· Gold prices rose to a more than seven-year high on Tuesday on rising fears of a steeper economic downturn and amid massive liquidity measures by global central banks.

Spot gold gained 0.2% to $1,716.76 per ounce by 0421 GMT, having touched its highest since Nov. 2012 at $1,725.10 earlier in the session. U.S. gold futures rose 0.9% to $1,777.40.

· "The concerns about the economic outlook are particularly supportive for gold. Liquidity (from the Federal Reserve) combined with the background of lower interest rates makes gold a much more attractive proposition," said Michael McCarthy, chief strategist at CMC Markets.

But he warned that in the absence of new news, there could be "modest pull backs as investors and traders reposition themselves".

Many countries and central banks have taken fiscal and monetary measures to prop up their economies amid the coronavirus outbreak.

The Fed last week announced a $2.3 trillion stimulus package, while European Union finance ministers agreed on half-a-trillion euros worth of economic support.

The Fed's stimulus aimed at injecting liquidity into the virus-hit U.S. economy tend to weigh on the dollar, which makes gold relatively cheaper to buy, while lower interest rates reduce the opportunity cost of holding non-yielding bullion.

· A steep economic downturn and massive rescue spending will nearly quadruple the fiscal 2020 U.S. budget deficit to a record $3.8 trillion, a staggering 18.7% of U.S. economic output, a Washington-based watchdog group said on Monday.

Meanwhile, the International Monetary Fund said it would provide debt relief to 25 member countries under its Catastrophe Containment and Relief Trust to allow them to focus more financial resources on fighting the pandemic.

· On the technical front, spot gold may test a resistance at $1,739 per ounce, a break above which could lead to a gain at $1,767, according to Reuters technical analyst Wang Tao.

· Reflecting appetite for bullion, holdings in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund (ETF), rose 1.6% to 1,009.70 tonnes on Monday, the highest since June 2013.

· "Gold as a safe-haven has gained traction as currencies are being devalued by massive stimulus programs. This has also increased physical demand of gold (such as ETFs) to hedge against the debasement of fiat currencies," said Avtar Sandu, a senior commodities manager at Phillip Futures, in a note.

· Gold Asia Price Forecast: XAU/USD hits eight-year's highs, trades above $1700/oz

