.jpg)

Gold dives 2% as dollar, yields gain after Fed comments

· Gold slumped over 2% in volatile trading on Thursday as the U.S. dollar and Treasury yields rose after Federal Reserve Chair Jerome Powell shifted the central bank’s inflation target in a widely expected move.

· Spot gold fell 1.1% to $1,931.96 per ounce by 02:49 pm EDT (1849 GMT). Prices had risen as much as 1.1% during Powell’s speech.

· U.S. gold futures settled down 1% at 1,932.60.

· “The Fed had a chance to update their forward guidance and signal that the labour market may warrant more support but we really didn’t get that,” Edward Moya, senior market analyst at broker OANDA said.

· “We’re probably going to see the stimulus trade unwind a little bit here and while this has really prompted a strong move with the Treasury curve and the dollar, this provides us with a frustrating consolidation (in gold).”

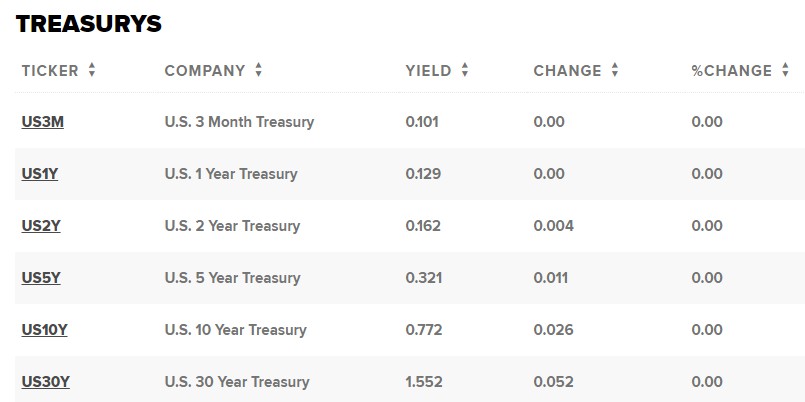

· Longer-term U.S. Treasury yields moved to their highest levels in months after Powell’s remarks.

· In a widely expected move, the Fed said it will seek to achieve inflation averaging 2% over time, offsetting below-2% periods with higher inflation “for some time” and rolled out an aggressive new strategy to lift employment.

· The Fed made no explicit promises on how long it may keep rates low, or how high it would allow inflation to go.

· The Fed had pumped in massive stimulus and kept interest rates near zero to lift the U.S. economy from the impact of the coronavirus.

· “We expect support for gold prices to remain firm, as Powell’s comments clearly reflect that the economic recovery from the COVID-19 crisis will be long and gradual, with ample central-bank support necessary to avoid backsliding,” said Cailin Birch, global economist at The Economist Intelligence Unit.

· Elsewhere, silver was down 1.8% at $27.01, having fallen over 3% earlier.

· Palladium declined 1.2% to $2,171.70 and platinum fell 0.9% to $920.41.

· Dollar gains after Fed shifts inflation target as expected

The U.S. dollar gained on Thursday in choppy trading after Federal Reserve Chairman Jerome Powell said, as widely expected, that the U.S. central bank would roll out an aggressive new strategy to lift U.S. employment and inflation.

Under the new approach, the U.S. central bank will seek to achieve inflation averaging 2% over time, offsetting below-2% periods with higher inflation “for some time,” and to ensure employment does not fall short of its maximum level.

The dollar index initially sank on the announcement, before rebounding to last be up 0.53% on the day at 93.31.

The euro fell 0.51% to $1.1769.

· Yields move higher amid Fed’s changes in inflation, unemployment approach

Treasury yields reversed higher on Thursday after Federal Reserve Chairman Jerome Powell announced a major policy shift to allow inflation to run hotter and unemployment to stay lower to support the economy.

The yield on the benchmark 10-year Treasury note cut earlier losses and gained 3 basis points to 0.729%. The yield on the 30-year Treasury bond jumped basis points to 1.483%. Yields move inversely to prices.

· Mexico records 6,026 new coronavirus cases, 518 more deaths

Mexico’s health ministry on Wednesday reported 6,026 new confirmed cases of coronavirus infections and 518 additional fatalities, bringing the total in the country to 579,914 cases and 62,594 deaths.

The government has said the real number of infected people is likely significantly higher than the confirmed cases.

