· The dollar pushed higher on Wednesday and flirted with the $1.10 level against the euro, boosted by yet more talk of a deal to resolve the U.S.-China trade dispute.

The greenback, which this week has risen in line with the more positive tone in trade negotiations, also increased versus the yen towards three-week highs.

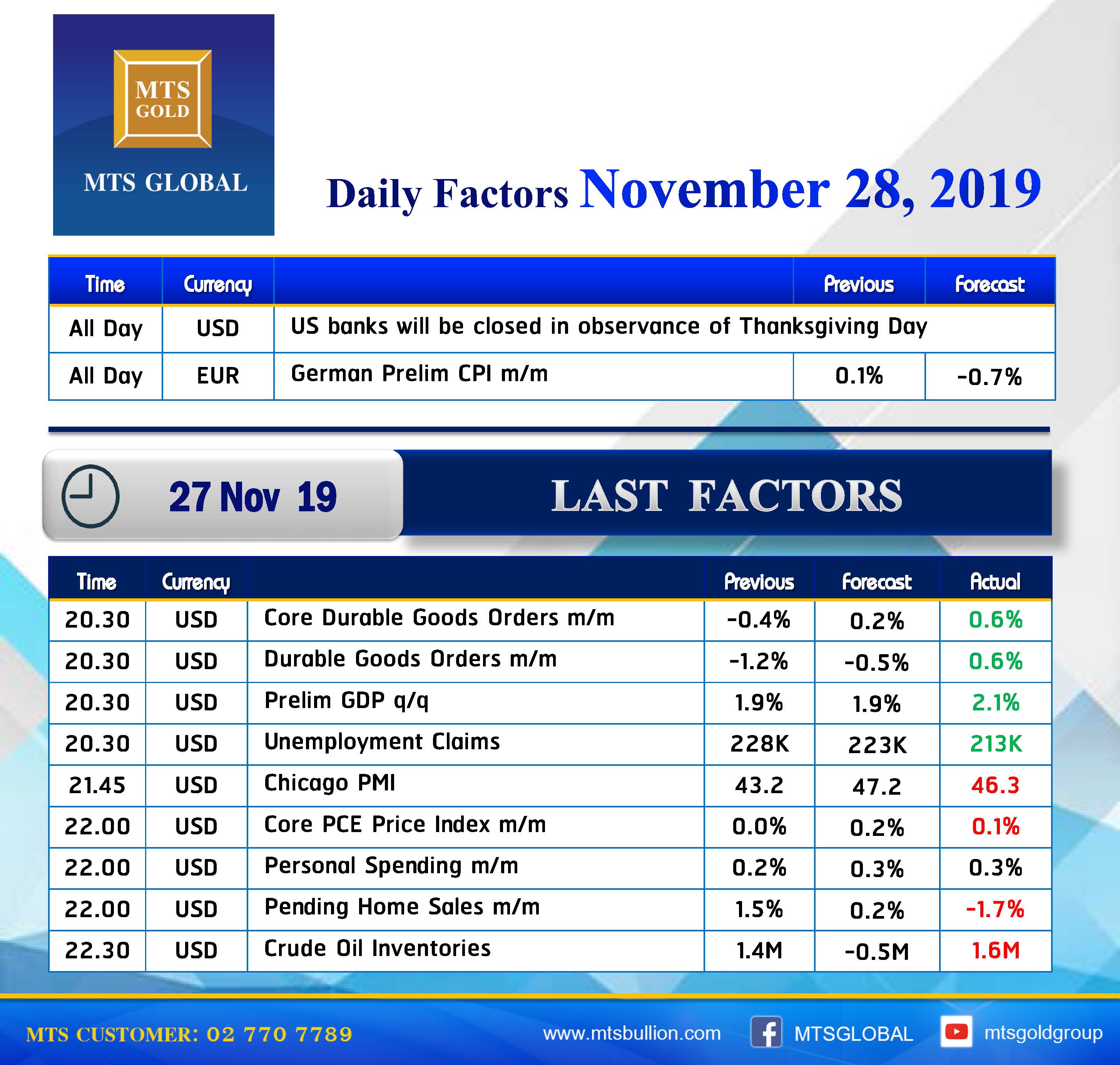

Wednesday sees little new data releases in the euro zone but a clutch of revisions in the United States ahead of Thursday’s Thanksgiving holiday.

