance of a rate cut at the Fed’s April policy meeting, according to the CME FedWatch Tool. Traders also see the possibility of three reductions in 2020.

· Oil slides more than 2%, tumbling deeper into bear market territory

Oil prices fell more than 2% on Wednesday after hundreds of new coronavirus cases reported in Asia, Europe and the Middle East stoked fears that energy demand would decline, while crude oil inventories in the United States grew.

Brent crude fell $1.52 or 2.7% to settle at $53.43 per barrel, while U.S. West Texas Intermediate crude fell 2.34%, or $1.17, to settle at $48.73 per barrel.

Prices briefly turned positive after the U.S. government reported a drop in gasoline inventories last week. Crude stocks grew by 452,000 barrels to 443.3 million barrels, the Energy Information Administration said, which was less than the 2-million-barrel rise analysts had expected.

Goldman Sachs cut its 2020 oil demand growth forecast to 600,000 barrels per day (bpd) from 1.2 million bpd, and lowered its Brent forecast to $60 a barrel from $63.

Reference: Reuters, CNBC