· Gold prices have dipped as the US dollar held firm and investors opted for riskier assets after a fall in the number of new confirmed cases of coronavirus in China eased some of fears over global economic impact.

· Spot gold was down 0.3 per cent at $US1,567.26 per ounce by 1343 EST on Tuesday (0543 AEDT on Wednesday), having touched its highest since February 4 at $US1,576.76 on Monday.

US gold futures settled down 0.6 per cent at $US1,570.10 an ounce.

· Gold is slightly down in tandem with another round of new highs across the board in equity markets, as there has been some conversation that the impacts from coronavirus are slightly overdone," said David Meger, director of metals trading at High Ridge Futures.

However, "dips in gold are still being fairly bought very readily ... given the strength seen in global equities and the fact that gold continues to hold up so well".

· Global financial markets scaled new highs as the number of new coronavirus cases slowed in China and the country's factories slowly returned to work.

After more than 1,000 deaths, the China's foremost medical adviser on the epidemic said infections may be over by April, with the number of new cases already declining in some places.

Further limiting gold's appeal, the dollar hit a four-month high against a basket of rivals on safety buying and Federal Reserve Chair Jerome Powell's upbeat view of the US economy.

· The US central bank kept benchmark interest rates unchanged at its January policy meeting, citing moderate economic growth and a strong jobs market.

But in testimony before a US congressional committee, Powell cited a potential threat from the virus and concerns about the economy's long-term health.

· "Gold's longer-term bullish backdrop will remain primarily supported on physical demand from central banks and rising risks to the global growth that will trigger another wave of worldwide stimulus," Edward Moya, a senior market analyst at broker OANDA, said in a note.

· Gold, which is used as an insurance against economic risks, tends to appreciate on expectations of lower interest rates, which reduce the opportunity cost of holding non-yielding bullion.

· China's gold demand could fall by 10% in 2020, analysts cite economic uncertainty, coronavirus

The upbeat December gold imports number out of China is just a temporary relief before a steep drop in gold demand this year due to coronavirus fears and growing economic uncertainty, according to analysts.

· “The latest data from China’s customs authority showed that imports of gold increased three-fold in m/m terms in December. This tallies with a seasonal pick-up in jewellery demand in the run-up to Chinese New Year,” wrote Capital Economics commodities economist Alexander Kozul-Wright.

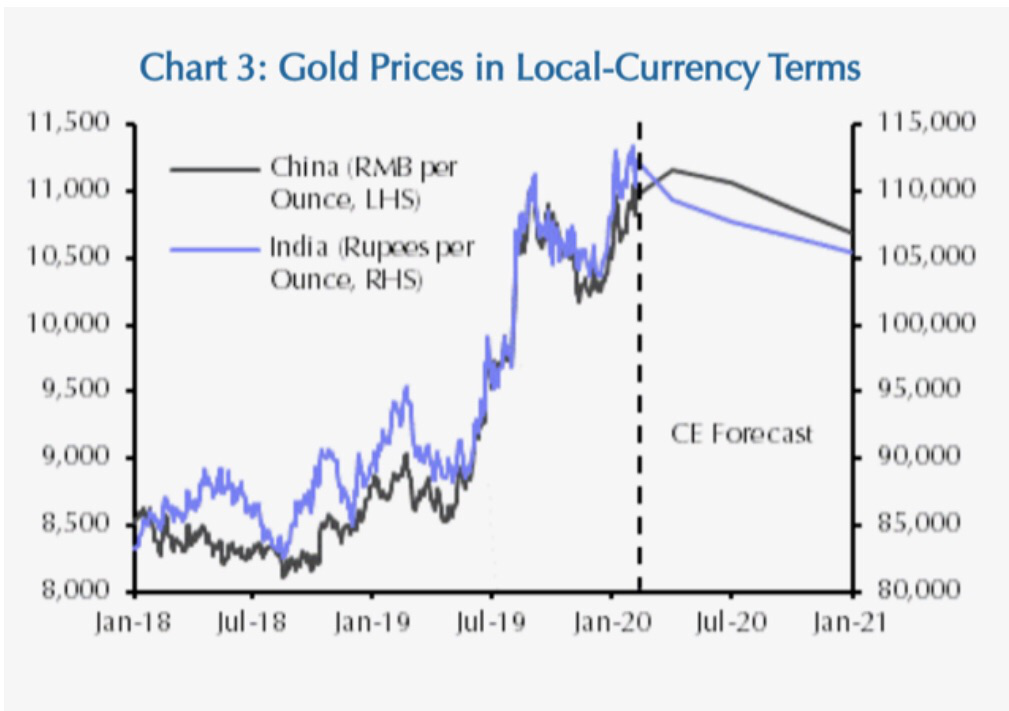

· This surge in demand will not hold in China, said Kozul-Wright, citing high local-currency gold prices and slower economic growth in China.

“Looking ahead, we expect high local-currency prices in India coupled with a slowdown in Chinese economic growth to curb physical demand for gold in 2020,” the economist wrote on Tuesday.

· Goldman Sachs has also slashed its 2020 forecast for China’s GDP to 5.2% from 5.8%, while shaving off about 2% of annualized growth off this quarter.

· China’s physical demand first took a hit in May of last year when gold prices surged in local currency terms and demand in Q2 dropped 27%.

· “While there has been a gradual improvement since, the year as a whole was down by a combined 15% against 2018, to 848 tons,” said Rhona O’Connell, INTL FCStone head of market analysis for EMEA and Asia regions.

Due to higher gold prices mixed in with coronavirus uncertainty this year’s Chinese New Year celebrations were “very subdued” when it came to gold purchases, O’Connell wrote on Tuesday.

“The change in price range has taken a much longer time than usual for price-elastic consumers to re-adjust, as economic uncertainties have kept buyers on the sidelines,” she described.

It will take time for China to recover from the coronavirus with gold demand projected to fall about 10% in 2020, said O’Connell.

A large portion of gold jewelry demand in China is based on “an adornment” factor rather than “an investment” opportunity, O’Connell pointed out.

“This section of the market is likely to take more time to recover as consumers keep their powder dry—especially while the population remains in lockdown in a number of regions with the government restrictions on travel and logistical issues, along with workers not back from New Year’s travel (only 20% have come home so far),” she noted. “We would expect to see another contraction in gold demand this year and a further 10% reduction is perfectly possible.”

· Among other precious metals, palladium fell 0.6 per cent to $US2,339.26 an ounce, silver dropped 0.7 per cent to $US17.63, while platinum rose 0.9 per cent to $US969.43.

Reference: Business News, Kitco