· Dollar loses support amid doubts about U.S. stimulus

The dollar nursed losses against most currencies, undermined by concern that Republicans and Democrats are struggling to reach consensus on the next round of U.S. economic stimulus measures.

The euro traded near its strongest level in more than a year on Wednesday after European leaders agreed a stimulus plan to fuel recovery from the economic drag caused by the COVID-19 pandemic.

Risk appetite has improved greatly this week as progress in developing vaccines for the novel coronavirus reduced the U.S. dollar’s safe-harbor appeal.

Investors also expect a massive amount of fiscal spending to support growth in major economies but could easily be disappointed if any stimulus falls short of expectations.

The dollar fell to 0.9315 Swiss franc to reach the lowest since March. The euro briefly touched the highest since Jan. 10 before settling at $1.1538.

The dollar was steady at 106.85 yen.

The onshore yuan rose to 6.9649 per dollar to reach the strongest since March 11, highlighting the dollar’s lack of support during the Asian session.

The Dollar Index, which tracks the greenback against a basket of six other currencies, was up 0.1% at 95.097, having earlier fallen to a low of 95.007 overnight, a level not seen since early March.

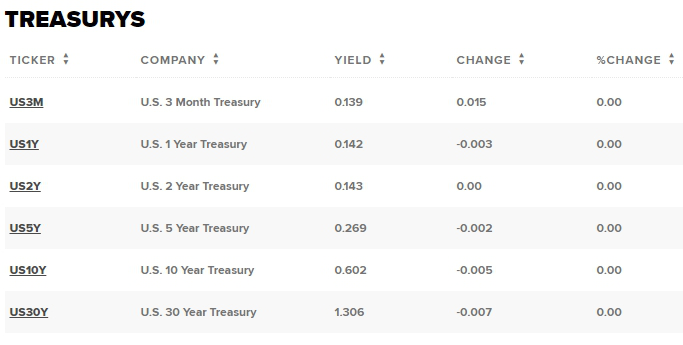

· Treasury yields edge lower as pandemic and stimulus concerns guide sentiment

U.S. government debt prices edged higher Wednesday morning after President Donald Trump conceded that the coronavirus pandemic will probably “get worse before it gets better.”

At around 2 a.m. ET, the yield on the benchmark 10-year Treasury note was lower at 0.6036% and the yield on the 30-year Treasury bond was down slightly at 1.3090%. Yields move inversely to prices.

In a White House briefing Tuesday, Trump adopted a more somber tone regarding the outlook for the pandemic in the U.S. than in recent weeks, having long downplayed the threat of the virus.

Trump also signaled a willingness to work with China and other countries to deliver a successful coronavirus vaccine, despite a recent escalation of tensions with Beijing.

Republicans and Democrats remain at odds over the extent of the next round of coronavirus aid, with Congressional Democrats demanding more money and more details on a potential $1 trillion relief package after a meeting with White House advisers Tuesday.

Existing home sales for June will be released at 10:00 a.m. on Wednesday. Economists polled by Dow Jones are expecting a rebound to 4.73 million sales.

· EUR/USD rally may pause on US fiscal wrangling

Broad-based US dollar weakness powers EUR/USD to an 18-month high of 1.1547 in Asia. Politicians in Washington tussle over the next round of fiscal spending. The US fiscal impasse may dent risk sentiment and allow recovery in the US dollar.

From a technical perspective, the overnight sustained move beyond the previous YTD tops and a subsequent positive move support prospects for additional gains. However, oscillators on hourly/daily charts are already flashing oversold conditions and warrant some caution for bullish traders. Hence, it will be prudent to wait for some near-term consolidation or a modest pullback before positioning for a further near-term appreciating move. Nevertheless, the pair still seems poised to move beyond 2019 swing highs, around the 1.1570 region, and reclaim the 1.1600 round-figure mark. The mentioned level coincides with the 50% Fibonacci level of the 1.2555-1.0636 downfall and might keep a lid on the ongoing upward trajectory.

On the flip side, the 1.1500-1.1495 region now seems to protect the immediate downside. Any further profit-taking slide might still be seen as a buying opportunity. This, in turn, should help limit the downside near the 1.1430 horizontal support.

· GBP/USD: Eases from 1-½ month top above 1.2700 amid no-deal Brexit fears

GBP/USD recedes towards 1.2700 while heading into the London open on Wednesday. The cable steps back from the highest since June 10 on renewed fears of a no-deal Brexit. Also challenging the pair could be coronavirus (COVID-19) woes and the UK-China tussle.

GBP/USD recedes from 1.2740 to 1.2725 while heading into the London open on Wednesday.

