Gold futures pop 5% amid extraordinary central bank actions

· Futures contracts tied to gold popped more than 5% on Tuesday, extending gains from a near 4% surge in the previous session, after the U.S. Federal Reserve’s unprecedented measures to help an economy reeling from the coronavirus pandemic halted a rush for cash.

· Spot gold rose 4.7% to $1,626.45 per ounce. The metal rose 3.7% on Monday, its highest percentage gain since June 2016. U.S. gold futures climbed 5.3% to $1,650.70.

· “Gold is surging higher after the Fed went above and beyond in unveiling measures to support the economy,” said Edward Moya, a senior market analyst at broker OANDA.

· The U.S. central bank on Monday rolled out an extraordinary array of programs and will lend against student loans, credit card loans, and U.S. government backed-loans to small businesses.

That failed to push Wall Street higher on Monday, but it was enough to drive a rebound in Asian shares.

· Meanwhile, a coronavirus economic stimulus package, remained stalled in the U.S. Senate on Monday as lawmakers haggled over its provisions, but the U.S. Treasury secretary and the Senate Democratic leader voiced confidence a deal would be reached soon.

· “The U.S. Senate setback seems only temporary and gold traders are feeling pretty confident that at the end of the week, massive fiscal and monetary stimulus should help calm markets. If market volatility stabilizes somewhat, gold will resume its safe-haven status,” said OANDA’s Moya.

· President Donald Trump said on Monday he is considering how to reopen the U.S. economy when a 15-day shutdown ends next week, even as the virus spreads rapidly.

· Global central banks took various measures to mitigate the damage of the outbreak, which has infected over 351,300 and killed more than 15,300 people globally.

· Australia’s central bank proposed to buy $2.35 billion in government bonds and Germany agreed for a package worth up to $808 billion.

· Also propping up bullion markets was the closure of three of the world’s largest gold refineries in Switzerland due to the outbreak that has squeezed supply of the physical metal, Stephen Innes, chief market strategist at financial services firm AxiCorp, said in a note.

“There is just not enough around to support the underlying promissory notes (paper gold)... It’s a godsend for bullion investors.”