“Everything all told, the U.S. data is more likely to support the dollar, so that EUR-USD might well drop below the $1.10 mark again today,” Commerzbank analysts said in a note.

Euro/dollar volatility remains at low levels and largely stuck in tight trading ranges in the absence of major catalysts such as monetary policy shifts.

Investors are growing more hopeful of a trade deal between Washington and Beijing - U.S. President Donald Trump said overnight that Washington was in the “final throes” of work on a deal to defuse the trade war.

Many analysts say investors have struggled to make up their minds on whether trade optimism and a buoyant risk-on mood is a positive for the safe-haven dollar, especially as the Federal Reserve has been cutting interest rates.

The euro slipped 0.1 percent to $1.1011, close to a two-week low of $1.0989.

Against a basket of currencies, the dollar index rose 0.1 percent to 98.352.

The yen, usually bought when investors turn nervous, has struggled in recent sessions as equity markets soared. The dollar gained another 0.1 percent to 109.18 yen on Wednesday.

· The safe-haven yen rose against the dollar after U.S. President Donald Trump signed into law legislation supporting anti-government protesters in Hong Kong, which could complicate efforts to end the U.S.-China trade war.

The yuan fell in offshore trade as scrutiny of Hong Kong’s response to months of often violent protest against Chinese rule of the former British colony potentially opens up a new fault line in already fractious relations between Washington and Beijing.

The yen rose around 0.2% to 109.35 versus the dollar on Thursday in Asia, rebounding from a six-month low reached Wednesday after U.S. economic growth was revised up in the third quarter.

In the offshore market, the yuan fell 0.19% to 7.0290 per dollar.

The focus now shifts to China’s reaction as investors try to gauge how much impact U.S. support of anti-government protests in Hong Kong will have on negotiations to scale back a 16-month long trade war between the world’s two-largest economies.

· Chinese President Xi Jinping has had a “horrible couple weeks” politically — and he’s not likely to sign a “phase one” trade deal with U.S. President Donald Trump without any roll back in existing tariffs, one expert said.

“China has politics the same as U.S. has politics. Trump has to play to his base, Xi has to worry about his internal politics, he has to worry about his standing within the party,” Steve Okun, senior advisor at consultancy McLarty Associates, told CNBC’s “Street Signs Asia” on Wednesday.

Any trade deal between the two countries “needs to be a win-win,” Okun said, and delaying new tariffs may not work.

In light of political challenges facing Xi such as Hong Kong, Okun said he can’t see the Chinese leader signing an agreement “in which he gets nothing other than the postponement of new tariffs.”

In addition to the stalemate in the U.S.-China trade negotiations, the protests in Hong Kong could be another major challenge to Xi’s authoritative rule, according to political commentators and media reports.

However, trade experts, including Okun, said Hong Kong wouldn’t be a direct hurdle to the U.S. and China reaching a deal. The bigger issue is whether Trump would roll back existing tariffs — as China has repeatedly called for — at a time when Xi appears to need a political boost back home, said Okun.

That’s especially so after China has seemingly addressed some of the U.S. concerns by agreeing to increase agricultural purchases, open up China’s financial sector and strengthen intellectual property rights, explained Okun.

“President Xi is not in a great position right now, he’s had a horrible couple weeks; President Trump has had a horrible couple weeks. Both sides really should be looking for a win-win, they haven’t to date,” he said.