A bearish candlestick formation, Graveyard Doji, on the four-hour chart joins overbought RSI conditions to drag the sellers towards 1.2685-70 region comprising highs marked between June 16 and July 09. Meanwhile, an upside clearance of the June month’s top surrounding 1.2815 will propel the quote towards the February-month lows near 1.2840 and 1.2880 ahead of targeting 1.3000 psychological magnet.

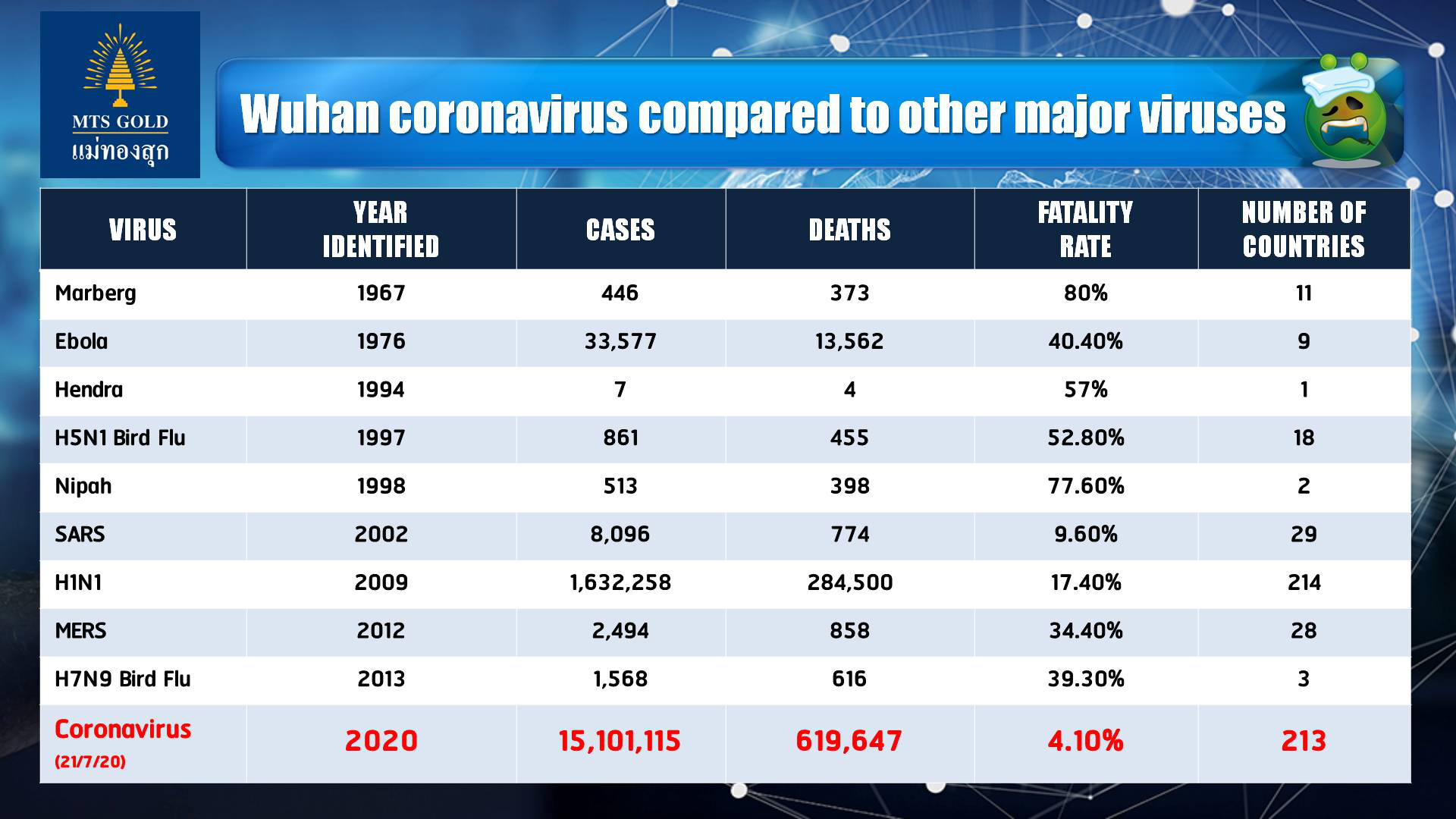

· Global coronavirus cases exceed 15 million: Reuters tally

Global coronavirus infections surged past 15 million on Wednesday, according to a Reuters tally, with the pandemic gathering pace even as countries remain divided in their response to the crisis.

In the United States, which has the highest number of cases in the world with 3.91 million infections, President Donald Trump warned: “It will probably, unfortunately, get worse before it gets better.”

The top five countries with the most cases is rounded out by Brazil, India, Russia and South Africa. But, the Reuters tally shows the disease is accelerating the fastest in the Americas, which account for more than half the world’s infections and half its deaths.

