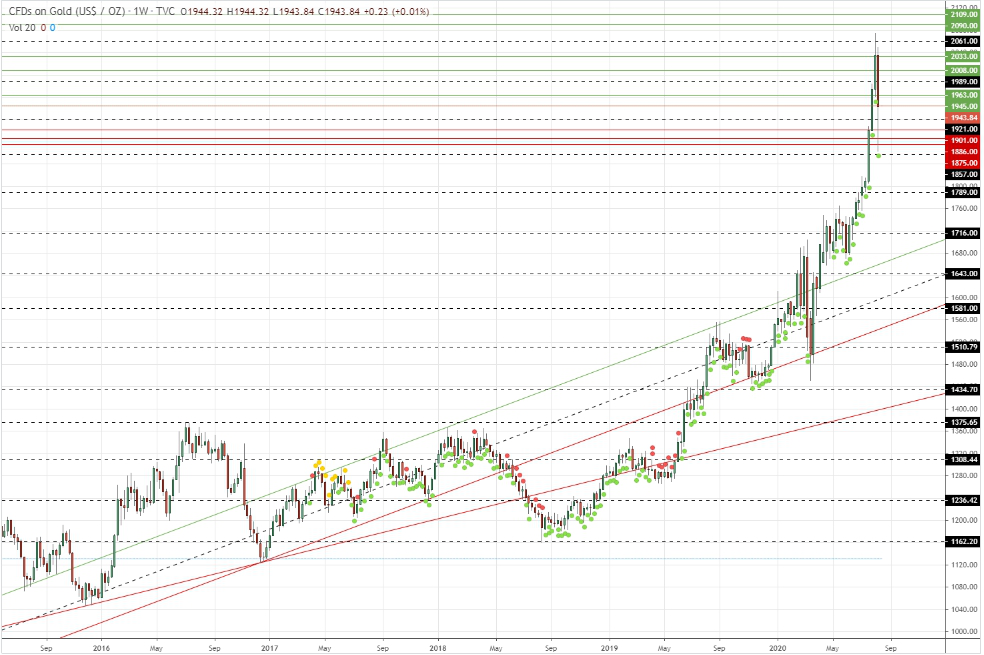

Gold had a huge week with a candle of over 180 points where it saw one of the biggest intraday fall lately all getting accounted for the overbought state of the metal since fundamentals didn’t change a bit nor did the dollar see a reversal in trend. This move, probably a historical one was largely a technical pullback/retest of previous highs as things were getting far too overstretched for any kind of risk reward to fit in nicely. Post the retest which was highly anticipated though not so swiftly the trend just gets stronger than ever as global situations remain murky since pandemic continues to wreck havoc and geopolitical tensions remain simmering. The week’s move may have irked a lot of bears as their hopes for a trend reversal were dashed at the similar speed at which they were cultivated. To watch next week – FOMC meeting minutes, earnings and other important economic data.

Gold saw one of the swiftest and biggest intraday fall in recent times without much/none fundamental backing. The intensity of the move was such that interim supports were melting like a hot knife through butter but the agony was short lived as the price catapulted back after testing previous high which was always the expected scenario. This fall was definitely on cards as technicals were posing a corrective pattern but the ferocity and depth was a surprise which may have taken out most of the retail longs. Amidst all the gloom, a bullish pattern of inverse head and shoulders breakout likely got confirmed reaffirming the trend. We have 2 scenarios –

1. Gold closed above the support, till this is held it can go to $1963. If this is crossed it can move towards $1989. And if this is taken out it can rally to $2008.

2. Short bets still remain neglected except scalp trades.

Bullish view – Bulls took a breather after 9 straight weeks of gains as the price corrected from highs mostly due to technical reasons. Overall the negativity was indeed a positive for the bulls as their tenacity got retested and the price resumed its upward journey. Not only the previous highs but the neckline of inverse head and shoulders was also retested pointing towards a sustained bull run as global tensions remain in similar state which they were a week back rather it is getting worse only. Fundamentals and technicals remain strongly in favor of higher prices with $2300 plus now seeming an attainable target in short-medium term.

Bearish bets were hooked in for a short while but failed to capitalize.

On larger terms, Gold continues to remain bullish and prices are expected to head higher.

Possible trades are on both sides but mainly on upside, gold can be bought above $1945 for the targets of $1963 and $1989 with a stop loss placed below $1932. Longer term target $2008.

Dips towards support (and breakout region) can be used to create longs for the above mentioned targets.

Shorts can be useful for scalp trades only.

Reference: Trading View