· Gold prices edged down to a one-week low on Monday after the United States and China expressed willingness to sign an initial trade deal by the year-end, lifting demand for riskier assets and boosting the dollar.

Spot gold was down 0.1% to $1,461.24 per ounce by 0335 GMT, having fallen to its lowest since Nov. 18 earlier in the session. U.S. gold futures were down 0.2% to $1,461.

· “Trade optimism is sending global equities higher and capital is fleeing away from safe havens into risk assets,” said Margaret Yang Yan, a market analyst at CMC Markets.

Upbeat headlines about trade talks between Washington and China helped Asian shares regain footing, while the dollar rose against a basket of rivals, making the non-yielding bullion expensive for holders of other currencies.

· The U.S. currency rebounded strongly on Friday after a survey showed the U.S. manufacturing output accelerated in November and services activity picked up more than expected.

“U.S. economic data has shown signs of stabilisation recently ... also consensus is that the global slowdown is going to bottom in the first quarter of next year and then start to rebound,” Yan said.

· Gold, considered a safe asset in times of political and economic uncertainty, has gained over 13% this year, mainly due to the long drawn-out tariff dispute and concerns over slowing global growth.

Limiting bullion’s downside, investors were still cautious with U.S. and Beijing officials saying an ambitious “phase two” trade deal looked less likely.

· “The market is in an extended period of consolidation at the bottom of the recent range, waiting for the next major catalyst to emerge,” AxiTrader market strategist Stephen Innes said in a note.

“U.S. economic data will likely factor a lot into gold traders’ decision making into year-end as will the ebb and flow of trade talks. But ultimately, it’s all about the (U.S. Federal Reserve) Fed policy, U.S. interest rates and the dollar.”

Lower interest rates reduce the opportunity cost for holding the non-yielding bullion.

· Hedge funds and money managers increased their bullish positions in COMEX gold and silver contracts in the week to Nov. 19, data showed.

· Gold Technical Analysis: Down for third straight day, 100-day EMA caps immediate upside

Gold prices slip beneath 100-day EMA while taking rounds to $1,461 during the initial trading session on Monday.

The yellow metal's trading below 100-day and 21-day Exponential Moving Averages (EMAs) takes clues from 12-bar Moving Average Convergence and Divergence (MACD) that has been sending bearish signals recently.

As a result, 61.8% Fibonacci retracement of July-September upside, at 1,448.50, gains sellers' attention, a break of which will shift bears’ focus to 200-day EMA level of $1,417.

Meanwhile, an upside clearance of a 100-day EMA level of $1,464 could push the bullion towards $1,475 including 21-day EMA.

Assuming that the buyers’ sneak in around $1,475, a fresh upside to $1,481 and 38.2% Fibonacci retracement around $1,490 can be expected.

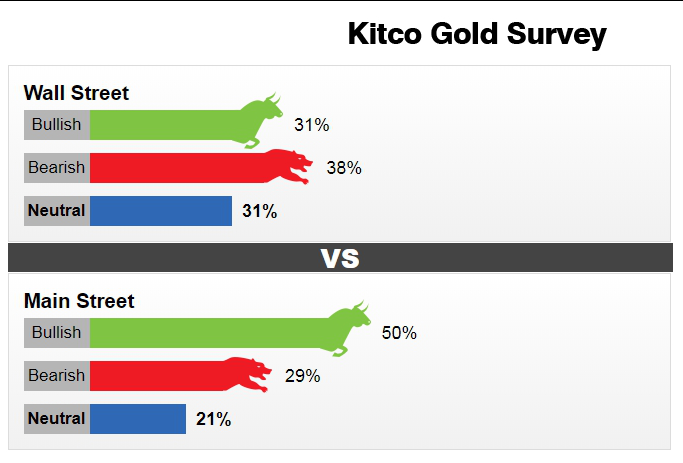

· The latest Kitco News Weekly Gold Survey shows Wall Street analysts nearly caught in a three-way tie, while only a slight majority of retail investors remain bearish on gold.

This week, 16 market professionals took part in the Wall Street survey. In a tie, five analysts or 31% said they see higher, and other five analysts saw a sideways market next week. Six analysts, or 38%, predicted gold would fall.

Meanwhile, 587 respondents took part in an online Main Street poll. A total of 292 voters, or 50%, called for gold to rise. Another 173, or 29%, predicted gold would fall. The remaining 121 voters, or 21%, saw a sideways market.

“One day a trade deal with China is on and then the next day it’s off. This uncertainty is supporting gold but it’s not enough to drive gold prices higher,” said Afshin Nabavi, head of trading with MKS (Switzerland) SA.

Adam Button, managing director for Forexlive.com, said that he is bullish on gold.

“The timing is tricky but cracks are beginning to appear in the phase one trade deal and if it breaks down, that would be a major catalyst for gold,” Button said. Right now, the market has largely priced in a deal but even if there is a deal, it may be less than hoped.”

However, on the other side, Button said that if the U.S. delays the Dec. 15 tariffs and there is progress made between the two countries, then gold prices would drop.

Adrian Day, chairman and chief executive officer of Adrian Day Asset Management, also named the trade talks as the primary catalyst to push gold higher in the short term. But, he also noted that “wobbly” global equity markets heading into year end could provide some support for gold.

Sean Lusk, co-director of commercial hedging with Walsh Trading, said that he is bearish on gold in the near-term as speculative interest remains high. He added that traders might shed some bullish bets next week ahead of the U.S. Thanksgiving holiday. He added that resilient strength in the U.S. dollar could also weigh on the yellow metal in the near-term.

Although he is bearish on gold in the short-term, Lusk added that even with the recent selling pressure, the market is still in a strong uptrend.

“There is still a strong sense of uncertainty and interest rates are still fairly negative and in that environment, you want a tangle asset like gold,” he said.

· Elsewhere, silver shed 0.3% to $16.94 per ounce, after touching its lowest in a week.

Palladium rose 0.7% to $1,787.87 per ounce, its highest since Nov.8, and platinum gained 0.4% to $894.85.

Reference: Reuters, FX Street, Kitco