· Gold prices on Monday held near a two-week high scaled in the previous session as uncertainty prevailed over the impact of the coronavirus outbreak on the global economy.

Spot gold was little changed at $1,582.08 per ounce, as of 0701 GMT, having touched its highest since Feb. 3 at $1,584.65 on Friday. U.S. gold futures were down about 0.1% at $1,585.30.

· “Gold is holding firm at high prices as uncertainty around coronavirus remains high, while the economic impact is still unclear,” said Michael McCarthy, chief market strategist at CMC Markets.

The death toll from the outbreak in mainland China reached 1,770 by Sunday, up by 105 from the previous day, the country’s National Health Commission.

· “Given the extent of the impact of the coronavirus in China, gold physical demand is likely to suffer. (But) it is too early to estimate the effects,” UBS said in a note dated Feb. 14.

Premiums for physical gold in China, the world’s biggest bullion consumer, slid to their lowest since at least July 2018 last week.

The epidemic pushed Singapore to downgrade its 2020 economic growth forecast, while a Reuters poll showed Japanese manufacturers remained pessimistic in February.

· The U.S. Federal Reserve had also flagged concerns regarding the potential impact on the U.S. economy.

Cleveland Fed Bank President Loretta Mester said on Friday the epidemic could be a drag on the U.S. economy this quarter.

· “Sentiment is friendly and there is an underlying bias to be long. For now, investors wait for fresh catalysts and/or more attractive levels to reengage,” UBS said in the note.

Speculators increased their bullish positions on COMEX gold in the week to Feb. 11.

Asian shares, however, moved back toward a three-week high on China’s efforts to cushion the blow from the virus, while the dollar hovered near a more-than four-month high.

· “The dollar normally works against the gold price, but the fact that gold did rise despite that goes to say that it (dollar) doesn’t have much impact on gold at the moment,” CMC’s McCarthy said, adding, the strong technical resistance of $1,590 is “limiting the enthusiasm in the market.”

· Gold Price Analysis: Probes pennant resistance

Gold tested key resistance a few minutes ago, which, if breached, could accelerate the broader uptrend that has been in place since November.

The yellow metal ran into $1,584 – the top end of the pennant pattern (series of lower highs and higher lows) created over the last 6 weeks.

A pennant breakout would be confirmed if prices close Monday above $1,584, signaling a continuation of the rally from the Nov. 26 low of $1,463 and open the doors for a test and possible break above the recent high of $1,611.

Alternatively, if the yellow metal dives out of the narrowing price range, the sellers would regain control and could push the shiny metal down to $1,536 (pennant low), under which major support is seen at $1,500.

· Gold prices to stay healthy amid continuing virus worries

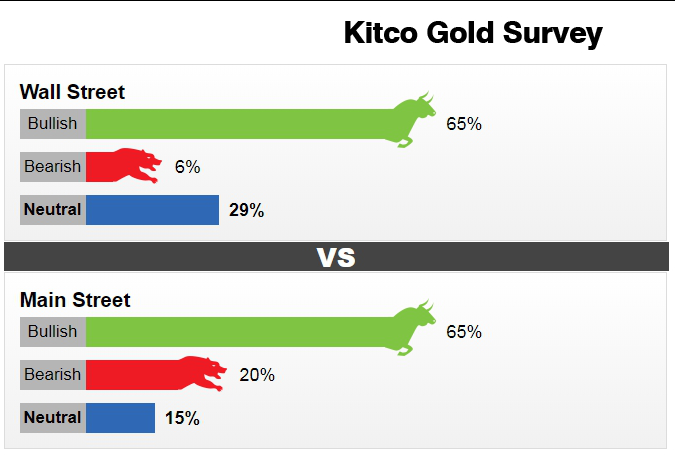

Voters in the weekly Kitco gold survey are bullish on the metal for the week ahead, citing gold's ability to hold up even when the dollar and equities strengthen, technical factors and ongoing worries about how the coronavirus could impact the global economy.

· Elsewhere, palladium rose 0.6% to $2,446.39 an ounce, silver was up 0.6% at $17.83, while platinum gained 0.6% to $968.69.

Trading is expected to be light as financial markets in the United States will be shut for a public holiday.

Reference: Reuters, FX Street, Kitco