· Santa came early to Asia’s stock markets on Tuesday as trade deal optimism, positive economic signals in China and Wall Street’s rally sent shares to an 18-month high, while familiar Brexit worries knocked sterling.

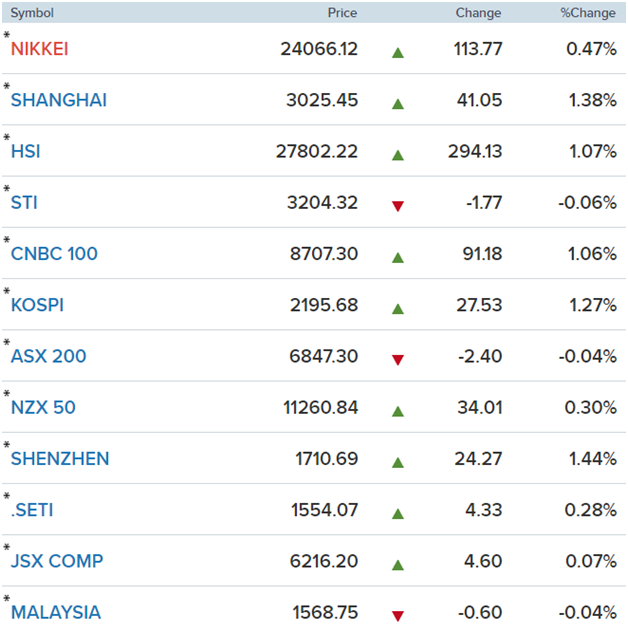

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 1% to its highest since June 2018. Japan's Nikkei .N225 touched its firmest in more than year, while markets from Shanghai .CSI300 to Seoul .KS11 and Hong Kong .HSI all rose by more than a percentage point.

Oil hovered near three-month highs in anticipation of growing demand from the world’s biggest economies. [O/R]

Yet with no fresh news on the trade front, the euphoria did not extend into the debt or currency markets, where movements were slight.

· Japanese stocks rose to their highest level in more than a year on Tuesday, tracking Wall Street's run to a record closing high on renewed optimism over the US-China interim trade deal.

The Nikkei index settled 0.47 per cent higher at 24,066.12, with the healthcare and industrials sectors leading the gains. Earlier in the session, the benchmark index reached its highest level since Oct. 4, 2018. It is up 19.67 per cent so far this year.

The broader Topix index rose 0.59 per cent to 1,747.20, also reaching the highest since Oct. 10, 2018.

· China stocks extended gains into a third session on Tuesday, with the blue-chip index posting an eight-month closing high, boosted by an interim China-U.S. trade deal which helped temper a key external risk to its financial markets.

The blue-chip CSI300 index rose 1.4%, to 4,041.80, the highest close since April 19, while the Shanghai Composite Index rallied 1.3% to 3,022.42.

Sentiment was also aided by a host of recent data pointing to resilience in the world’s second-largest economy.

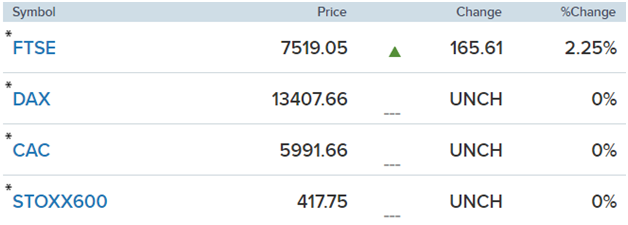

· European stocks opened lower Tuesday morning as caution returned following a worldwide rally on the back of a “phase one” U.S.-China trade deal.

The pan-European Stoxx 600 slipped 0.4% in early trade, with household goods sliding 1.3% to lead losses as most sectors and major bourses entered negative territory.

Reference: Reuters, CNBC