· A pre-Christmas rally fuelled by hopes of waning trade tensions have pushed share prices to a fresh high and on course for their biggest rise in a decade.

Donald Trump’s promise that a US-China trade pact would be signed “very shortly” sent the MSCI gauge of stock markets around the world to new record levels.

The boost to share prices was led by Wall Street where both the S&P 500 – a measure of the performance of the US’s leading companies – and the technology-rich Nasdaq both traded at unprecedented levels.

MSCI’s all-country world index has risen nearly 3% this month amid optimism that 2020 will see a de-escalation of the protectionist stand-off between the world’s two biggest economies and that Britain would avoid a chaotic exit from the European Union. The index is up 23% in 2019, set for its best year since 2009.

Peter Cardillo, chief market economist at Spartan Capital Securities in New York, said sentiment in stock markets was driven by developments in the trade war.

“It’s a rally being based upon momentum buying now. Stocks are being marked up, and it will continue right up until year end,” he said.

· Asian shares and edged lower and U.S. stock futures darted in and out of losses on Tuesday, as the holiday lull offset optimism that a U.S.-China trade deal will boost exports and corporate earnings.

MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.14%.

Sterling traded near a four-week low versus the euro and a three-week trough against the dollar on growing doubts over how Britain will navigate the transition period for its exit from the European Union.

Wall Street’s main indexes posted record closing highs on Monday after U.S. President Donald Trump said an initial U.S.-China trade pact would be signed soon.

A de-escalation of a trade conflict between the world’s two-largest economies is a positive for companies that feed global supply chains, but some investors want to wait until next year to see how long the current thaw in Sino-U.S. relations lasts.

· Japanese shares ended nearly unchanged on Tuesday ahead of Christmas holidays, as some investors booked profits to cash in on a recent rally sparked by a preliminary U.S.-China trade deal.

The Nikkei index closed up 0.04% at 23,830.58. The Nikkei has advanced 19% so far this year and many investors have been closing out positions this month to book gains on this rally.

Trading is expected to be subdued as many financial markets will start closing from Tuesday for Christmas holidays.

· China stocks ended higher on Tuesday on hopes that Beijing will roll out more measures to bolster the real economy.

The blue-chip CSI300 index closed up 0.7% at 3,992.96, while the Shanghai Composite Index gained 0.7% to 2,982.68.

Chinese Premier Li Keqiang said on Monday the government will study taking more measures to lower financing costs for smaller companies, including broad-based and "targeted" cuts in the reserve requirement ratio (RRR), relending and rediscounting.

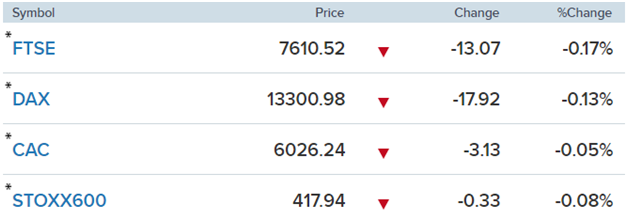

· European stocks open slightly lower on Tuesday in a shortened trading session due to the Christmas holidays.

The pan-European Stoxx 600 hovered near the flatline, with all major bourses in negative territory. In terms of individual sectors, the performance was generally flat across the board, with oil & gas sector at the top of the table, up 0.2%.

Reference: Reuters, CNBC,The Guardian