Gold finally had a green week after a gap of 14 days as U.S Fed reaffirmed its easing monetary policy rather it extended the timeline to few years from the earlier 2022 end. This move by the Fed indicates that the economic revival will be slow and painful as the pandemic is still creating fresh turbulence and will likely continue for sometime as historically seen during the Spanish Flu outbreak. Ample liquidity combined with bullish breakouts certainly makes gold the most desirable option mainly due to its safe haven class in times of uncertainty. Though the money from the dollar is also flowing towards equities pretty strongly as most world indices are hovering near/above all time highs, it might be getting fairly overstretched in terms of valuation and risk-reward and may well demand a pullback for further followup which again will be bullish for gold prices. The stage is set for gold to make a commendable move once again. To watch next week – Important economic data.

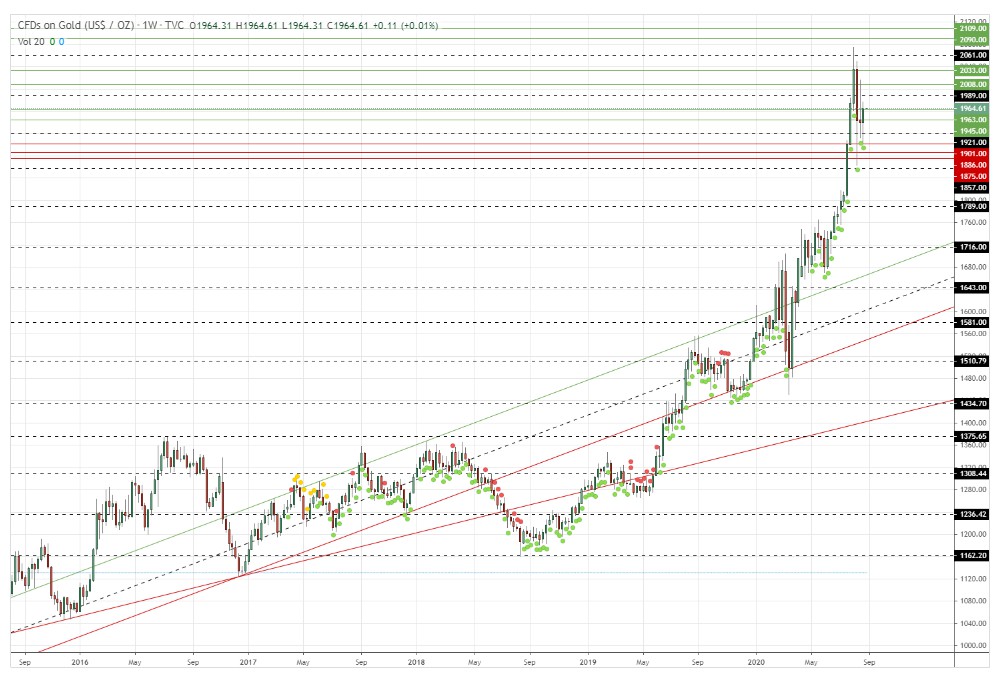

Gold posted its first weekly gains after the massive fall mainly on back of a lower dollar continuity which was confirmed by the Fed last week. The yellow metal at last broke out of the triangle consolidation which it was in for last 15 trading sessions signalling a fresh leg of upmove which should now test new highs. We have 2 scenarios –

1. Gold closed above the support, till this is held it can go to $1989. If this is crossed it can move towards $2008. And if this is taken out it can rally to $2033.

2. Short bets again go in limbo after the fresh bullish breakout except scalp trades.

Bullish view – Bulls finally made a green bar as dollar continued to decline breaking out of the triangle consolidation. This breakout opens up a new wave of uptrend allowing the metal another run towards its pattern target of $2700 plus which can be deemed quite optimistic in short run but nonetheless it is the breakout target which should be achieved in mid-long term. Factors supporting higher gold prices remain ultra supportive as pandemic continues to wreck havoc on global economies and geopolitical tensions remain elevated with no signs of any near term respite. Technicals have turned super bullish after the breakout with price expected to test new highs.

Bearishness remains unmindful after the breakout.

On larger terms, Gold continues to remain bullish and prices are expected to head higher.

Possible trades are on both sides but mainly on upside, gold can be bought above $1970 for the targets of $1989 and $2008 with a stop loss placed below $1955. Longer term target $2033.

Dips towards support (and breakout region) can be used to create longs for the above mentioned targets.

Shorts can be useful for scalp trades only.

Reference: Trading View