Globally, the rate of new infections shows no sign of slowing, according to the Reuters tally, based on official reports.

· Pandemic’s economic hit will be here ‘for a long time’ even if a vaccine is approved, economist says

While markets reacted positively this week to promising news of potential coronavirus vaccines in development, a top economist warned that the economic hit from the pandemic will be here for a long time.

A large number of small businesses that closed in March — when restrictions around social movements went into effect — are not going to reopen even when the situation improves, according to Raghuram Rajan, a professor of finance at the University of Chicago’s Booth School of Business.

“I think the hit is going to be with us for a long time,” Rajan, who was also the former governor at India’s central bank, told CNBC’s “Street Signs Asia” on Wednesday.

“As this goes on, more and more businesses find that a long period without revenue, but high cost, implies that they simply don’t have a chance, and they’re closing down,” he added.

“You don’t get a full economy back until there is greater confidence for people to mingle, until the high-contact services like restaurants, travel, tourism – all those can open up again. Till then, you’re at a 95% economy,” Rajan said, adding that countries need to now start thinking about providing long-term support to affected sectors.

Experts have previously warned that the pandemic could lead to more protectionism around the world as countries attempt to safeguard their domestic industries.

For his part, Rajan said that a rise in protectionism will further delay economic recovery.

“A world which has strong protectionism is going to be a world that recovers much more slowly, and much of the damage is going to be done in the countries that are dependent most on commodity exports,” he said, adding it would also affect many poor developing countries as well the emerging markets.

· Japan June industrial output seen rebounding from pandemic slump: Reuters poll

Japan’s industrial output likely rebounded in June from the near double-digit decline in the previous month, in a sign factory activity may have bottomed out from the deep slump caused by the coronavirus pandemic, a Reuters poll of 13 economists showed.

While a relatively small rebound in factory output would point to a modest economic recovery ahead, the jobless rate was expected to creep up from decades-low levels, underscoring a more prolonged impact from the health crisis.

· Confusion Swirls as Japan Launches Tourism Campaign amid Virus Surge

Japan on Wednesday kicked off a national travel campaign aimed at reviving its battered tourism industry, but the effort has drawn heavy criticism amid a jump in new coronavirus cases.

“Go To Travel” - dubbed “Go To Trouble” by some local media - offers subsidies of up to 50% on trips to and from prefectures excluding Tokyo, which was removed from the program last week after infections surged to new highs.

But many of Japan’s governors wanted the campaign delayed or amended out of fear it would spread the virus to rural areas with low infection numbers, while a Mainichi newspaper poll this week showed 69% of the public wanted the program cancelled entirely.

The criticism underlines the public’s growing exasperation with what critics say are mixed messages as the government tries to boost the economy while containing the virus.

· Oil prices slip as U.S. inventories, virus fears grow

Oil prices fell on Wednesday as industry data showed a bigger-than-expected inventory build in the United States, where climbing coronavirus cases may further dent fuel demand in the world’s biggest oil consumer.

Industry group American Petroleum Institute (API) reported U.S. crude inventories rose last week by 7.5 million barrels, against expectations for a draw of 2.1 million barrels.

Brent crude fell 35 cents, or 0.8%, to $43.97 a barrel by 0541 GMT, and U.S. West Texas Intermediate (WTI) crude dropped 39 cents, or 0.9%, to $41.53.

Oil prices climbed about $1 the previous day, reaching their highest since March 6.

The U.S. Energy Information Administration (EIA) will release official oil data later on Wednesday.

· Thailand to extend emergency decree until end of August: official

Thailand will extend a state of emergency until the end of August, a senior official said on Wednesday, maintaining the security measure put in place to contain its coronavirus outbreak.

The announcement comes after nearly two months without local transmission and with many people in Thailand questioning the need for an emergency decree.

The extension comes after a weekend where political protests took place against the government, in defiance of a ban on gatherings. Somsak, however, said the emergency decree would be used only to contain virus outbreaks and not rallies.

· Powerful 7.8 earthquake hits Alaska isles, tsunami possible

A powerful 7.8 earthquake has struck the Alaska Peninsula and a tsunami warning has been issued.

According to the U.S. Geological Survey, the 7.8 magnitude quake struck Tuesday at about 11:12 p.m. PST. It had a depth of 6 miles (9.6 kilometers) and was centered 60 miles (96 kilometers) south-southeast of Perryville, Alaska.

The tsunami warning was issued for South Alaska, the Alaska Peninsula and the Aleutian Islands.

A tsunami advisory was posted for some areas nearby. For other US and Canadian Pacific coasts in North America, there is no tsunami threat.

Reference: CNBC, Reuters, FXStreet