Gold gains 1% on hopes for U.S. stimulus

Gold jumped 1% on Thursday to firm above the key $1,900 level on renewed hopes for U.S. stimulus that could help ease the economic pain from the coronavirus, while a weaker dollar also boosted bullion’s appeal.

Spot gold rose 1.2% to $1,907.46 per ounce, after hitting its highest level since Sept. 22 at $1,911.66. U.S. gold futures settled up 1.1% at $1,916.30 per ounce.

Investors were eyeing talks between U.S. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin to reach a deal on the long-awaited COVID-19 relief bill.

“If there’s a deal, chances are stimulus will reignite the idea that inflation will move towards the Federal Reserve’s target,” which along with the interest rate suppression policy by the Fed are very good catalyst for gold, said Bart Melek, head of commodity strategies at TD Securities.

He added, the breakthrough in the psychological barrier of the $1,900 level can further drive the market technically a little higher. The dollar fell to a more than one week low versus rivals, making gold cheaper for holders of other currencies.

Dollar retreats on U.S. stimulus hopes

The dollar kicked off the fourth quarter on a sour note, falling to a more than one-week low on Thursday against a major currency basket, as hopes for U.S. fiscal stimulus cheered investors and spurred them to seek higher-yielding but riskier currencies.

The Chinese yuan gained the most against the dollar, reaching a year-and-a-half high in the offshore market, as a holiday in China dried up liquidity, exaggerating the moves.

“Both sides have a lot of signaling, like peacocks walking around. If we don’t get anything before the election, we’ll get something after,” said Marc Chandler, chief market strategist, at Bannockburn Forex in New York.

“But as we get into the new period, people still want to buy equities and to take on some risk,” he added.

Wall Street shares were higher on the day, while U.S. Treasury prices were lower.

The dollar index was down 0.1% at 93.722, after earlier falling to 93.522, its weakest level since Sept. 22.

That said, analysts remained skeptical about the dollar’s weakness and looked to fade the moves in risk assets overall.

Elsewhere, the dollar fell to 6.7306 yuan in the offshore market, its lowest since early May 2019. It was last down 0.5% at 6.7506 yuan.

In afternoon trading, the euro rose 0.2% against the dollar to $1.1743.

“There is heightened possibility, especially in Europe, for more localized lockdowns,” said Simon Harvey, FX market analyst, at Monex Europe in London. “And that kind of risk-off filtering into the dollar is very much alive and kicking.”

Thursday’s U.S. data had minimal impact on currencies. If anything, they affirmed the tentative nature of the U.S. economic recovery.

House passes $2.2 trillion Democratic coronavirus stimulus bill

The House passed a $2.2 trillion Democratic coronavirus stimulus plan on Thursday night even as Democrats and the Trump administration struggle to strike a relief deal.

The bill likely will not get through the Republican-held Senate and become law. Senate Majority Leader Mitch McConnell has opposed the legislation as his caucus resists spending trillions more on the federal response to the pandemic.

Meanwhile, U.S. manufacturing activity unexpectedly slowed in September as new orders retreated, while U.S. weekly jobless claims drifted lower, but remained at recession levels, further bolstering the metal’s safe haven appeal.

“The main driver (for gold) is investment money and reaction to economic headlines, geopolitical headlines and the dollar,” David Govett, CEO of Govett Precious Metals and a former trader said.

“A lot of those things are factored in but its going to get worse before it gets better and because of that gold is going to benefit and move back to $2,000”.

Elsewhere, silver rose 2.56% to $23.80 per ounce. Platinum was up 1.05% to $897.63 per ounce, while palladium gained 1.42 % to $2,337.48 per ounce.

Health measures could dampen flu season, Fauci says

White House coronavirus advisor Dr. Anthony Fauci said public health measures, like avoiding close contact with others and mask wearing, could help suppress the forthcoming influenza season, which will overlap with the coronavirus in the U.S.

Pfizer CEO criticizes presidential debate as ‘disappointing’

Pfizer CEO Albert Bourla has criticized the U.S. presidential debate as ‘disappointing’ in a memo to company employees, warning the political rhetoric is “undercutting public confidence” in a vaccine.

Biden accused Trump of misrepresenting for political gain how long it will take to make a vaccine widely available to the American public. The former vice president and his running mate Kamala Harris have said the public cannot trust what Trump says about vaccine development.

Public health experts, including the director of the Centers for Disease Control and Prevention, have said a vaccine likely won’t be widely available to Americans until well into 2021, contradicting Trump.

Latest layoffs do not signal a collapsing labor market, top economist Michael Darda suggests

Layoffs in several of the nation’s biggest industries are making headlines this week.

“Keep in mind those numbers sound terrible, but they’re not enormous in the context of the size of the total U.S. labor market,” the firm’s chief economist and macro strategist told CNBC’s “Trading Nation” on Thursday.

Darda expects that the September employment report, which is scheduled to be released Friday at 8:30 a.m. ET, will give Wall Street assurance that the economic recovery is still on track.

“If we look at [weekly] jobless claims, a high-frequency indicator, that’s contemporaneous, right? We have claims data reaching all the way into September,” he said. “First-time claims are running about 13% below the August average.”

