· Gold prices edged down on Monday as optimism grew about U.S.-China trade ties following a report of "constructive talks" over the weekend, while losses were capped by a softer dollar.

Spot gold was down about 0.3% to $1,463.40 per ounce at 0732 GMT, while U.S. gold futures were 0.4% lower at $1,462.90.

Chinese state media Xinhua reported Washington and Beijing had a high-level phone call on Saturday and that the two sides discussed each other's core issues for the first phase of an initial trade agreement.

· "The first phase of the deal is extremely important to investors as it will set the tone for later phases," said Hareesh V, head of commodity research at Geojit Financial Services.

Asian shares advanced after Beijing surprised markets by trimming a key interest rate for the first time since 2015, stirring speculation that more stimulus was on the way for the world's second-largest economy.

· "A recovery in risk sentiment across Asia and investors cautiously optimistic about the phase one deal to go through before Christmas, are weighing on gold," said Margaret Yang Yan, a market analyst at CMC Markets, adding that a weak dollar limited the metal's fall.

The dollar was a shade softer versus major currencies.

· "In all likelihood, a breakdown in trade talks remains the only scenario to breathe new life into gold prices at this time," Jeffrey Halley, senior market analyst, Asia Pacific at OANDA said in a note.

· Investors also kept a close eye on developments in Hong Kong, with police on Monday trapping hundreds of protesters inside a major university and demonstrators rampaging through a tourist district, after almost two straight days of standoffs.

Gold is considered a safe store of value during times of economic or political uncertainty.

· Market participants now await minutes of the Federal Reserve's last policy meeting, due on Wednesday, for clues about the future interest rate trajectory.

Gold is highly sensitive to interest rates, as a lower interest reduces the opportunity cost of holding the non-yielding bullion.

· On the technical front, spot gold looks neutral in a narrow range of $1,462-$1,472 per ounce but a break above $1,472 may lead to a gain limited to $1,480, according to Reuters technical analyst Wang Tao.

· Gold might be looking at a sideways market before picking up pace again as U.S.-China optimism weighs on the precious metal, according to analysts.

The yellow metal was stuck in a narrow range this week, fighting off significant downside pressure from rallying U.S. equities and rising risk-on sentiment.

“The safe-haven gold and silver markets are seeing buying interest squelched by a generally upbeat trader and investor risk appetite the past several weeks. This is evidenced by the rally in the U.S. stock market that has seen the major indexes this week hit record highs,” explained Kitco’s senior technical analyst Jim Wyckoff.

This week showed that gold has a strong floor at $1,450 an ounce, which is protecting the metal from a bigger selloff. Gold was holding its ground solidly above the $1,460 an ounce on Friday despite rallying stock market.

· China’s central bank unexpectedly trimmed a key interbank lending rate on Monday, the first easing in the liquidity tool in more than four years and a signal to markets that policymakers are ready to act to prop up slowing growth.

The People’s Bank of China (PBOC) said on its website that it was lowering the seven-day reverse repurchase rate CN7DRRP=PBOC to 2.50% from 2.55%.

Analysts say the unexpected cut on Monday shows the central bank is keen to ease investor worries that higher inflation will prevent it from delivering fresh stimulus measures.

The PBOC has skipped reverse repo operations for 15 straight trading days before the resumption on Monday, when it injected 180 billion yuan ($25.74 billion) into the interbank market. [CN/MMT]

· The United States condemned the “unjustified use of force” in Hong Kong and called on Beijing to protect Hong Kong’s freedom, a senior official in President Donald Trump’s administration said Sunday, as protesters battled Hong Kong police who had trapped them inside a major university.

“We condemn the unjustified use of force and urge all sides to refrain from violence and engage in constructive dialogue,” the senior U.S. official said.

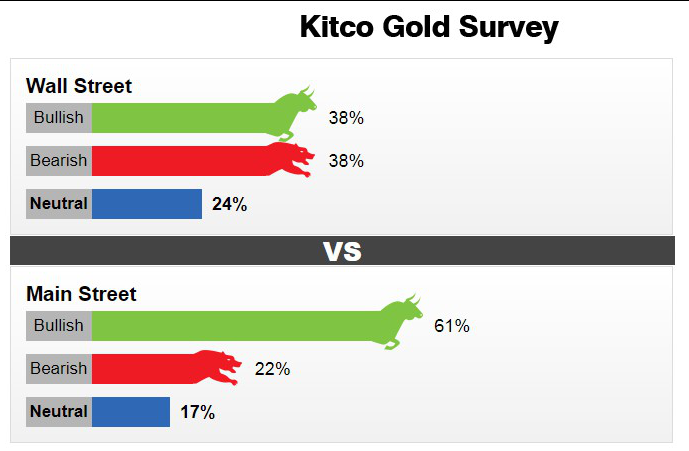

· A total of 15 market professionals took part in Kitco’s gold survey this week — representing the Wall Street side. There was an interesting split formed between projections of higher and neutral prices. Six of the analysts, or 37.5%, said they see gold moving higher next week, while another six, or 37.5%, said they project neutral prices. Another four, or 25%, voted for a move down in gold.

