· Asia’s stock markets retreated from their highest levels for a month and the dollar extended gains on Thursday as the damage the coronavirus has wrought on the world economy soured appetite for risk.

Data showed U.S. retail sales fell the most on record last month and manufacturing output fell by the most in 74 years, raising fears of a deep recession. Another sky high figure is expected when U.S. weekly jobless claims land later in the day.

E-mini futures for the S&P 500 ESc1 fell half a percent in Asia after a 2.2% drop on the index .SPX on Wednesday and European futures were marginally lower STXEc1 FFIc1.

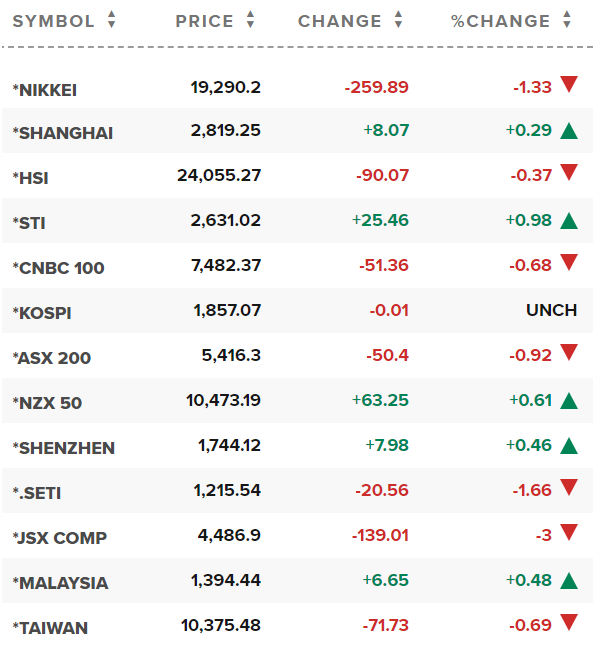

MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost about 1%, wiping out early week gains that had taken the index to its best level since mid-March.

· Japanese shares on Thursday tracked overnight losses on the Wall Street, as economic damage from COVID-19 weighed on investor sentiment, with banks and automakers leading the declines.

The benchmark Nikkei average ended 1.3% lower at 19,290.20. The Nikkei’s volatility index, a measure of investors’ volatility expectations based on option pricing and considered to be a fear gauge, rose 8.6% to 39.36.

On Wednesday, all three major U.S. stock indexes fell as the raft of weak economic data and dismal first-quarter earnings reports compounded concerns over the extent of damage from the coronavirus pandemic.

The broader Topix fell 0.8% to 1,422.24, with two-thirds of the 33 sector sub-indexes on the Tokyo exchange finishing lower.

· China stocks ended higher on Thursday on recovering global investor sentiment, but gains were modest ahead of March-quarter GDP data that is expected to show an economic contraction for the first time in nearly 30 years.

The Shanghai Composite index closed up 0.3% at 2,819.94, while the blue-chip CSI300 index gained 0.1%, having fitted in and out of negative territory.

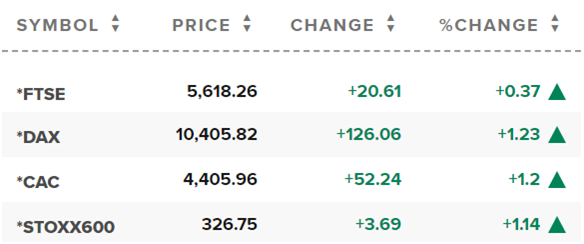

· European markets opened higher Thursday as investors digest the economic impact of the coronavirus on the global economy and countries begin plotting an exit from lockdown measures.

The pan-European Stoxx 600 climbed 1.2% in early trade, with travel and leisure stocks adding 2.4% to lead gains as all sectors and major bourses entered positive territory.

An increasing number of European countries have cautiously started to ease restrictive measures on public life and businesses this week and Germany is the latest to set out a road map for how it will reopen its economy. Smaller shops will be able to start reopening on April 20 as long as they can implement good hygiene measures and schools will reopen on May 4. Mass gatherings have been banned until Aug. 31, however.

Reference: CNBC, Reuters