· Powell announces new Fed approach to inflation that could keep rates lower for longer

The Federal Reserve announced a major policy shift Thursday, saying that it is willing to allow inflation to run hotter than normal in order to support the labor market and broader economy.

In a move that Chairman Jerome Powell called a “robust updating” of Fed policy, the central bank formally agreed to a policy of “average inflation targeting.” That means it will allow inflation to run “moderately” above the Fed’s 2% goal “for some time” following periods when it has run below that objective.

The changes were codified in a policy blueprint called the “Statement on Longer-Run Goals and Monetary Policy Strategy,” first adopted in 2012, that has informed the Fed’s approach to interest rates and general economic growth.

As a practical matter, the move means the Fed will be less inclined to hike interest rates when the unemployment rate falls, so long as inflation does not creep up as well. Central bank officials traditionally have believed that low unemployment leads to dangerously higher levels of inflation, and they’ve moved preemptively to head it off.

However, a speech Powell delivered to a virtual gathering of the Fed’s annual Jackson Hole, Wyoming, symposium, and accompanying documents that codified the new policy, signaled a shift away from the old thinking. The policymaking Federal Open Market Commitee approved the changes unanimously.

· Factbox: Quotes from last day of Republican National Convention themed 'Land of Greatness'

President Donald Trump prepared to attack Democratic rival Joe Biden in front of a large crowd on the South Lawn of the White House on Thursday, as the United States struggles to address the coronavirus pandemic and a wave of anti-racism protests.

The following includes excerpts of the speech Trump will make on Thursday night, as well as remarks from other speakers as delivered.

· Walmart wanted to be majority owner of TikTok, and was teamed up with Alphabet and SoftBank before Microsoft

Walmart and Microsoft might seem like an unlikely partnership to acquire TikTok’s U.S. assets, but until very recently the retailer had other plans.

Before teaming up with Microsoft in recent days, Walmart was part of a consortium put together by SoftBank Chief Operating Officer Marcelo Claure, which also included Google parent company Alphabet, according to people familiar with the matter.

Walmart wanted to be the exclusive e-commerce and payments provider for TikTok and have access to user data to enhance those capabilities, one of the people said. But the people said the U.S. government wanted the lead buyer of TikTok to be a technology company because that would better fit with its national-security rationale for forcing Chinese owner ByteDance to divest TikTok’s U.S. operations.

Walmart confirmed its partnership with Microsoft Thursday, releasing a statement stating its interest in TikTok’s e-commerce and advertising capabilities.

· Japan PM Abe set to hold news conference amid health concerns

Japanese Prime Minister Shinzo Abe is set to hold a news conference on Friday afternoon in which he is expected to address growing concerns about his health after two recent hospital examinations within a week.

Ruling party officials have said Abe’s health is fine, but the hospital visits, one lasting nearly eight hours, have fanned speculation about whether he will be able to continue in the job until the end of his term in September 2021. On Monday he surpassed a record for longest consecutive tenure as premier set by his great-uncle Eisaku Sato half a century ago.

Under fire for his handling of the coronavirus pandemic and scandals among party members, Abe - who vowed to revive the economy with his “Abenomics” policy of spending and monetary easing - has recently seen his support fall to one of the lowest levels of his nearly eight years in office.

Though he has beefed up Japan’s military spending and expanded the role of its armed forces, his dream of revising the pacifist constitution has so far failed due to divided public opinion.

· Oil dips as Hurricane Laura hammers U.S. Gulf Coast

Oil prices fell on Thursday as a massive hurricane in the Gulf of Mexico made landfall in the heart of the U.S. oil industry, forcing oil rigs and refineries to shut down.

Brent crude futures for October, which expire on Friday, fell 57 cents, or 1.3%, to $45.10 a barrel. West Texas Intermediate crude futures settled 35 cents, or 0.8%, lower at $43.04 per barrel.

The storm hit Louisiana early Thursday with 150 mile-per-hour (240 kph) winds, damaging buildings, knocking down trees and cutting power to more than 400,000 people in Louisiana and Texas. Its storm surge was less than predicted, sparing inland plants from feared flooding.

Oil producers on Tuesday had shut 1.56 million barrels per day (bpd) of crude output, or 84% of the Gulf of Mexico’s production, evacuating 310 offshore facilities.

· Dow rises more than 100 points, briefly turns positive for 2020