The Main Street side, on the other hand, kept its bullish hopes for next week. Out of the 473 total online responders, 290 votes, or 61.3%, called for higher prices; 104 votes, or 22%, projected lower prices; and another 79, or 16.7% called for neutral prices next week.

In the last survey, Wall Street anticipated lower prices this week and was proven right, while Main Street called for higher prices.

Gold price moves next week are likely to be dominated by the U.S.-China trade headlines, macro data, and the risk-on/risk-off sentiment in the marketplace, analysts told Kitco News.

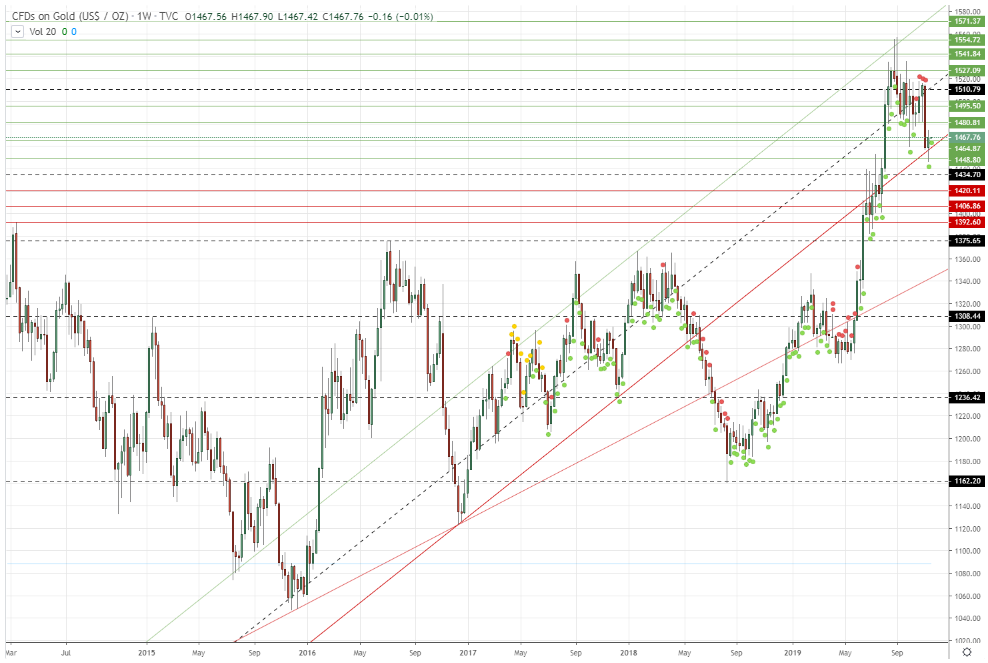

· Gold recovered after making a fresh low as it ended with gains of just over $9 in a ranged week also defending the support of red diagonal trendline which suggests a near term bottom formation. A lower dollar was the key reason for an upswing the yellow metal prices as risk-on intensified further with indexes making new all time highs. The move may have been just a pullback after a massive red bar but it sure does boost bullish bets as the supports were held comfortably with double bottom in place likely on weekly timeframe . To watch this week – Fed meeting minutes and other important data.

Gold had a green week after a mammoth red bar on account of a weaker dollar as it defended the support of the red diagonal trendline making a probable near term bottom. Fundamentals still does not support bulls fully but technically till the support is held gold can have a prolonged bounce which may result in a directional move as well. Till uncertainties remain (which is present) demand for yellow metal will remain elevated providing an extra cushion for bulls even in adverse/against scenarios. We have 2 scenarios –

1. Gold closed above the support, till this is held it can go to $1480. If this is crossed it can move towards $1495. And if this is taken out it can rally to $1510.

2. Gold may have made a near term bottom but once that breaks it can be sold for $1434 and $1420.

· Among other metals, silver was down 0.6% at $16.85 per ounce, while platinum inched down 0.1% to $888.41 per ounce.

Palladium rose 0.7% to $1,716.61 per ounce.

Reference: Reuters, Kitco