· Asian shares hit their highest in nearly eight months on Monday after the United States and China agreed on a preliminary trade deal, with Australian shares leading the way on expectations of more easing of monetary policy there.

U.S. Trade Representative Robert Lighthizer said on Sunday a deal was “totally done”, notwithstanding some needed revisions, and would nearly double U.S. exports to China over the next two years.

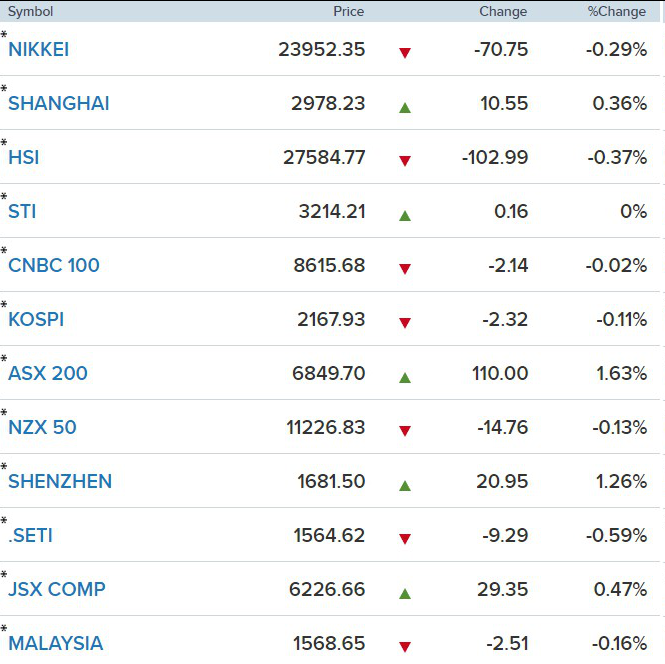

Positive sentiment helped push the MSCI’s broadest index of Asia-Pacific shares outside Japan to its highest level since April 18. It was last up 0.25%.

Australia’s S&P/ASX 200 led the way as it jumped 1.63%, while shares in Taiwan added 0.22%.

· Japanese stocks fell on Monday, slipping from an over one-year high hit in the previous session, as investors booked profits following an initial rally sparked by a preliminary trade deal between the United States and China.

The Nikkei index ended down 0.29% at 23,952.35 as the industrial and materials sectors leading the declines. It is up 20.03% so far for the year.

U.S. Trade Representative Robert Lighthizer on Sunday said a so-called “phase one” deal was “totally done”, notwithstanding some needed revisions, adding that it would nearly double U.S. exports to China over the next two years.

China will purchase the U.S. goods in exchange for the delay of U.S. tariffs on Chinese goods originally scheduled to take affect on Dec. 15 and the reduction of some existing tariffs, but officials in Beijing have been vague about the size of these purchases.

The United States and China had been locked in a 17-month long trade dispute that became the biggest headwind to global economic growth. Scaling back the trade war would be a huge boost to international trade and corporate profits.

The broader Topix index fell 0.18% to 1,736.87.

· China stocks rose to a six-week closing high on Monday, as investors cheered a preliminary Sino-U.S. trade deal and upbeat data pointing to resilience in the world’s second-largest economy.

The blue-chip CSI300 index rose 0.5%, to 3,987.55, while the Shanghai Composite Index added 0.6% to 2,984.39, its highest close since Nov. 8.

The United States and China cooled their trade war on Friday, announcing a “Phase one” agreement that reduces some U.S. tariffs in exchange for what U.S. officials said would be a big jump in Chinese purchases of American farm products and other goods.

The deal will nearly double U.S. exports to China over the next two years and is “totally done” despite the need for translation and revisions to its text, U.S. Trade Representative Robert Lighthizer said on Sunday.

Analysts said they expected the deal to help reduce external uncertainties for the A-share market and boost market sentiment, though some sounded a cautionary note given the long-term character of the disputes between the two countries.

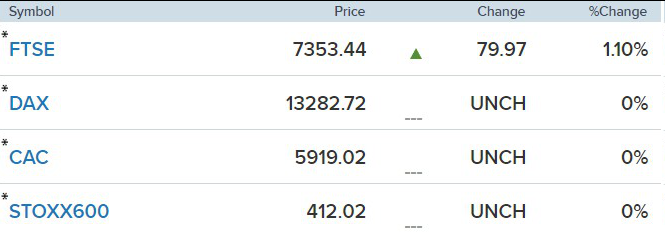

· European stocks opened higher Monday after the U.S. and China agreed a ‘phase one’ trade deal, though investors are likely to remain cautious with some details remaining unclear.

The pan-European Stoxx 600 climbed 0.5% in early trade, basic resources leading the way with 1% gains as all sectors and major bourses entered positive territory.

Washington and Beijing announced on Friday that an agreement had been reached pending legal procedures, a significant step forward after a bruising 18-month trade war.

However, questions have been raised by market participants over some details of the deal which remain hazy, notably the scale of agricultural purchases and the prospect of China balancing bilateral trade flows.

Reference: Reuters, CNBC