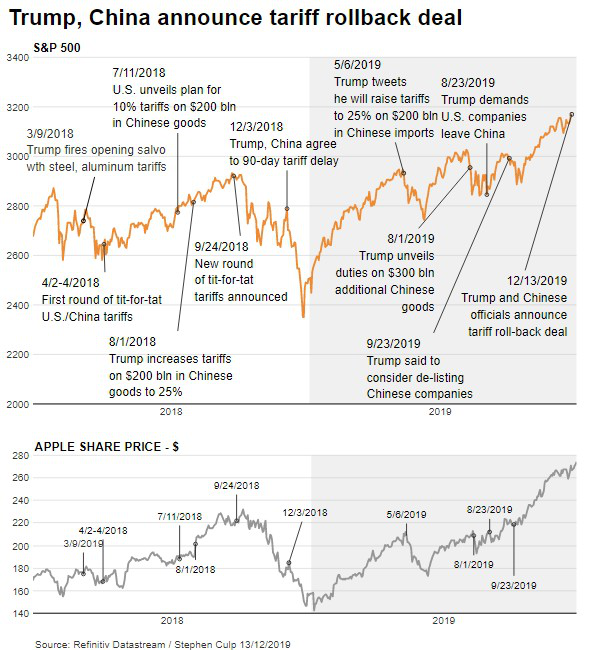

· Asian stock markets rose on Friday as the US and China moved toward striking a trade deal to avert a new round of tariffs.

The deal could be announced later in the day, after US President Donald Trump reportedly signed off on the terms.

Washington is said to have agreed to remove some tariffs, while Beijing would boost purchases of US farm goods.

However, many of the more difficult issues are still to be addressed.

Optimism surrounding a trade deal pushed Asian markets higher, with Japan's Nikkei 225 index rising 2.3% while Hong Kong's Hang Seng put on 2%. The Shanghai Composite added 1.2%.

Earlier, US markets also gained ground with the S&P 500 and the Nasdaq closing at fresh record highs.

· The S&P 500 and the Dow industrials ended little changed on Friday, hitting record highs in the session, as the United States and China announced an initial trade agreement, cooling tensions that have rattled markets.

Trading was choppy following announcement of the agreement, which reduces some U.S. tariffs in exchange for increased Chinese purchases of American farm goods. The United States has agreed to suspend tariffs on $160 billion in Chinese goods that were due to take effect on Dec. 15, a deadline that had been closely watched by investors.

The Dow Jones Industrial Average .DJI rose 3.33 points, or 0.01%, to 28,135.38, the S&P 500 .SPX gained 0.23 point, or 0.01%, to 3,168.8 and the Nasdaq Composite .IXIC added 17.56 points, or 0.2%, to 8,734.88.

The S&P 500 rose 0.7% for the week, its ninth rise out the past 10 weeks.

Improving sentiment about trade tensions, interest rate cuts from the U.S. Federal Reserve and encouraging economic data have fueled records for the major U.S. stock indexes. The benchmark S&P 500 has gained 26% so far in 2019.

· European stocks closed higher Friday after news that the U.S. and China have reached a phase one trade deal, while the U.K.’s ruling Conservative Party won a commanding majority in the general election.

The pan-European Stoxx 600 traded around 1.1% higher by the close of trade, with travel and leisure stocks soaring 3.7% to lead gains as all sectors and major bourses traded in positive territory. Retail stocks added 2.9% while both banks and basic resources each gained just shy of 1%.

U.K. Prime Minister Boris Johnson’s Conservative Party has won a commanding majority in the country’s general election, granting Johnson the power to drive through his Brexit deal and take the U.K. out of the EU before the January 31 deadline. The result is the party’s biggest election win since 1987.

· Markets in Asia were mixed in early trade on Monday, as trade optimism soared with China and the U.S. announcing they are finally set to sign off on a phase one trade agreement.

Australia’s S&P/ASX 200 jumped 1%, led by banks and major miners.

However, Japan’s Nikkei 225 was flat, while the Topix edged up slightly. Autos fell, reversing gains they made last week on the back of Brexit optimism.

Over in South Korea, the Kospi rose 0.15%.

Overall, MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.16%.

U.S. Trade Representative Robert Lighthizer said on Sunday that the phase one U.S.-China trade deal reached on Friday is “totally done,” and it will nearly double U.S. exports to China over the next two years.

Reference: CNBC, BBC, Reuters