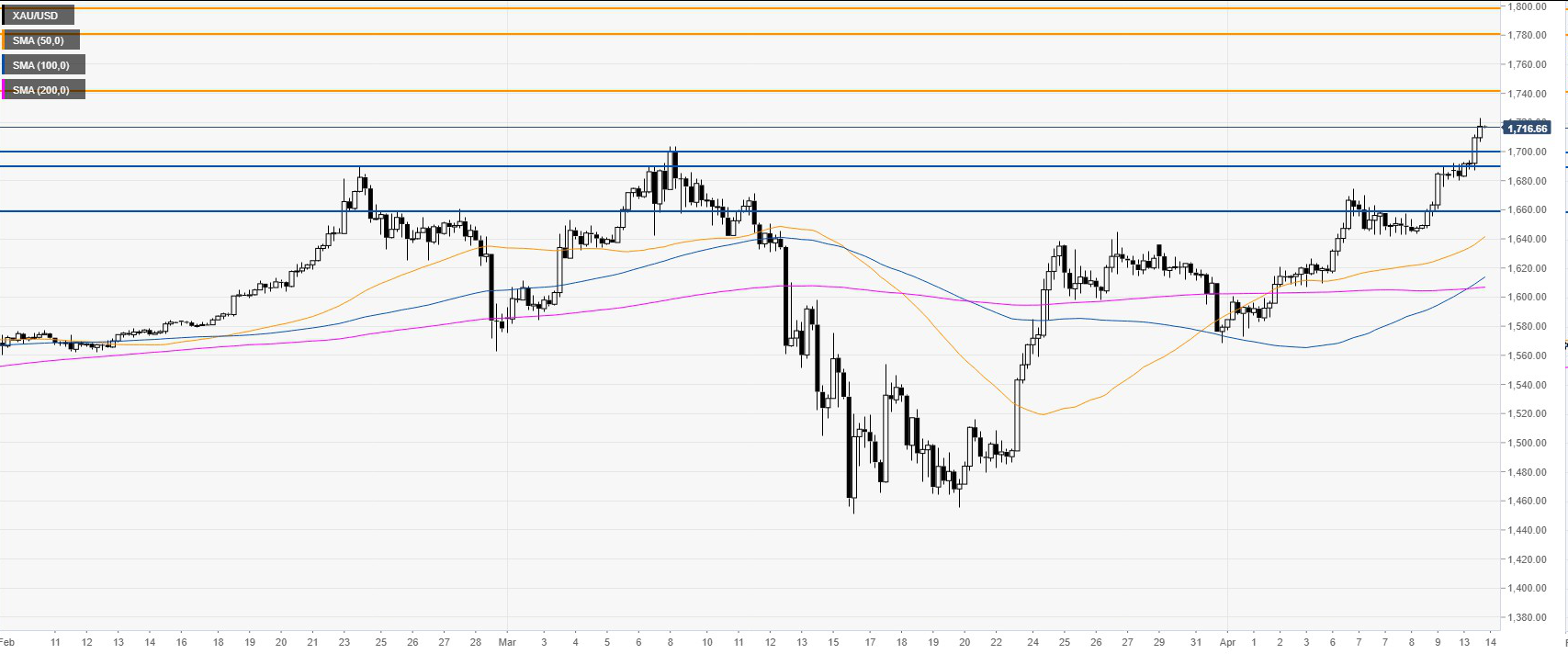

XAU/USD daily chart

Gold broke to fresh 2020 highs while trading above the main DMA (daily simple moving averages) suggesting that buyers remain in full control of the market.

XAU/USD four-hour chart

XAU/USD is trading above the main SMAs while breaking above the 1690/1700 resistance zone as bulls are eyeing the 1740 and 1780/1800 levels on the way up. On the flip side, support can emerge near the 1690/1700 price zone and the 1660 level on any dip down.

· Gold price forecast: Turns lower from $1,730

Gold has pulled back from the seven-year high of $1,730 and could witness a deeper pullback to the former hurdle-turned-support of $1,703, as the hourly chart is reporting a bearish divergence of the relative strength index.

A bearish divergence occurs when the indicator charts lower highs, contradicting higher highs on price and is widely considered an early indicator of bearish reversal.

However, in this case, the bearish divergence has occurred on the hourly chart and indicates temporary bull fatigue.

As a result, prices may pullback to $1,703 before posting stronger gains above $1,730. The yellow metal charted a big bullish candle on Monday and closed above $1,703 (March 9 high, previous seven-year high), reinforcing the bullish view and opening the doors for a continuation of the "V-shaped" rally from the March 20 low of $1,445.