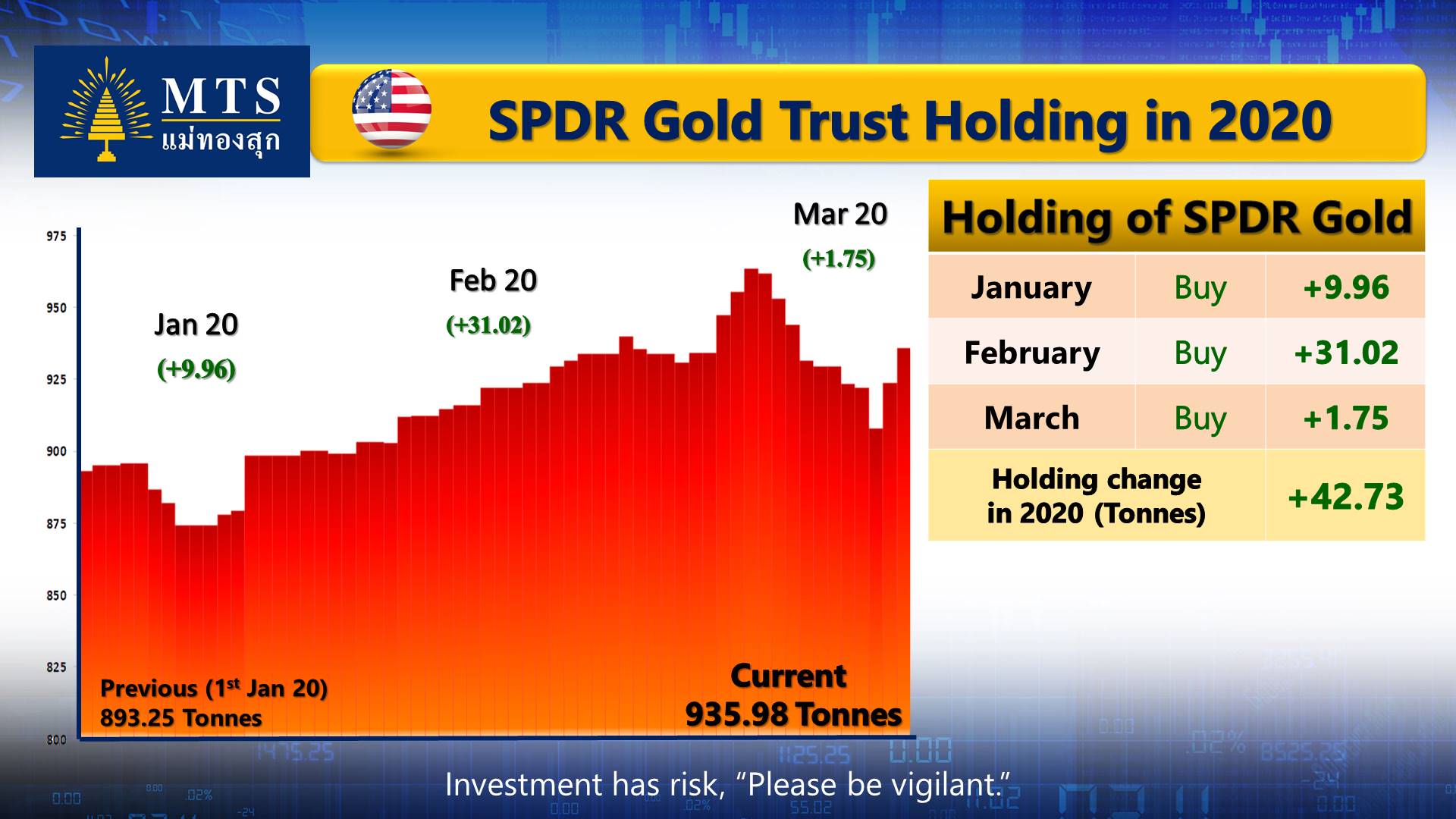

· Holdings of the world’s largest gold-backed exchange-traded fund, SPDR Gold Trust, rose 1.8% to 923.99 tonnes on Monday.

· Swiss gold sales surge as wary investors snap up precious metals

Gold dealers in Switzerland are rushing to keep up with a surge in demand as worried investors seek out lower risk investments in precious metals with financial markets roiled by the coronavirus pandemic.

Some sellers are seeing a ten-fold increase in sales of gold bars, coins and other pieces as existing buyers increase their holdings and newcomers enter the market.

Banks too are seeing a sharp rise in demand for other precious metals, including silver, as well as smaller investments like 20 or 50 gram gold combibars which look like credit cards and can be divided into 20 or 50 squares.

The price of gold had been steadily increasing since the start of the year but was briefly knocked lower as investors scrambled for cash to meet margin calls in other markets as the coronavirus outbreak spread.

However, it has surged since March 19, gaining nearly 10% in less than a week.

Retailers have extended opening times and also tried to take on extra staff to deal with the rising demand, which is being channeled online as shops are shuttered on government orders to contain the virus.

· South Africa’s Mining Industry Is About to Come to a Standstill

South Africa’s iconic mines, from the ever-deepening gold shafts on which the economy was founded to massive iron ore pits and rich platinum seams, are about to go silent.

From midnight Thursday, all but a few coal operations needed to fuel the country’s power stations are expected to be included in a nationwide lockdown aimed at containing the coronavirus. The sweeping shutdown is unprecedented in the 150-year history of South Africa’s mining industry, which today employs more than 450,000 people.

President Cyril Ramaphosa is moving quickly to curb the virus spread as infections threaten to spiral out of control in a country with an already strained health system and rampant unemployment. The army will help police to enforce the lockdown, with grocers, pharmacies, banks, filling stations and other essential services allowed to remain open.

Producers from Harmony Gold Mining Co., the nation’s biggest producer of the precious metal, to top platinum miner Sibanye Stillwater Ltd. said they’re bracing for earnings hits as mines move to care and maintenance, an industry term for when production stops but essential services like underground water pumping continue. Anglo American Plc said it will review the detailed regulations on the lockdown when they’re published, including for potential exemptions.

South Africa’s mining industry is labor intensive, and digging underground means workers regularly enter narrow elevators together to travel beneath the surface. Many of the thousands of workers who will be affected by the shutdown live in close proximity to one another in mining communities around the operations.

“Companies whose operations require continuous processes such as furnaces, underground mine operations will be required to make arrangements for care and maintenance to avoid damage to their continuous operations,” Ramaphosa said Monday.

For global metal markets, the biggest impact may be in platinum and palladium -- South Africa accounts for 75% and 38% respectively of global supply. Prices for both metals, which are used in autocatalysts, extended gains Tuesday, with spot palladium rising more than 15%, the biggest intraday gain since 1998. Shares in MMC Norilsk Nickel PJSC, the world’s top producer of palladium, jumped as much as 23%.

· Palladium surged 6.2% to $1,825.79 per ounce, silver advanced 3.2% to $13.67 and platinum rose 2.3% to $657.41 per ounce.

Reference: CNBC, Reuters, Bloomberg