· Gold rose over 1% on Monday to its highest in more than seven years as dismal U.S. data underscored how badly the COVID-19 pandemic has damaged the world's top economy, while palladium soared over 9% on better-than-expected demand outlook.

· Spot gold was up 1.1% at $1,760.85 per ounce by 0402 GMT, after rising to its highest since Oct. 12, 2012 at $1,763.51. U.S. gold futures gained 0.8% to $1,770.50.

· "Markets are pricing in that the (economic) recovery is going to be a little slower than previously expected, and that's probably going to require an environment of lower rates," said IG Markets analyst Kyle Rodda, adding that Friday's "really poor" U.S. economic data was the big catalyst.

· Data out on Friday showed U.S. retail sales and industrial production both plunged in April, putting the economy on track for its deepest contraction since the Great Depression.

· Federal Reserve Chairman Jerome Powell said a U.S. economic recovery may stretch deep into next year and a full comeback may depend on a coronavirus vaccine.

· The Bank of England is also looking more urgently at options such as negative interest rates as the economy slides into a deep coronavirus slump, according to its chief economist.

· Gold is considered an attractive investment during times of political or economic turmoil. Lower interest rates also reduce the opportunity cost of holding non-yielding bullion.

Adding to the bleak economic scenario was renewed Sino-U.S. friction, with China's commerce ministry on Sunday saying it was firmly opposed to the latest rules by the United States against Huawei and would take all necessary measures to safeguard Chinese firms' rights and interests.

· "There is increased volatility as the rhetoric is becoming very hot, and especially from the United States. That is manifesting some weakness in growth-sensitive markets, and in particular China-sensitive markets," Rodda said.

· Reflecting investor sentiment, SPDR Gold Trust holdings, the world's largest gold-backed exchange-traded fund, rose 0.8% to 1,113.78 tonnes on Friday.

· Among other precious metals, palladium was up 4.2% at 1,980.25, having surged more than 9% earlier in the session.

· "Both palladium and platinum are rising sharply after the World Platinum Investment Council (WPIC) provided their updated metals forecast," said Edward Moya, a senior market analyst at broker OANDA.

"The WPIC highlighted that the outlook for both metals is better than expected, and that the COVID-19 impact could be less (than expected)," he said, adding that the market was moving on optimism over autocatalyst demand in China and America.

· Platinum gained 0.8% to $804.43, while silver rose 3.3% to $17.17.

· Gold Price Analysis: Symmetrical triangle breakout targets $1805 in the coming weeks

The bullish reversal in Gold prices (XAU/USD) kicked-off last week after bottoming out at 1690 levels.

The upside momentum gained traction after the rates closed Wednesday above the 21-DMA, then at 1705.81.

While the actual bullish break materialized after a classic symmetrical triangle pattern was confirmed on the daily chart last Thursday. The bulls rallied hard to clock a fresh seven-year high at 1751.80 before retracing slightly into the weekly closing on Friday.

In a month’s time, the price is likely to test the pattern target at $1807. Ahead of that level, the key resistances are located at 1754.39 (Nov 2012 high), 1760 (round number) and 1795.25 (Oct 2012 high).

Advocating the case for additional gains, the daily Relative Strength Index (RSI) is pointing upwards, although remains below the overbought territory, near the 65.15 region. Meanwhile, the spot trades above all majors DMAs.

Alternatively, any pullback will target the earlier resistance-turned-descending trendline support aligned at 1719.61, below which the 21-DMA will be tested on its south run towards the 1700 level. Selling pressure will accelerate below the latter, opening floors for a test of the ascending trendline (pattern) support at 1685.56.

Wall St., Main St. both look for gold prices to keep shining

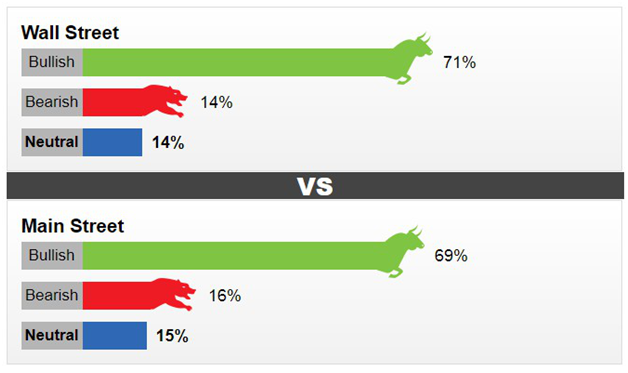

Wall Street and Main Street alike remain bullish on gold prices for the week ahead, according to the weekly Kitco News gold survey.

Professional investors and traders cited the ongoing quantitative-easing efforts as a factor propping up gold as economic data remain soft. The latter was highlighted again this week as weekly U.S. jobless claims rose another 3 million and a Friday report showed that April retail sales fell 16.4%.

“The momentum is definitely with gold as more and more investors see gold as the only alternative to unlimited and endless QE,” said Adrian Day, chairman and chief executive officer of Adrian Day Asset Management.

“I am bullish for gold next week,” said Kevin Grady, president of Phoenix Futures and Options LLC. “We are starting to see equities slow at this point. The massive global stimulus packages that the central banks have undertaken should propel gold to higher levels. This low interest-rate environment will be here for a while, also bullish for gold.”

Richard Baker, editor of the Eureka Miner's Report, commented that gold has benefited from safe-haven flows and silver is starting to show some “spark.” Still, he offered some caution, pointing out that investors can exit bullish positions just as quickly as they enter, and there’s always potential for a breaking news event to reverse moves in markets, such as a breakthrough vaccine for COVID-19.

Still, for now, Baker said, “I believe it likely that gold will make the $1,780 level next week with silver looking above $17, a level not seen since early March.”

Reference: Reuters,FX Street,Kitco