· U.S. dollar struggles to sustain rally, eyes bond yields

The U.S. dollar was struggling to keep a rare rally together on Monday as its longest losing streak in a decade left much of the market structurally short of the currency and vulnerable to a squeeze on any upbeat news.

Bears were caught out by a better payrolls report on Friday, which pushed Treasury yields higher into this week’s massive $112 billion debt sale. Yet the dollar still ended lower for the seventh week in a row.

The euro edged up to $1.1791 on Monday, having hit a two-year high of $1.1915 last week, which now acts as major resistance. Support comes in around $1.1755 and $1.1694.

Turnover was light with Tokyo on a holiday and considerable uncertainty on whether U.S. policymakers can agree a new package of fiscal support for the virus-hit economy.

Against a basket of currencies, the dollar was a fraction firmer at 93.339 and just above a two-year trough.

The dollar was a little steadier on the yen at 105.75, well above the recent low of 104.17 but facing stiff resistance at 106.46.

Investors were wary of a fresh flare up in Sino-U.S. tensions with trade talks scheduled for Aug. 15 even as Washington imposed sanctions on senior Hong Kong and Chinese officials.

Any breakdown in talks would tend to benefit the dollar, and the safe-haven Swiss franc, at the expense of the Japanese yen and commodity currencies such as the Australian dollar.

On the data front, the United States has consumer prices on Wednesday and retail sales on Friday, which is expected to show a solid bounce in spending albeit before the latest round of social restrictions took some steam out of the economy.

A raft of Chinese figures is due this week, which is forecast to show a continued recovery, while EU production data is also expected to please.

Data showed China’s factory deflation eased in July, driven by a rise in global oil prices and as industrial activity climbed towards pre-coronavirus levels.

· Treasury yields edge higher as investors monitor stimulus hopes and U.S.-China relations

U.S. government debt prices were lower Monday morning as investors monitored the state of U.S. stimulus talks and the latest fraying of relations between Washington and Beijing.

At around 2:50 a.m. ET, the yield on the benchmark 10-year Treasury note was higher at 0.5673% and the yield on the 30-year Treasury bond edged up to 1.2431%. Yields move inversely to prices.

Investors also have an eye on relations between the U.S. and China in the aftermath of Trump’s executive order banning Chinese tech giants TikTok and WeChat. U.S. Health Secretary Alex Azar voiced strong support for Taiwan on Monday, a move likely to further irk Beijing.

On the data front, JOLTs job openings for June are expected at 10 a.m. ET ahead of consumer inflation expectations at 11 a.m. ET.

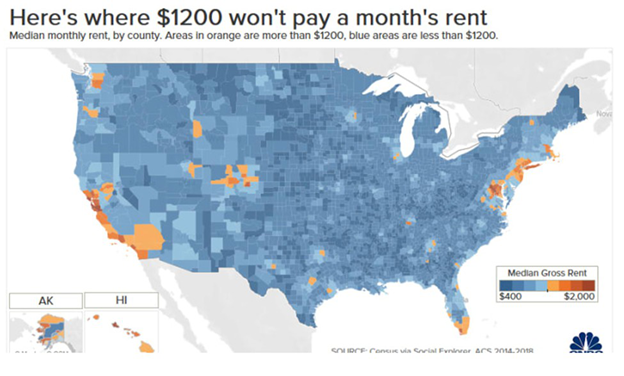

· Second $1,200 stimulus checks could be coming. For many, that won’t cover the rent

Negotiations over the next coronavirus stimulus package on Capitol Hill ended the week in a stalemate.

But struggling Americans may find that money won’t cover one month’s rent in many parts of the country.

Lawmakers on Capitol Hill are mostly in agreement when it comes to a second set of stimulus checks.

Democrats want to continue the extra $600 per week through January. Republicans have proposed reducing that to $200 per week through September, followed by a 70% wage replacement through December.

· Some office space could get permanently cut during the pandemic. Here’s how companies will cope

Working from home has become the norm during the coronavirus pandemic, and Morgan Stanley predicts that office tenants across Asia will permanently give up between 3% and 9% of their existing office space.

That will result in rent declining between 10% and 15% over the next three years, a recent report by the investment bank estimated.

Big tenants from the financial and IT industries, which have well established business continuity plans or work-from-home infrastructure, could give up even more office space — at 10% over the next three years, said the report

One option would embark on desk-sharing, where everyone works from home one day a week.

That can save 20% of office space, the investment bank says.

Another strategy would identify some functions that can be permanently done from home, such as human resources or other back-office jobs. Companies could also look into relocating some roles to low-cost locations such as India or Vietnam, according to the report.

The investment bank predicted that if companies have any additional demand for office space, they would tap on flexible work spaces instead.

· Pelosi, Mnuchin open door to narrower COVID-19 aid through 2020

U.S. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin on Sunday said they were open to restarting COVID-19 aid talks, after weeks of failed negotiations prompted President Donald Trump to take executive actions that Democrats argued would do little to ease Americans’ financial distress.

