· Gold prices edged up on Wednesday as a weaker dollar eclipsed optimism over plans for a gradual easing of coronavirus curbs, while investors awaited a policy decision by the U.S. Federal Reserve due later in the day.

Spot gold rose 0.2% to $1,711.31 per ounce by 0539 GMT after three straight sessions of falls. U.S. gold futures climbed 0.3% to $1,727.50 per ounce.

· Making greenback-denominated gold more appealing to investors using other currencies, the dollar eased as the slowing coronavirus' spread and moves to re-open economies boosted risk appetite, though there was caution ahead of the Fed decision.

· "There's a movement out of the dollar because there's a lot of uncertainty around an event like the Fed meeting, and that's supporting a little bit of a lift in gold on an intra-day basis," said IG Markets analyst Kyle Rodda.

"We've got a lot of major events on the economic and corporate calendar in the next few days," Rodda said, adding that this was leading to heightened risks in the equities market.

· Asian shares rose for a third straight session in cautious trading and oil prices jumped on hopes demand will pick up as countries look to ease restrictions.

Many countries tiptoed out of lockdowns and more parts of the United States looked set to restart businesses.

· "With central banks increasing liquidity in financial markets, low interest rates and rising money supply are all factors that are bullish for gold in the longer term," Phillip Futures said in a note.

· The Fed has slashed interest rates, resumed bond-buying and backstopped credit markets. Its statement on Wednesday could begin to clarify how long it intends to leave rates near zero.

· Gold tends to benefit from widespread stimulus measures as it is often seen as a hedge against inflation and currency debasement.

· U.S. consumer confidence tumbled to near a six-year low in April as restrictions disrupted economic activity and threw millions of Americans out of work.

· Drawing the curtains on one of the most venerable names in precious metals trading, Bank of Nova Scotia (Scotiabank) told staff on Tuesday it would close its metals business, two sources familiar with the matter told Reuters.

· Palladium rose 3% to $1,974.33 an ounce platinum gained 0.4% to $775.18 per ounce, silver was up 0.1% to $15.20 per ounce.

· Gold Price Analysis: Currency debasement fears could push yellow metal to all-time highs

Gold is often used as a hedge against currency debasement, making the current environment a perfect one for gold, ForexLive editor Adam Button said in an interview with Kitco News earlier this week.

“Unlimited monetary policy easing, rising debt levels, inflation worries and currency debasement is what’s on gold analysts minds lately.

Once we get over to 8-year highs and then eventually all-time highs then money just starts to flood in and you have this snowball rolling downhill and the sky is the absolute limit.”

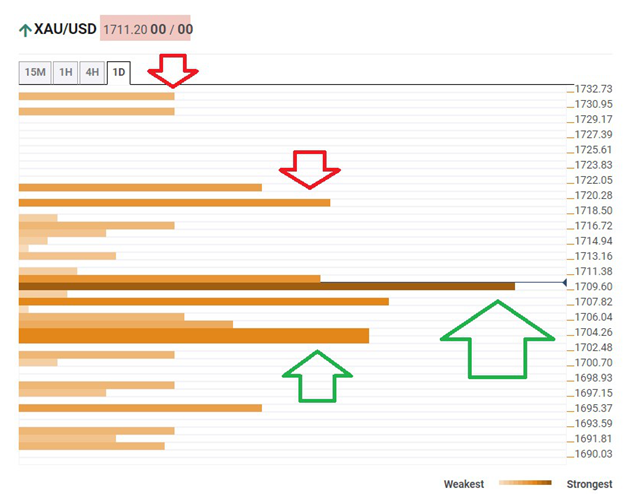

· Gold Price Analysis: Well-supported and ready to rise ahead of the Fed – Confluence Detector

Gold has been holding onto some of its gains and now faces a big test – the Federal Reserve's rate decision. Can the precious metal continue higher? The technical positioning looks promising.

The Technical Confluences Indicator is showing that XAU/USD is sitting above strong support at $1,709, which is the convergence of the Fibonacci 38.2% one-week, the Simple Moving Average 10-one-day, the SMA 5-1h, the Bollinger Band 15min-Middle, the SMA 50-1h, the SMA 200-15m, and more.

Further down, another cluster awaits at $1,704, which includes the Pivot Point one-month Resistance 1, the previous monthly high, and the SAM 50-4h.

Looking up, the initial target is $1,719, which is the confluence of the PP one-day Resistance 1 and the SMA 5 one-day.

The upside target is $1,732, which is where the Fibonacci 161.8% one-day hits the price.

· FX Empire: Gold Uptrend Expected to Aim at $1900-$2000 Targets

The XAU/USD is either building a wave 2 (blue) pullback or price is in a larger and more complex wave 4 (purple) correction. The bullish outlook remains valid as long as price stays above the 50% Fibonacci level of wave 4 vs 3 (red x).

A breakout above the resistance trend line (red) is the first signal of a larger uptrend continuation. A pullback is expected to retest the 21 ema zone before a next breakout above the larger resistance (red) would confirm (green check) a potential impulsive swing.

Reference: Reuters, FX Street, FX Empire