· Stock markets have taken a battering as the ongoing coronavirus pandemic continues to rattle global economies. But some young people are taking it as an opportunity to kick-start their investing careers.

Online stock trading platforms have seen a surge in demand in recent months as investors seek to take advantage of undervalued equities.

Investing app Robinhood saw “record” deposits in the first quarter of 2020, with daily trades up 300% compared to late-2019. Elsewhere, eToro and Raging Bull Trading saw demand surge 220% and 158%, respectively, over the same period.

Many of those new users are young or even first-time investors. Over half (55%) of Wealthsimple’s new users are aged 34 or below. That is unsurprising, according to Raging Bull Trading’s founder, Jeff Bishop, who said many millennials are now looking for new opportunities to make some extra cash — or recover earlier losses.

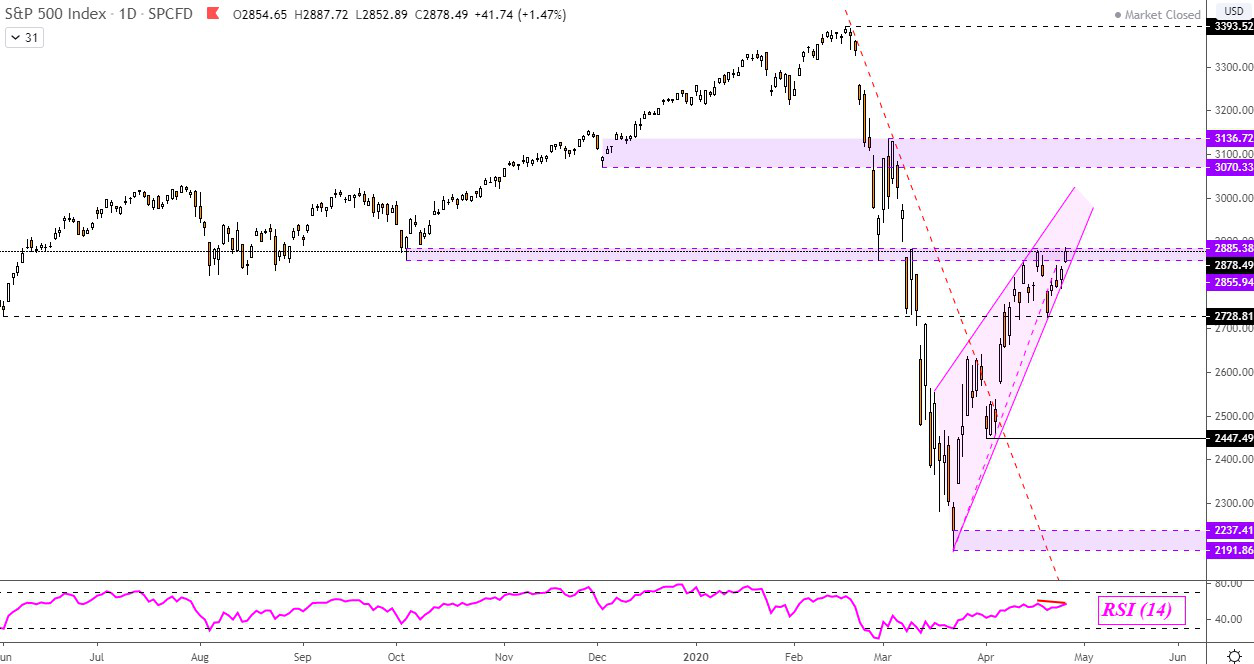

· S&P 500 Technical Analysis

The S&P 500 could be at a turning point from a technical perspective. Prices are attempting to push through the April 17 high as negative RSI divergence forms in the background. That is a sign of fading momentum which can precede a turn lower if resistance holds at 2885 on the daily chart below. The S&P 500 also appears to be trading within a Rising Wedge bearish reversal pattern since last month’s bottom.

· Most Asian shares ground higher while U.S. stock futures fell on Tuesday amid choppy trade as a renewed decline in oil prices partially offset optimism about the easing of coronavirus-related restrictions.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.2%. Shares in China .CSI300 rose 0.65%. South Korean shares .KS11 gained 0.4%, but shares in Japan .N225 were little changed.

· HSBC, Europe’s largest bank, said on Tuesday that it’s pre-tax profit fell 48% year-over-year to $3.229 billion in the first quarter of 2020, while revenue dropped by 5% to $13.686 billion.

Dickie Wong, executive director at Kingston Securities, said before the earnings release that HSBC was expected to post “a dramatic drop” in earnings and revenue.

“The first-quarter earnings will drop as much as 50%,” he told CNBC’s

· Japanese stocks ended steady on Tuesday as investors booked profits after sharp gains in the previous session, while a raft of better-than-expected earnings results and forecasts supported the major indexes.

The benchmark Nikkei average slipped 0.1% to close at 19,771.19, a day after the index posted a hefty gain of 2.7% and ahead of the Showa Day holiday on Wednesday.

· China’s blue-chip and start-up shares inched up on Tuesday after fresh regulatory reform cheered the market, but the main Shanghai benchmark slipped as big banks lined up their earnings following a tumultuous first quarter.

The blue-chip CSI300 index added 0.7%, with its financial sector sub-index higher by 0.9%, the consumer staples sector up 1.5%, the real estate index up 1.1% and the healthcare sub-index up 0.2%.

The Shanghai Composite index closed down 0.2% at 2,810.02, having dipped to its lowest level in over three weeks and then fitted in and out of positive territory during the session.

· European stocks inch higher with earnings and oil prices in focus

European markets opened slightly higher Tuesday as investors react to falling oil prices and a host of corporate earnings.

The pan-European Stoxx 600 edged 0.15% higher at the start of trading, insurance and media stocks each gaining 0.7% while the oil and gas sector slid by 0.9%.

Global oil markets are focused on oil prices that continue to fall as the coronavirus has demand global demand for oil, sending prices tumbling.

In corporate news, HSBC, Europe’s largest bank, said on Tuesday that it’s pretax profit fell 48% year over year to $3.229 billion in the first quarter of 2020, while revenue dropped by 5% to $13.686 billion.

Reference: CNBC, Reuters