Gold eases on firm dollar; rising virus cases lend support

· Gold prices eased on Wednesday on hopes of a potential Covid-19 drug and a stronger U.S. dollar, but the fall was limited due to worries about surging cases of the novel coronavirus in Beijing.

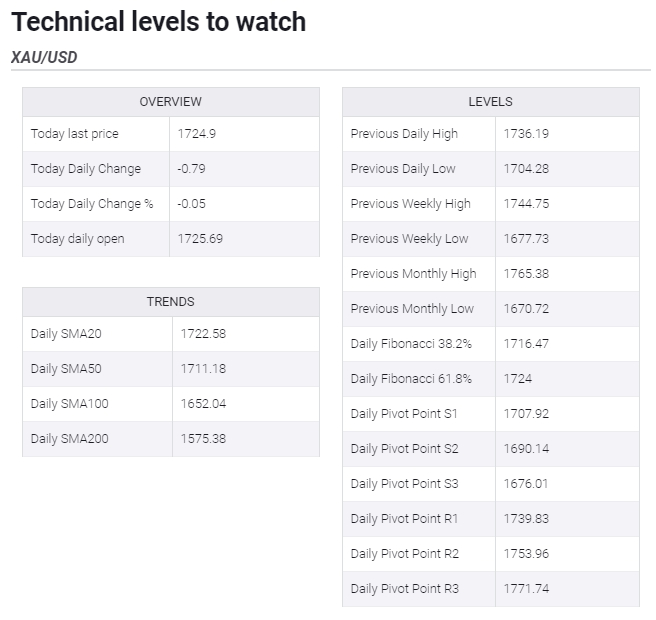

· Spot gold was down 0.2% at $1,723.20 per ounce by 0302 GMT, holding a tight $6 narrow range. U.S. gold futures fell 0.3% to $1,731.

· “The attention remains elsewhere, mostly equity markets. However, Covid-19 nerves as Beijing shutdowns extend should offer support on any dips,” said Jeffrey Halley, senior market analyst at OANDA.

· Beijing officials reported several new Covid-19 cases for the sixth consecutive day, while new infections hit record highs in six U.S. states on Tuesday.

However, the dollar rose 0.1% against its rivals, making gold expensive for holders of other currencies.

· Meanwhile, a record increase in U.S. retail sales in May supported views the U.S. recession might be drawing to an end, with upbeat trial results for a Covid-19 treatment further aiding investor sentiment.

· Geopolitical tensions and additional stimulus measures from global central banks also offered some support to the safe-haven, which often used as a safe store of value during times of political and financial uncertainty.

· India reported 20 of its soldiers had been killed in clashes with Chinese troops at a disputed border site, while North Korea rejected a South Korea offer to send special envoys and vowed to send back troops to the border.

· Gold holds steady near $1724-25 area, Powell’s testimony eyed for fresh impetus

Gold dropped to fresh session lows, around the $1717-16 region in the last hour, albeit lacked any strong follow-through and was last seen trading in the neutral territory.

Investors cheered the Fed's announcement on Monday that it will start buying purchasing a diversified range of investment-grade US corporate bonds. The global risk sentiment got an additional boost from reports that the Trump administration was preparing an additional $1 trillion infrastructure spending bill.

The upbeat market mood was seen as one of the key factors that undermined demand for the safe-haven precious metal and kept a lid on the intraday uptick. This coupled with some strong follow-through uptick in the US Treasury bond yields further collaborated towards capping the upside for the non-yielding yellow metal.

Meanwhile, the modest pullback from the daily swing highs, around the $1733 region, was sponsored by a goodish intraday bounce in the US dollar, tends to drive flows away from the dollar-denominated commodity. The USD uptick got an additional boost following the release of stronger-than-anticipated US monthly retail sales data.

The downside, however, remained cushioned, at least for the time being, as investors refrained from placing any aggressive bets ahead of the Fed Chair Jerome Powell's testimony before the Senate Banking Committee. Powell's expectations for the US economy will now play a key role in determining the commodity's near-term trajectory.

· Gold Price Forecast – Gold Markets Somewhat Sluggish

Gold markets have gone back and forth during the trading session on Tuesday as markets do not really know what to do next as far as risk appetite is concerned. With this being the case, it makes quite a bit of sense that the candlestick is essentially a neutral candle. I like the overall idea of buying gold, so therefore I am looking for bits and pieces of value at lower levels. I think that starts at the $1700 level extending down to the $1675 level in a $25 range of buying pressure. Ultimately, this is a marketplace that continues to see a lot of volatility but quite frankly there are so many things out there that could cause trouble I think it is only a matter of time before gold does break out.

If the market does in fact break down a bit from here think it is only a matter of time before we see buyers come into the market, especially near the $1700 level as it is such an important support level from a psychological standpoint, and of course will continue to attract a lot of order flow. Having said that, the market is likely to see a lot of volatility but a lot of “value hunting” underneath as well. I think at this point selling gold is all but impossible, because we have so much in the way of financial risk out there that it makes sense to have a certain amount of gold into the portfolio as it will protect from this risk and you also have to keep in mind that the Federal Reserve is crushing the US dollar anyway.

Reference: CNBC, FXStreet, FX Empire