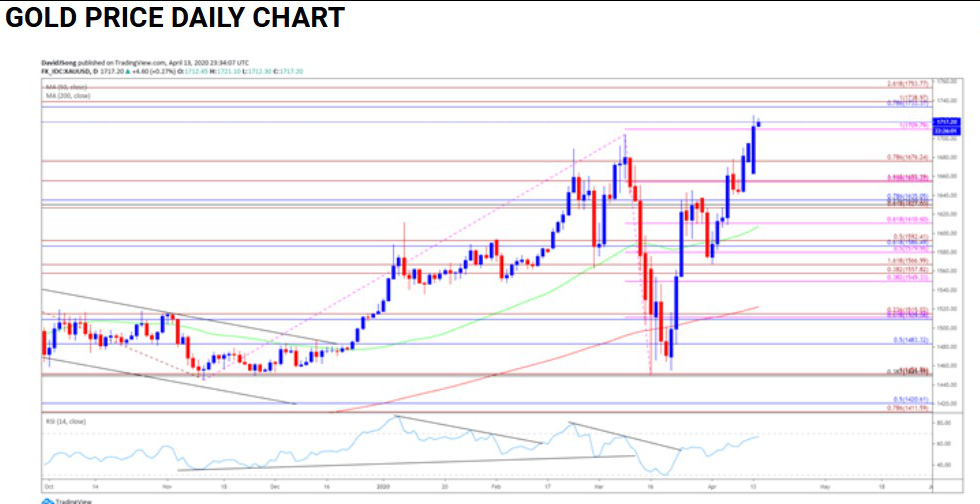

· Gold Price Rally to Persist If RSI Pushes Into Overbought Territory

The price of gold clears the March high ($1704) as the Federal Reserve plans to provide $2.3T in loans to US households and businesses, and the precious metal may extend the advance from earlier this month if the Relative Strength Index (RSI) pushes into overbought territory.

The announcement suggests the Federal Open Market Committee (FOMC) will continue to deploy non-standard measures to support the US economy as the central bank “remains committed to using its full range of tools to support the flow of credit to households and businesses to counter the economic impact of the coronavirus pandemic.”

The break/close above $1710 (100% expansion) brings the Fibonacci overlap around $1733 (78.6% retracement) to $1739 (100% expansion) on the radar, with the next area of interest coming in around $1754 (261.8% expansion).

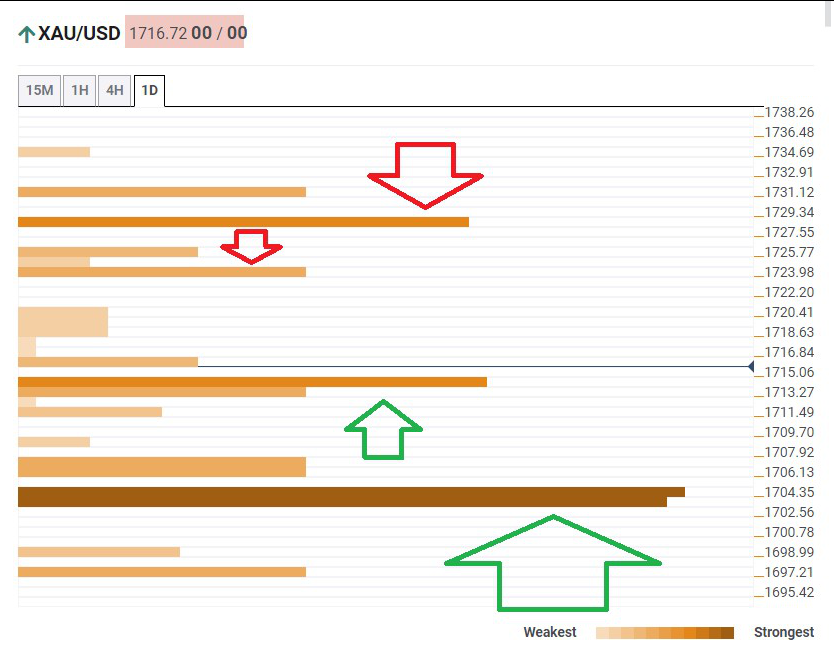

· Gold Price Analysis: Bulls eyeing $1,728 as long as support holds – Confluence Detector

The Technical Confluences Indicator is showing that that gold has some support at $1,714, which is the convergence of the Bollinger Band 15min-Lower and the Pivot Points one-week Resistance 1.

It is followed by strong support at $1,704, which is a dense cluster of lines including the Simple Moving Average 100-15m, the Pivot Point one-month Resistance 1, and the previous month's high.

Some resistance at $1,723, which is the confluence of the previous daily high and the BB 15min-Upper.

The upside target is at $1,729, where we see the Bollinger Band one-day Upper and the BB 4h-Upper converge.

· Palladium rose 3.2% to $2,259.07 per ounce. Silver gained 0.5% to $15.53 and platinum was up 0.9% to $755.06.

Reference: Reuters, Daily FX, FX Street