· Gold prices fell on Monday as risk appetite improved on further stimulus from Japan’s central bank and countries considering easing of coronavirus-led restrictions, although bullion’s losses were limited on worries over a global recession.

Spot gold eased 0.3% to $1,722.61 per ounce by 0259 GMT. U.S. gold futures rose 0.3% to $1,740.90.

· “The peak(ing) (of the) virus will be the theme of the week. Should be positive for equities but will sap the upside momentum for gold for now,” said Jeffrey Halley, senior market analyst at OANDA.

″... Only the U.S. Federal Reserve really matters, and if the world thinks we’ve reached peak virus and countries are partially reopening, any extra stimulus will get drowned in COVID-19 noise.”

Gold tends to benefit from widespread stimulus measures as it is often seen as a hedge against inflation and currency debasement.

· Asian shares inched higher ahead of a busy week for earnings and central bank meetings.

The Bank of Japan ramped up risky asset purchases and pledged to buy unlimited amounts of government bonds to combat the economic fallout from the coronavirus epidemic.

Against key rivals, the U.S. dollar inched lower, but hovered close to a near three-week peak it touched on Friday. A stronger dollar makes gold costlier for investors using other currencies.

Various nations, including the United States, are on track to ease certain restrictions and allow businesses to reopen, raising investors’ hopes of higher number of testing kits and more drug trials.

· Holdings of the world’s largest gold-backed exchange-traded fund, SPDR Gold Trust, rose 0.6% to 1,048.31 tonnes on Friday.

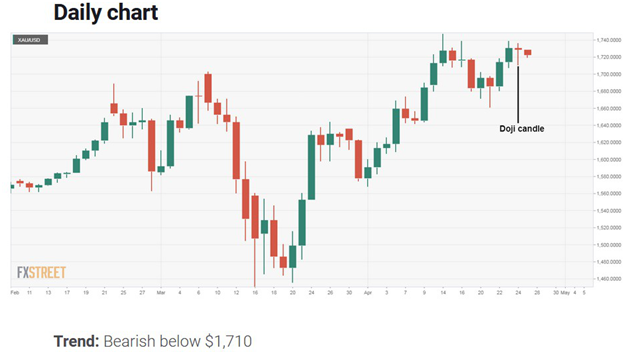

· Gold Price Analysis: Under pressure in Asia after Friday's Doji

Gold is trading near $1,722 per ounce, representing a 0.30% drop on the day, having hit a high of $1,729 during the early Asian trading hours.

The metal is flashing red, having carved out a Doji candle on Friday, a sign of indecision in the market place.

A bearish Doji reversal would be confirmed if the yellow metal closes Monday under Friday's low of $1,710. That would also confirm a head-and-shoulders breakdown on the hourly chart.

A bearish close, if confirmed, would open the doors for a drop to $1,658 - the low of the long-tailed candle created on April 21.

Alternatively, a close above Friday's high of $1,736 would imply a continuation of the rally from the low of $1,658 and will likely allow a sustained move above $1,750.

· Gold closed at a fresh seven-year high of $1730.51/oz last Thursday and continues to trade within our model-implied range of $1645- $1745/oz, per OCBC Bank.

“Prices are expected to remain elevated in the near-term.”

· Palladium rose 0.7% to $2,038.16 per ounce, while platinum gained 0.9% to $766.90 and silver edged higher by 0.3% to $15.28.

Reference: Reuters, FX Street