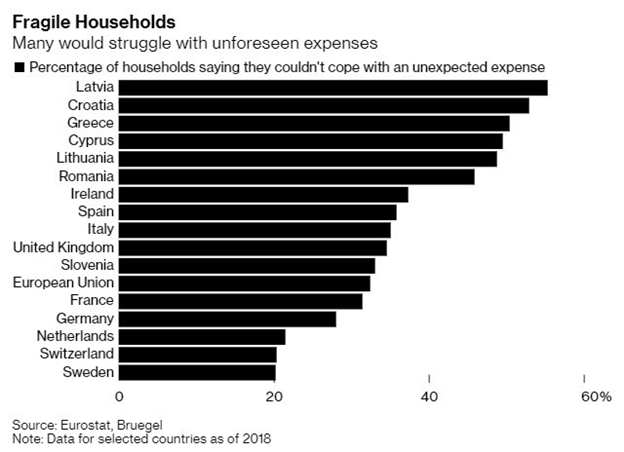

· Pandemic Puts Millions of Europeans on Path to a Debt Crisis

Organizations that help individuals sort out their financial problems are warning of a sharp increase in the number of families burdened by bills they can’t pay.

The Resolution Foundation said this month that 44% of U.K. households before the crisis would be unable to cover their bills if they lost their main source of income over a three-month period.

The European Consumer Debt Network, which tries to combat over-indebtedness, estimates that as much as 10% of European Union households already have a problem, and adviser Kosta Skliris reckons that will at least double.

· French economic activity runs 7% below normal level in July - Bank of France

Economic activity in France ran at 7% below normal levels in July, a slight improvement on June, as the construction sector neared pre-coronavirus crisis levels of activity and industrial capacity usage nudged higher, the Bank of France said.

In its monthly update on business conditions, the central bank said on Monday the euro zone’s second biggest economy contracted 13.8%, in line with its forecast.

In June, economic activity was 9% below normal levels, up from the 32% reduction seen during the first two weeks of lockdown in March.

· Brazil registers 3,035,422 confirmed cases of coronavirus, total deaths rise to 101,049

Brazil reported 23,010 new cases of the novel coronavirus and 572 deaths from the disease caused by the virus in the past 24 hours, the health ministry said on Sunday.

Brazil’s coronavirus outbreak is the world’s worst after the United States.

· China July Consumer Inflation Picks Up Amid Flood Disruption

China consumer inflation accelerated and factory price deflation eased in July, as the nation’s economy continued to recover from the coronavirus crisis amid disruption from regional flooding.

Food prices were pushed higher in the month partly due to damage and transportation disruptions caused by floods in central and southern China.

Core inflation, which removes the more volatile food and energy prices, was 0.5% year-on-year, compared with 0.9% in June. That’s the weakest reading since 2010.

· China sends fighter jets as U.S. offers Taiwan 'strong' support

TAIPEI (Reuters) - Chinese air force jets briefly crossed over the mid-line of the Taiwan Strait on Monday and were tracked by Taiwanese missiles, Taiwan’s government said, as U.S. health chief Alex Azar visited the island to offer President Donald Trump’s strong support.

Azar arrived in Taiwan on Sunday as the highest-level U.S. official to visit in four decades, a trip condemned by China which claims the island as its own, further irritating Sino-U.S. relations.

Amid deteriorating relations between Washington and Beijing, the Trump administration has made strengthening its support for the democratic island a priority, and boosted arms sales.

Tsai told Azar his visit represented “a huge step forward in anti-pandemic collaborations between our countries”, mentioning areas of cooperation including vaccine and drug research and production.

· Oil giants' production cuts come to 1 million bpd as they post massive writedowns

The world’s five largest oil companies collectively cut the value of their assets by nearly $50 billion in the second quarter, and slashed production rates as the coronavirus pandemic caused a drastic fall in fuel prices and demand.

Several executives said they took massive writedowns because they expect demand to remain impaired for several more quarters as people travel less and use less fuel due to the ongoing global pandemic that has killed more than 700,000 people.

· Oil rises 1% on Saudi Aramco's upbeat demand view, Iraq supply cut

Oil prices climbed on Monday, supported by Saudi optimism about Asian demand and an Iraqi pledge to deepen supply cuts, although uncertainty over a deal to shore up the U.S. economic recovery capped gains.

Brent crude LCOc1 futures rose 34 cents, or 0.8%, to $44.74 a barrel by 0641 GMT, while U.S. West Texas Intermediate (WTI) crude CLc1 futures were up 47 cents, or 1.1%, to $41.69 a barrel.

Both benchmark contracts fell on Friday, hurt by demand concerns, but Brent still ended the week up 2.5%, with WTI up 2.4%.

“Comments from the weekend from Aramco are the driver at the moment,” said Michael McCarthy, market strategist at CMC Markets and Stockbroking.

Saudi Arabian Aramco’s (2222.SE) Chief Executive Amin Nasser said on Sunday he sees oil demand rebounding in Asia as economies gradually open up after the easing of coronavirus lockdowns.

On the supply side, Iraq said on Friday it would cut its oil output by a further 400,000 barrels per day in August and September to compensate for its overproduction in the past three months. The move would help it comply with its share of cuts by the Organization of the Petroleum Exporting Countries and their allies, together called OPEC+.

The sharper cut will take Iraq’s total reduction to 1.25 million bpd this month and next.

Reference: CNBC, Reuters, Bloomberg