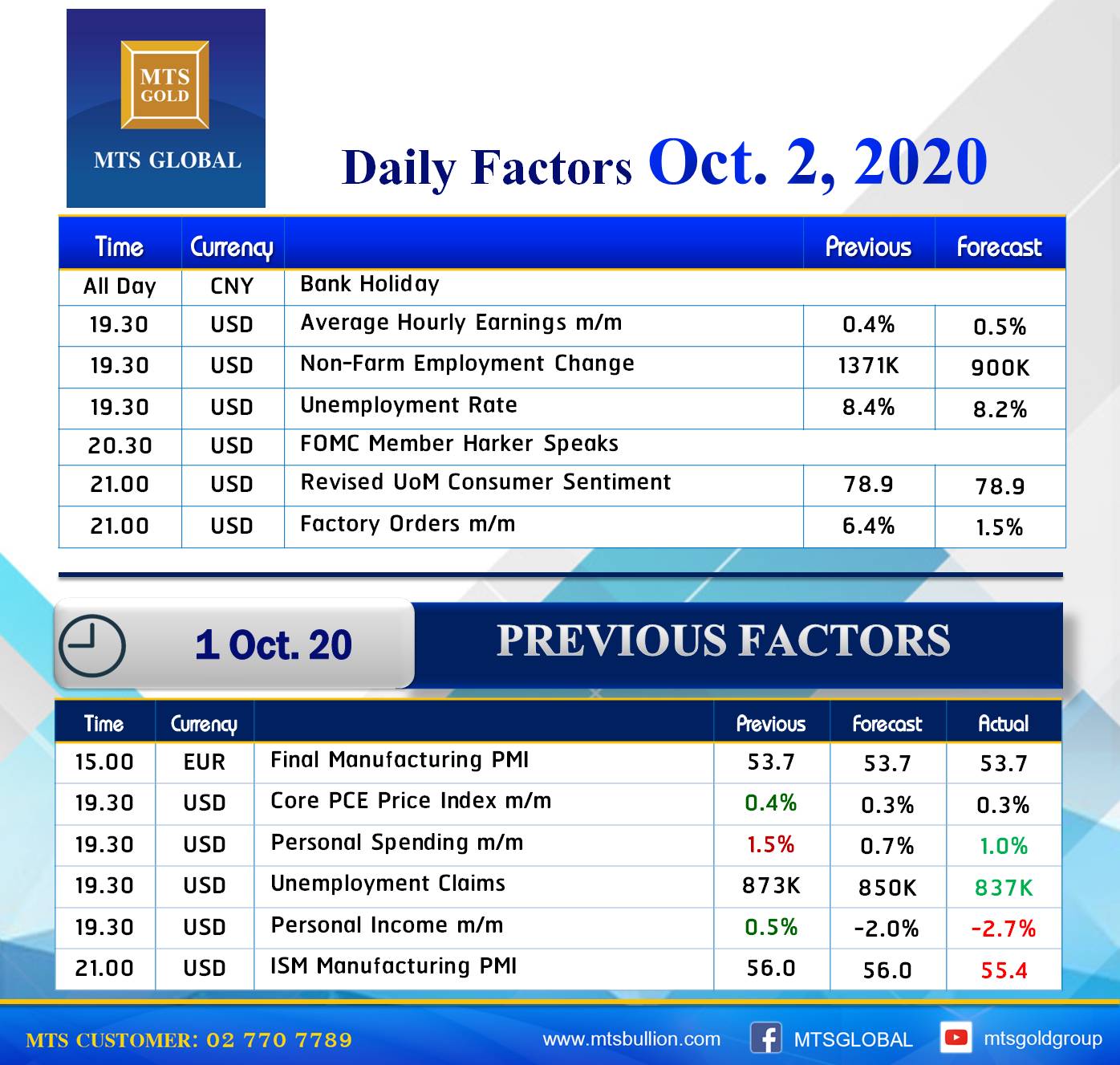

According to Dow Jones, the latest employment report is expected to reveal 800,000 nonfarm payrolls were added in September versus 1.37 million in August. It will be the final monthly jobs report before the presidential election.

Despite his optimism, Darda acknowledges robust gains since the 2020 low will slow.

“That will be a slowdown from the pace of improvement seen over the last four months,” he said. “I’m not sure there are any big political implications from that simply because we’ve seen a pretty rapid turnaround.”

Top Trump aide Hope Hicks tests positive for coronavirus after traveling with president to debate

Hope Hicks, one of President Donald Trump’s closest aides, has tested positive for the coronavirus, NBC News reported, citing a source close to the Trump campaign.

Hicks had traveled with the president to the debate Wednesday night in Cleveland.

Biotechs Move Toward First U.S. Covid-19 Vaccinations by Yearend

Pfizer Inc. and German partner BioNTech SE this month plan to reveal late-stage results showing whether or not their two-shot regimen is effective in preventing the spread of the virus. Moderna also expected to release Phase 2 results for vaccine

“This could be a key catalyst for not only the companies, but the entire market,” JPMorgan analyst Cory Kasimov said.

EU begins legal action against UK after it approves contentious Brexit bill

European Commission President Ursula von der Leyen said Thursday it has formally notified the U.K. over its contentious plan to override the Brexit divorce deal, marking the first step in legal proceedings.

Reference: CNBC, Reuters