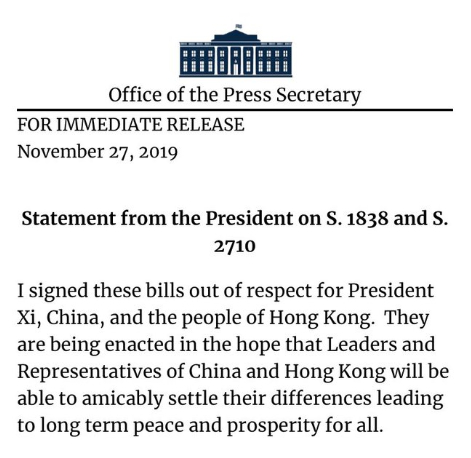

· President Donald Trump has signed two bills supporting the Hong Kong protesters into law on Wednesday, despite Beijing’s repeated objections.

“I signed these bills out of respect for President Xi, China, and the people of Hong Kong. They are being enacted in the hope that Leaders and Representatives of China and Hong Kong will be able to amicably settle their differences leading to long term peace and prosperity for all,” Trump said in a statement released by the White House.

Congress sent the bills to the president’s desk last week, after both chambers passed the legislation with overwhelming bipartisan support.

· British Prime Minister Boris Johnson is on course to win a majority of 68 in parliament at the Dec. 12 election, according to a model from pollsters YouGov that accurately predicted the 2017 election.

Johnson has pledged to deliver Brexit by Jan. 31 if he wins the election after nearly four years of political crisis that has shocked allies of what was once considered one of the pillars of Western economic and political stability.

His Conservative Party could win 359 seats out of 650, up from 317 in the 2017 general election and the best result for the party since Margaret Thatcher’s 1987 victory, according to the YouGov model, called Multilevel Regression and Post-stratification - or ‘MRP’ for short.

The YouGov model crunches data from more than 100,000 interviews over seven days along with demographics, specific constituency circumstances and national statistics to come up with a projection.

It shows the election is now Johnson’s to lose.

According to the model, Johnson’s Conservatives would gain 47 seats - 44 of them from Labour, two from the Liberal Democrats and one from the Speaker’s old seat. Labour are on course to not take any new seats.

The margins of error in the model put the Conservatives seat projection between 328 and 385, YouGov said, adding that there was still more than sufficient time for people to change their minds before Dec. 12 - the first Christmas election in nearly a century.

· China will speed up reforms to help build a market-based, globalized business environment and break investment barriers for all kinds of companies, Premier Li Keqiang was quoted as saying during a Cabinet meeting on Wednesday.

Economic growth slowed to 6% year on year in the third quarter of 2019, the weakest pace in more than 25 years, with the economy hit by a punishing trade war with the United States.

· Asia is “unable to feed itself” — and needs to invest another $800 billion in the next 10 years to produce more food and meet the region’s needs, according to a report.

The population in Asia is growing, and consumers are demanding safer, healthier, and more sustainable food.

Food spending will more than double — from $4 trillion in 2019 to over $8 trillion by 2030, said the Asia Food Challenge Report which was released last week.

· Oil eased on Wednesday after a report showing U.S. crude inventories grew unexpectedly last week and gasoline stocks surged, but losses were limited by optimism that a U.S.-China trade deal would be reached soon.

Brent crude futures fell 27 cents, or 0.4%, to settle at $64.00 a barrel. U.S. West Texas Intermediate crude fell 30 cents, or 0.5%, to settle at $58.11 a barrel.

WTI trade volumes were also on track to be lower for the week ahead of the U.S. Thanksgiving holiday.

U.S. crude stocks swelled by 1.6 million barrels last week as production hit a record high at 12.9 million barrels per day and refinery runs slowed, the Energy Information Administration said. Analysts in a Reuters poll had forecast a drop of 418,000 barrels.

The more bearish news from the EIA was that U.S. gasoline inventories soared 5.1 million barrels, compared with expectations for a 1.2 million-barrel gain.

Reference: CNBC, Reuters