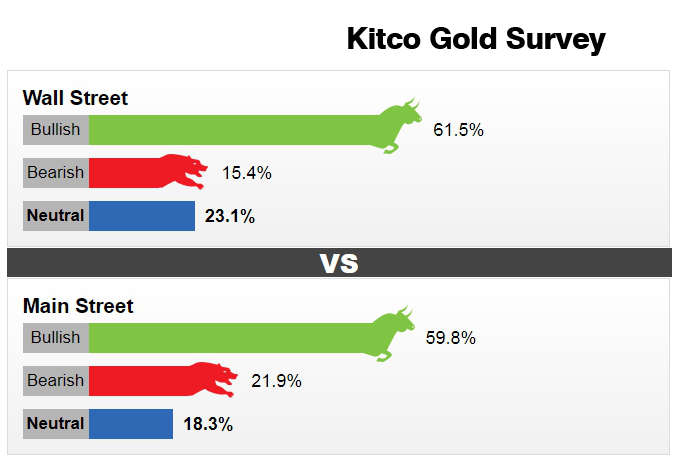

Gold is ready to make more gains next week after what is being described as a very healthy price correction for the market, with both Wall Street and Main Street participants projecting higher prices next week.

This week's price correction saw gold shed nearly $200, falling from $2,060 an ounce to below $1,880. Since then, gold has stabilized around the $1,950 level.

Strong demand and the technical positioning in gold reveal that the bullish sentiment remains intact, which means that gold could be looking at $2,000 an ounce as soon as next week.

“What we saw was a very nice correction. Market was one-way street before that. Looking at the environment that we live in right now, the bull rally is not over. We should be heading back above the $2,000 line. We are going to continue on a bullish run until the election in the U.S.,” Afshin Nabavi, senior vice president at precious metals trader MKS SA, told Kitco News on Friday.

The gold market saw lots of participants jumping in and buying the dip this week, said Blue Line Futures chief market strategist Phillip Streible.

“I am optimistic on gold to the upside. Lots of participants were waiting for correction and they got it this week,” Streible said. “The $1,900 and $1,874 and good support levels. On the upside, north of $2,000. People would get much more conformable with gold at $2,000 and will start to re-enter on fear of missing out.”

The macro-environment remains very pro-gold, said Phoenix Futures and Options LLC president Kevin Grady.

“Nothing has changed. All the reasons why gold was rallying is still in effect — the tremendous liquidity put it by central banks and the low interest rate environment,” Grady said. “We still have not seen mass liquidation in open interest, which is a sign of the bullish sentiment out there. This shows me that these guys are in for the long haul and are not going to be driven out, at least not at these prices.”

Gold’s fairly quick recovery above $1,900 an ounce has many analysts convinced that the rally has more room to run. “The yellow metal bounced off its weekly low ($1,874.2) with gusto signaling there is more rally ahead. Although it won't be a straight line, I believe it likely that gold will make $2,200-plus for 2020,” said Richard Baker, editor of the Eureka Miner Report.

Bearish calls were also present this time around with some analysts pointing out that the overwhelming interest in gold these days makes the trade overcrowded.

“The number of retail accounts surged in the last few weeks … As we look at the pullback — the rise of speculative activity has not subsided, they are buying the dip. In our view those early dip buyers are somewhat vulnerable. Rates both nominal and real both started to rise and now you have a situation that’s driven gold higher subsiding but the buyers keep buying,” said TD Securities commodity strategists Daniel Ghali.

The overall picture remains very supportive for gold going forward but for the time being the $1,850 level is where gold starts to get attractive again, Ghali pointed out.

The neutral voices for next week said that gold needs some time to consolidate and head sideways before committing to a clear path.

“I am neutral after our big move up last week and profit taking this week. We need to settle down a bit and be sideways,” said John Weyer, co-director of commercial hedging with Walsh Trading.

Reference: Kitco