· Gold prices fell on Wednesday as investors locked in profits after the metal rallied to a more than seven-year high in the previous session, but fears of a deep global economic recession due to the coronavirus pandemic limited losses.

Spot gold was down 0.7% at $1,715.02 per ounce, as of 0643 GMT. In the previous session, it jumped as much as 1.9% to its highest since Nov. 2012 at $1,746.50.

U.S. gold futures fell 1.1% to $1,748.60.

· “Gold is consolidating gains at the top of its range … but there’s so much uncertainty in the world and so much of conflicting information that’s also supportive for gold,” said Jeffrey Halley, a senior market analyst at OANDA.

There was some profit-taking in gold, Halley said, adding “stocks and gold have been pumped to these levels by the recent $2 trillion of extra stimulus announced by the U.S. Federal Reserve”.

· Demand for gold tends to benefit from widespread stimulus from central banks, as it is often seen as a hedge against inflation and currency debasement. Lower interest rates also cut the opportunity cost of holding non-yielding bullion.

· Asian shares paused near one-month highs, as warnings of a deep recession dampened investor optimism that the slowing spread of the coronavirus could allow businesses to re-open.

· While the top infectious disease adviser of U.S. President Donald Trump said the May 1 target for restarting the economy is “overly optimistic”, the Fed was grappling with the challenge of how to re-open the economy, having launched a funding backstop.

· The retreat from riskier assets followed the International Monetary Fund’s prediction that the global economy may shrink by 3% in 2020 due to the pandemic, in the worst downturn since the Great Depression.

· The contagion, which has infected more than 1.9 million people and killed 120,670, has forced countries to shut activity and prompted central banks to unleash unprecedented support measures.

· Gold exchange traded funds continued to see inflows, with holdings of the world’s largest gold-backed ETF, SPDR Gold Trust now near its highest since May 2013, at 1,017.59 tonnes.

Elsewhere, palladium edged 0.1% higher to $2,220.20 per ounce.

· “We continue to expect the palladium market to be undersupplied this year and next year, despite latest industry expectations for auto sales to plummet by at least 14%,” Standard Chartered Bank analysts said in a note, adding the auto-catalyst metal will be supported above $2,000 “for now”.

· Silver dropped 1.6% to $15.55, while platinum advanced 0.8% to $780.93.

· Gold Price Analysis: Trendline support stands exposed as pullback gathers traction

Gold is extending the overnight pullback from 7.5-year highs and risks falling to the support of the trendline connecting from March 19 and April 9 lows.

The yellow metal is currently trading near $1,722 per ounce, representing a 0.35% loss on the day, having hit a high of $1,748 on Tuesday. That level was last seen in November 2012.

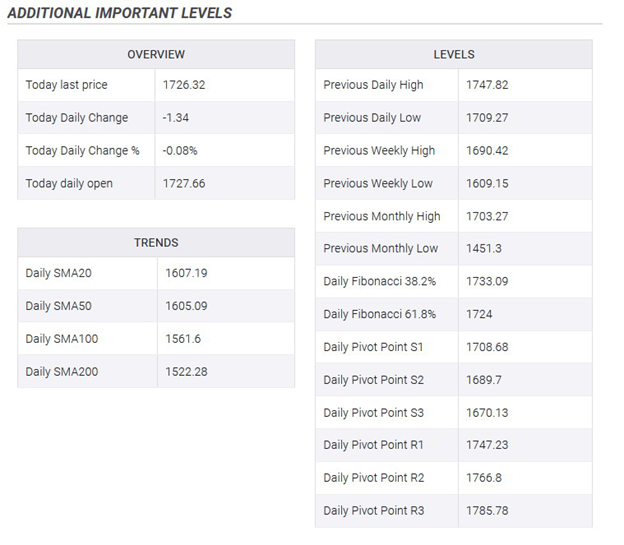

The metal could slide further to the ascending trendline support, currently at $1,690, as the 4-hour chart is reporting a bearish doji reversal pattern and a bearish divergence of the relative strength index.

On the way lower, the precious metal could encounter support of the 50-hour average placed at $1,712. If the average support holds ground, a fresh bounce to levels above $1,720 may be seen.

The short-term bullish bias would be invalidated if prices print two consecutive daily closes under the former seven-year high of $1,703 reached in March.

· Gold Remains Biased To The Upside

GOLD faces risk of price gain as it retains its upside pressure. On the upside, resistance resides at the 1,740.00 level. Further out, resistance stands at the 1,750.00 level. A break below here will aim at 1,760.00.

On the downside, support sits at the 1,710.00 level where a break will turn focus to the 1,700.00 level. Further down, a cut through here will open the door for a move decline towards the 1,690.00 level. Below here if it occurs will trigger further downside pressure aiming at the 1,680.00 level.

All in all, GOLD looks to strengthen further in the days ahead.

· Gold bulls probed near seven-year top amid US dollar pullback, risk-off

Gold prices step back from the seven-year high to $1,726, down 0.10% on a day, while nearing the European markets’ opening on Wednesday. Although broad risk-off, coupled with the investment buying, keeps the bullion near the multi-month top, the recent US dollar pullback seems to compress the further advances.

Technical analysis

October 2012 high surrounding $1,796/97 remains on the bulls’ radar unless gold prices decline below $1,700 on a day.

Reference: Reuters, Daily FX, FX Street