Gold slips on firm dollar, poor U.S. data limits losses

· Gold inched down on Friday after rising 1.4% in the previous session as the U.S. dollar firmed, but record high weekly U.S. jobless claims filings kept a check on bullion’s downside.

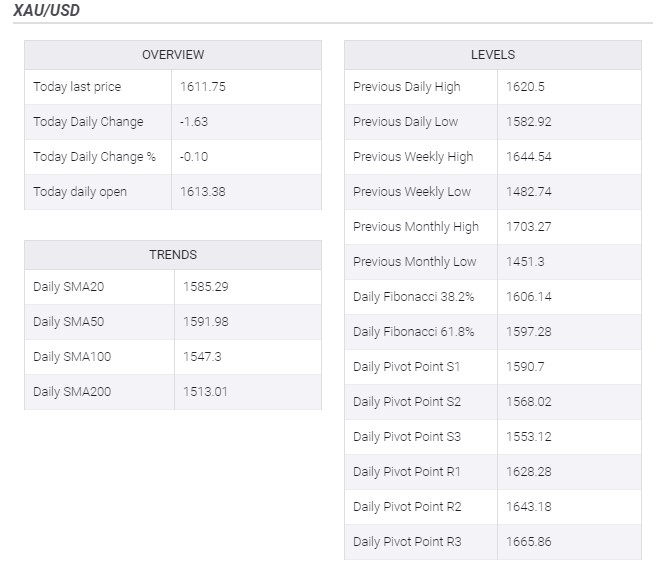

· Spot gold eased 0.1% to $1,610.64 per ounce by 0037 GMT. U.S. gold futures slipped 0.1% to $1,635.50.

· The metal was down over 0.4% for the week after an 8% jump in the previous week.

· The dollar was up 0.1% against key rivals, having risen for the last two sessions.

· The number of Americans filing claims for unemployment benefits last week shot to a record high of 6.65 million, as more jurisdictions enforced stay-at-home measures to curb the coronavirus.

· Asian markets looked to latch onto Wall Street’s overnight gains after crude prices notched their biggest one-day surge on record, helping offset concerns about the depth of a global recession.

· The U.S. unemployment rate will shoot past 10% in the second quarter and the growth rate of gross domestic product will decline by more than 7% as the virus grips the economy, according to projections released by the Congressional Budget Office.

· The World Bank said it had approved an initial $1.9 billion in emergency funds for coronavirus response operations in 25 developing countries.

· Global coronavirus cases surpassed 1 million on Thursday with more than 52,000 deaths as the pandemic further exploded in the United States and the death toll climbed in Spain and Italy, according to a Reuters tally of official data.

· Europe’s largest economy might shrink more this year than during the 2008/9 financial crisis, German Economy Minister Peter Altmaier said, adding that contractions of more than 8% might be registered in some months.

- Gold Price News and Forecast: XAU/USD stays above $1,600, as trade sentiment sours

Gold snaps two-day recovery, stays above $1,600, as trade sentiment sours

With the fresh challenges to risk-tone weighing on commodities, Gold snaps the previous two-day winning streak while declining to $1,610, down 0.07%, amid early Friday. The recent challenges to the yellow metal are likely from the coronavirus (COVID-19) front. It’s worth mentioning that the bullion earlier seemed to be benefited from the market’s risk-on due to US President Trump’s tweet suggesting an oil production cut pact between Saudi Arabia and Russia.

Gold Price Analysis: More upside for the precious metal as it consolidates its position above USD 1600

Today there has been some volatility in risk assets such as the indices after the US weekly initial jobless claims data reached another record level (6,648K). This led to a sharp fall in the indices as the S&P 500 dropped around 2.47% in a 50 min period following the news. Since then the indices have recovered and pushed into positive territory but gold still managed to hold on to its gains.ik

· Palladium fell 0.8% to $2,196.39 an ounce, platinum slipped 0.2% to $725.52 and silver declined 0.8% to $14.42. All three metals were set to register a weekly loss.

Reference: CNBC, FXStreet