Gold eases as dollar strength, delay in U.S. stimulus weigh

· Gold prices edged lower on Monday, after hitting a three-week high earlier in the session, as the dollar firmed and talks over a new U.S. stimulus package ran into resistance.

· Spot gold fell 0.2% to $1,925.29 per ounce by 0046 GMT, after hitting its highest level since Sept. 21 at $1,932.96 earlier in the session.

· U.S. gold futures were up 0.3% at $1,932.70.

· Speculators increased their bullish positions in COMEX gold and cut them in silver contracts in the week to Oct. 6, the U.S. Commodity Futures Trading Commission (CFTC) said on Friday.

· Physical gold was sold at a premium in India last week for the first time since mid-August as jewellers stocked up, hoping key festivals would bring customers back to stores.

· Gold price has room to move higher but breakout remains uncertain

After a rocky start, the gold market is heading into the weekend on a strong note, trading near a two-week high and with the prospect of more U.S. election turmoil. Market analysts and retail investors see the potential for higher prices next week, according to the latest Kitco News Weekly gold Survey.

Although there is a strong positive sentiment in the marketplace, the question remains as to whether or not gold has enough momentum to push back above $2,000 an ounce in the near-term.

"We are seeing some short-term upside potential in a larger downtrend," said Darin Newsom, president of Darin Newsom Analysis. "We still need to see if this momentum lasts."

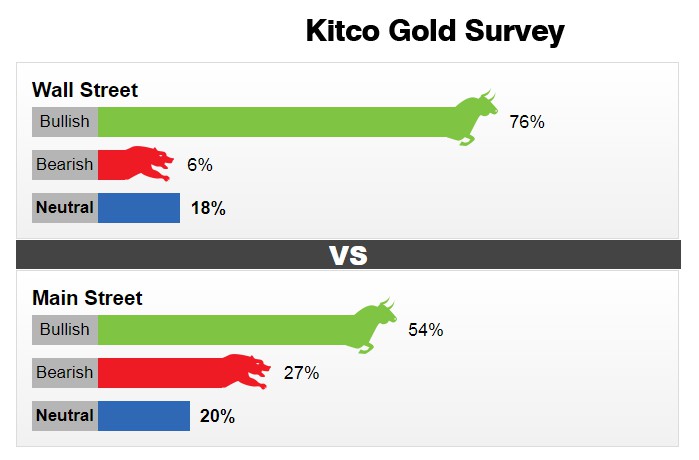

This week 17 analysts participated in the survey. A total of 13 voters, or 76%, called for gold prices to rise; one analysts, or 6%, called for lower prices next week; and three analysts, or 18%, said they see prices moving sideways.

Although sentiment among retail voters remains bullish, interest in the precious metal as prices continue to consolidate has dropped significantly.

Participation in Kitco News' weekly online surveys has dropped to its lowest level since late-June. A total of 1,164 votes were cast this past week. Among those, 628 voters, or 54%, said they were bullish on gold next week. Another 309, or 27%, said they were bearish, while 227 voters, or 20%, were neutral.

Renewed momentum in the gold market Friday is helping the precious metal close the week with a 1% gain; December gold futures last traded at $1,928.80 an ounce.

Although analysts see room for gold to move higher in the near-term, they are not convinced that prices will break above $2,000 anytime soon.

"I expect gold prices will move higher next week but this is really just an upswing within its broader trading range," said Colin Cieszynski, chief market strategist at SIA Wealth Management.

Cieszynski added that gold needs more stimulus spending for it to reach new all-time highs.

"It looks like central banks not ready to pump more stimulus into markets and I don't think the government will do anything until after the election," he said. "The election is so close and so tight either side wants to give the other a perceived win on stimulus."

However, other analysts are forecasting that this could just be the start of gold's new run.

Adrian Day, president and CEO of Adrian Day Asset Management, said that gold's two-steps forward, one-step back price action could start attracting investors back into the marketplace.

"The fundamentals remain exceedingly positive, so I suspect as those on the sidelines realize gold is not falling significantly from here, there will, as some point, be another rush into the metal," he said.

· Silver eased 0.4% to $25.02 per ounce, platinum fell 1% to $876.80, and palladium was down 0.2% to $2,435.35.

Reference: CNBC, Kitco