· The record-setting stock market rally will gain steam in 2020 as the stage is set for the global economy to recover, according to J.P. Morgan.

Dubravko Lakos-Bujas, the bank’s chief U.S. equity strategist, set his 2020 price target for the S&P 500 at 3,400, a roughly 8% gain from here. Betting on a limited U.S.-China trade deal and a reacceleration in the global economy, the analyst is more bullish than other Wall Street’s big equity strategists who see a modest 5% rise on average.

“The business cycle should begin to gain stronger traction by early 2020, providing further room for market upside and continued style and sector rotation,” Lakos-Bujas said in a note to clients on Monday. “We expect the rotation from Momentum into Value to persist as the global business cycle re-accelerates and puts upward pressure on bond yields and commodities.”

The analyst expects most of the upside, if not all, to be realized before the U.S. presidential election in November 2020. He noted the election is generally good for stocks with the S&P 500 rising 12% on average through the prior year with a hit rate of 90%.

· Asian stocks camped out at 18-month peaks on Wednesday having climbed for five straight sessions, while the British pound was licking fresh wounds as revived Brexit fears came back to haunt it.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was dead flat near its highest since June last year. Japan's Nikkei .N225 dipped 0.4% and off a 2019 top.

Upbeat economic news had helped the S&P 500 reach a record for the fourth straight session, building on its 27% gain this year. The Dow .DJI ended Tuesday up 0.19%, while the S&P 500 .SPX gained 0.07% and the Nasdaq .IXIC 0.11%. [.N]

· Japanese shares ended lower on Wednesday, after data showed that the trade-reliant economy’s exports shrunk for the 12th straight month amid the Sino-U.S. tariff war, raising the risk of a fourth-quarter contraction, and as investors booked profits.

The Nikkei index ended down 0.55% at 23,934.43, with the industrial and healthcare sectors leading the declines. The index had slipped 0.61% earlier in the session, its biggest intraday percentage loss since Dec. 4.

The Nikkei touched its highest since Oct. 4, 2018 on Tuesday.

Traders are trying to look beyond the disappointing export data as a de-escalation in the U.S.-China trade dispute and an improving U.S. economy fuelled expectations that Japan’s exports will recover next year.

· China shares ended a three-session rally on Tuesday as investors sought concrete details on the initial trade deal between Beijing and Washington.

The Shanghai Composite index closed 0.2% lower at 3,017.04, off the three-month high hit on Tuesday. The blue-chip CSI300 index also fell 0.2%, moving away from the highest level since April hit in the previous session.

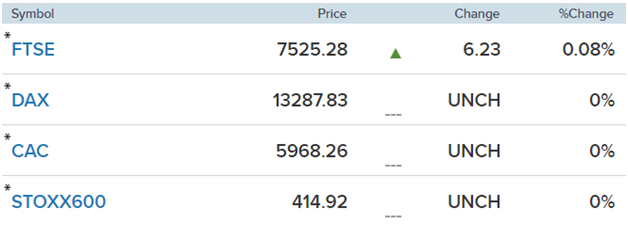

· European stocks opened slightly lower on Wednesday as investor caution returned following U.K. Prime Minister Boris Johnson’s vow to block an extension of EU trade talks beyond 2020, reviving fears of a “cliff-edge” Brexit.

The pan-European Stoxx 600 slipped 0.1% in early trade, basic resources falling 0.4% to lead losses while utilities bucked the trend to edge 0.2% higher.

Johnson on Tuesday used the power of his newly won parliamentary majority to set a hard deadline of December 2020 to reach a new trade deal with the EU, with the U.K. set to leave the bloc by January 31, in a bid to strong arm the bloc into hastening an accord.

Reference: Reuters, CNBC