· Gold prices edged lower on Wednesday as new coronavirus cases fell and risk appetite improved, although uncertainty over the economic impact of the outbreak still underpinned bullion.

Spot gold edged lower by 0.1% to $1,567.58 per ounce by 0642 GMT. U.S. gold futures edged 0.1% lower to $1,568.90.

· While the death toll exceeded 1,100, China’s foremost medical adviser on the epidemic said the infection may be over by April, with the number of new cases already declining in some places.

“Equity market is doing good, U.S. dollar is above 98.5 and there is some rebound in base metals and energy markets that is showing some increasing risk appetite in investors,” said Vandana Bharti, assistant vice-president of commodity research at SMC Comtrade.

· The U.S. dollar stayed close to four-month highs after soaking up safe-haven flows as worries about the coronavirus coincided with recent data showing the U.S. economy’s strength.

· “Gold is consolidating as the current virus scare is evaporating,” Stephen Innes, chief market strategist at AxiCorp, said.

Meanwhile, Asian stocks inched up as investors felt the worst of the epidemic may have passed.

Innes said the measures taken by Chinese authorities to avoid large-scale layoffs were “keeping a lid on gold prices as it would be positive for growth and bullish for equity markets”.

However, he said the underlying support for gold remains due to factors including the knock-on effects of the virus, the impact of existing tariffs following the U.S.-China Phase 1 trade deal.

· Chinese purchase of U.S. farm products this year under the Phase 1 trade deal could drop, White House national security adviser Robert O’Brien said.

· Meanwhile, Federal Reserve Chair Jerome Powell told Congress on Tuesday the U.S. economy is in a good place, but cited the potential threat from the epidemic and concerns about the economy’s long-term health.

Gold, which is often used as an insurance against economic risks, tends to appreciate on expectations of lower interest rates, which reduce the opportunity cost of holding non-yielding bullion.

· Holdings of the world’s largest gold-backed exchange-traded fund SPDR Gold Trust rose 0.67% to 922.23 tonnes on Tuesday, its highest in over three months.

· Palladium was flat at $2,340.44 an ounce, silver fell 0.5% to $17.55, and platinum shed 0.1% to $967.77.

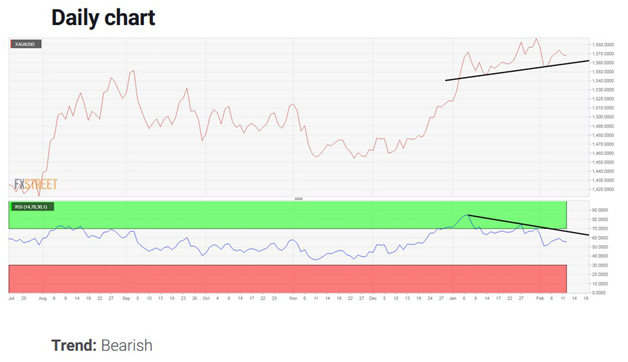

· Gold prices are virtually unchanged since the start of the week with XAU/USD carving out the weekly opening range just below key technical resistance. The risk remains for further losses near-term with the sell-off now approaching initial support targets. These are the updated targets and invalidation levels that matter on the XAU/USD charts. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold trade setup and more.

A closer look at Gold price action sees XAU/USD trading within the confines of a near-term descending pitchfork formation extending off the yearly highs with the upper parallel further highlighting near-term resistance ahead of 1575 – look for a reaction here. Failure to mount this threshold leaves the immediate advance vulnerable with a break of the weekly range lows exposing subsequent support objectives at 1562 and 1558. A topside breach from here would be needed to shift the focus higher again targeting critical resistance at 1582/86and the objective monthly open at 1590- a close above this threshold is needed to mark resumption of the broader uptrend.

· Gold Price Analysis: Potential head-and-shoulders on the daily line chart

Gold seems to be charting a head-and-shoulders bearish reversal pattern on the daily line chart.

A close below the neckline support at $1,555 would confirm breakdown and open the doors to $1,521 (target as per the measured move method).

At press time, the yellow metal is sidelined at $1,567. The prospects of gold completing a head-and-shoulders pattern would weaken if prices close above the Feb. 10 high of $1,572. That will likely fuel a re-test of levels above $1,580.

The downtrend on the 14-day relative strength index indicates the metal is likely to fall toward the neckline support at $1,555.

Reference: Reuters,FXstreet,Tradingview