· Gold prices dipped after hitting a near four-week high on Monday, as China’s central bank cut reverse repo rates and injected liquidity into markets to help support the economy hit by a rapidly spreading coronavirus outbreak.

Chinese authorities pledged to use various monetary policy tools to ensure liquidity remains reasonably ample and to support firms affected by the outbreak in Wuhan, which has so far claimed 361 lives.

Spot gold fell 0.6% to $1,580.48 per ounce by 0407 GMT, having earlier risen to its highest since Jan. 8 at $1,591.46. U.S. gold futures shed 0.2% to $1,584.70.

· “The fact that the People’s Bank of China (PBOC) is backstopping (the impact from the virus) is driving gold lower,” said Stephen Innes, chief market strategist at AxiCorp.

“Asia’s fear factor has dropped so they’re not buying gold ... but there’ll be a considerable knock-on effect over the longer term, given the fact that 50% of China is shut this week and there will be a drop in production and consumption.”

The dollar against a basket of rivals also firmed, making gold expensive for holders of other currencies.

Asian shares stumbled, oil skidded and commodities on Chinese exchanges plunged on their first trading day after the Lunar New Year break on fears the virus epidemic will hit demand in the world’s second-largest economy.

Investors took stock of PBOC’s measures, which included lowering of the 7-day reverse repo rate to 2.40% and the 14-day tenor to 2.55%, and an injection of 1.2 trillion yuan ($174 billion) worth of liquidity into the markets via reverse repo operations.

· However, AxiCorp’s Innes said “once we get through this ‘band-aid effect’, the reality will set in that there is an economic tumult about to happen in China, which is going to spread globally and force a lot of central banks to cut rates.”

Meanwhile, data showed China’s factory activity expanded at its slowest pace in five months in January, which traders said likely did not reflect the early impact of the public health crisis which flared in late January and that the readings could worsen in the coming months.

· Speculators cut their bullish positions in COMEX gold contracts in the week to Jan. 28, data showed on Friday.

· Holdings of the world’s largest gold-backed exchange-traded fund, SPDR Gold Trust, slipped 0.03% to 903.21 tonnes on Friday.

· Gold pulls back from 18-day top to $1,584 despite fears of coronavirus outbreak

Gold prices decline from more than three-weeks low to $1,584 during the Asian session on Monday. The yellow metal initially benefited from the market’s risk-off due to coronavirus outbreak fears. However, the recently recovered data from Japan and Australia, coupled with the Chinese government’s measures to tame the sell-off after long holidays, might have triggered the profit-booking.

Technical Analysis

Unless providing a daily closing below 21-day SMA level of $1,564, prices are not likely to revisit the previous month's low near $1,518.

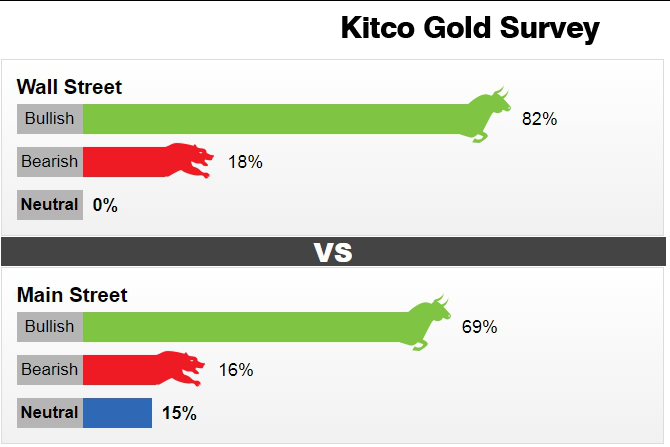

· Voters in the weekly Kitco News gold survey remain bullish on the yellow metal for next week, with traders and analysts citing ongoing worries about the economic fallout from the coronavirus that hit China, with a small number of cases now making their way to other countries.

· Palladium lost 0.1% to $2,276.81 an ounce, silver fell 1.2% to $17.82, and platinum rose 0.1% to $957.06.

Reference: Reuters, FX Street, Kitco