· Euro, risk currencies lifted by ECB stimulus

The euro jumped to a three-month high on Friday after the European Central Bank expanded its stimulus more than expected to prop up an economy dealing with its worst recession since World War Two.

The ECB’s move supported appetite for riskier currencies, lifting the Australian dollar to a five-month high and the British pound above peaks hit during the last two months.

The central bank increased its emergency bond purchase scheme by a bigger-than-expected 600 billion euros to 1.35 trillion and extended the scheme to mid-2021.

The euro rose 0.25% to $1.1367 EUR=, its loftiest level in almost three months. On the week, the single currency has risen 2.4% and is set to clinch a third straight week of gains.

Investor confidence in the currency has also grown after Germany last month threw its weight behind the idea of a European Union recovery fund, breaking away from its long-held tradition to resist moves towards fiscal integration in the currency bloc.

The dollar index =USD is on course for its third consecutive week of losses at 96.510, near its lowest in nearly three months.

The greenback firmed to 109.33 yen JPY=, flirting with its highest levels in two months.

Unwinding bets on safe-haven currencies reflected broad optimism in financial markets as easing social distancing restrictions supported economic recovery hopes.

The U.S. weekly jobless claims report showed the number of Americans filing for benefits dropped below 2 million last week for the first time since mid-March, even though that is still three times larger than their peak during the global financial crisis.

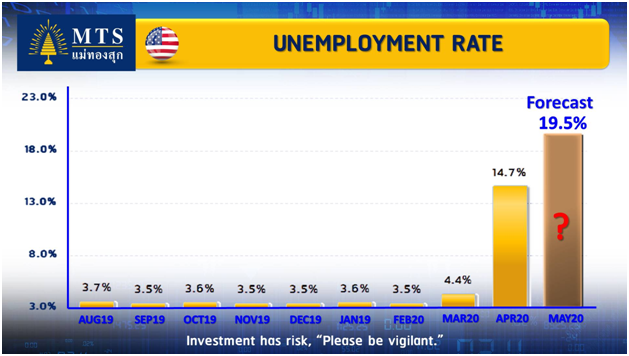

Official U.S. employment data due later on Friday is expected to show nonfarm payrolls fell by 8 million in May after a record 20.54 million plunge in April.

The unemployment rate is forecast to rocket to 19.8%, a post-World War Two record, from 14.7% in April.

· U.S. government debt prices were lower Friday morning ahead of a slew of key economic data releases.

At around 2 a.m. ET, the yield on the benchmark 10-year Treasury note was trading higher at 0.8418% and the yield on the 30-year Treasury bond was also rising to trade at about 1.6480%. Yields move inversely to prices.

U.S. government bond yields had began to push higher Thursday after the European Central Bank announced higher-than-expected purchases of euro zone debt. However, Friday’s focus will be on new U.S. nonfarm payrolls and unemployment figures due at 8.30 a.m. ET. There will also be new consumer credit figures at 3 p.m. ET.

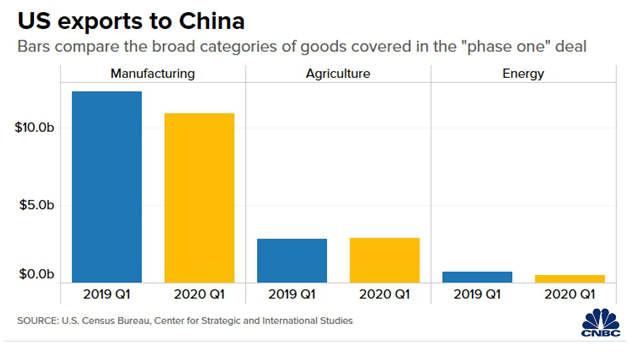

· The U.S. will not likely want to “break” its so-called phase one trade deal with China, even though tensions between the two countries have escalated in recent weeks, a Morgan Stanley economist said on Friday.

U.S. President Donald Trump said last month he was “very torn” about whether to end the phase one deal. His comments raised concerns among investors and analysts that the world’s two largest economies would resume a tariff war that’s damaging to the global economy.

“At this point, our view from an economics standpoint ... is as long as we have the phase one deal going on and there is no renewed escalation in terms of tariffs, then the global growth projections that we have should be intact,” Chetan Ahya, Morgan Stanley’s chief economist and global head of economics, told CNBC’s “Squawk Box Asia.”

He explained that the Trump administration “would be focused on economy right now and will not want to break the phase one deal,” so the risk of a renewed U.S.-China trade war hitting the global economy “is not likely to be happening in our forecast.”

· U.S. unemployment rate seen near 20% as COVID slams jobs market again in May

The U.S. unemployment rate likely shot up to almost 20% in May, a new post World War Two record, with millions more losing their jobs, exposing the horrific human toll from the COVID-19 crisis.

The Labor Department’s closely watched monthly employment report on Friday could bolster economists’ dire predictions that it would take several years to recover from the economic meltdown.

Still, May was probably the nadir for the labor market. While layoffs remained very high, they eased considerably in the second half of May as businesses reopened after shuttering in mid-March to slow the spread of COVID-19.

Consumer confidence, manufacturing and services industries are also stabilizing, though at low levels, hopeful signs that the worst was over.

· China May exports seen tumbling as coronavirus hits demand; imports fall: Reuters poll

China’s exports likely tumbled in May after a surprising rebound the previous month as global coronavirus lockdowns continued to devastate demand, but imports showed some signs of improvement as Chinese manufacturers got back on their feet, a Reuters poll showed on Friday.

May exports in the world’s second-largest economy are expected to have contracted 7% from a year earlier, according to a median estimate from the survey of 23 economists, compared with an unexpected 3.5% gain in April.

Imports likely fell 9.7% on year, the poll showed, easing from a 14.2% drop the previous month, due to recovering global oil prices, a low base last year and as manufacturers cranked up operations.

· Germany will need two years to recoup growth lost in recession, Bundesbank says

Germany’s economy will shrink significantly this year and may need two years to make up the lost ground, its central bank said on Friday, joining a number of forecasters predicting only a slow recovery from a coronavirus-induced recession.

The euro zone’s biggest economy will contract by 7.1% in 2020 based on calendar adjusted figures and 6.8% according to unadjusted data, the Bundesbank said in its biannual projections, days after the government agreed a 130 billion euro stimulus scheme.

The Bundesbank’s projections are now broadly in line with outlooks provided by the government and its Council of Economic Experts, which both predicted a drop in the 6% to 7% range.#

Much of Germany’s economy was shuttered for months amid the pandemic and restrictions are only slowly lifted.

· Oil dips on uncertainty over producers’ commitment to output cuts

Oil prices eased slightly on Friday as markets wait to see whether major producers will commit to an extension of record production cuts to support oil prices.

Brent crude futures were down 8 cents, or 0.2%, at $39.91 a barrel as of 0106 GMT and U.S. West Texas Intermediate (WTI) crude futures fell 15 cents, or 0.4%, to $37.26 a barrel.

Still both benchmarks are set for a sixth weekly gain on the back of output cuts and signs of improving fuel demand as countries begin to ease restrictions to prevent the spread of the coronavirus.

· Russia says OPEC+ meeting to be held on Saturday

The Russian energy ministry said a video conference of a group of leading oil producers, known as OPEC+, would be held on Saturday.

Separately, an OPEC+ source told Reuters that the OPEC conference was scheduled to start at 2 pm Vienna time (1200 GMT) on Saturday followed by the OPEC+ online meeting at 4 pm.

Reference: CNBC, Reuters,Daily FX