· Gold prices edged higher on Thursday after the U.S. Federal Reserve Chair’s remarks that the new coronavirus outbreak could impact China’s economy in the short term boosted the safe-haven metal’s appeal.

Spot gold rose 0.1% to $1,577.64 per ounce by 0613 GMT and U.S. gold futures gained 0.5% to $1,577.90.

· “The Fed acknowledged the new risk (coronavirus) that has come to the market scenario, and said it didn’t see 2% as a ceiling for inflation. In other words, it could continue cutting rates even if inflation remained higher,” said Michael McCarthy, chief market strategist at CMC Markets.

· Gold gained 0.7% on Wednesday after the U.S. Federal Reserve held interest rates steady and Chair Jerome Powell said the central bank was not satisfied with inflation running below 2% and that it is not a ceiling.

· Powell acknowledged the risks of any short-term slowdown in China due to the virus, which has claimed 170 lives so far. The World Health Organisation (WHO) will reconvene on Thursday to decide whether the epidemic constitutes a global emergency.

Among equities, Asian stocks slipped to seven-week lows on worries about the fast-spreading virus.

Limiting gold’s advance, the dollar held close to a near two-month high hit on Wednesday, against a basket of currencies.

· “At a minimum, gold will remain bid until the Wuhan flu becomes a transitory event. Still, with an array of risks simmering on the back burner, gold should remain in demand for the foreseeable future,” Stephen Innes, chief market strategist at AxiCorp, said in a note.

· Holdings of the world’s largest gold-backed exchange-traded fund, SPDR Gold Trust, rose 0.5% to 903.50 tonnes on Wednesday.

· Gold: Modestly flat around $1575, trade/coronavirus in the spotlight

Gold prices wait for clues to extend the earlier recovery while taking rounds to $1,575 amid Thursday’s Asian session. The yellow metal recently recovered after the Fed reiterated its dovish stance while worries surrounding China’s coronavirus keep the risk-tone heavy. Also contributing to the risk aversion were trade headlines from the White House.

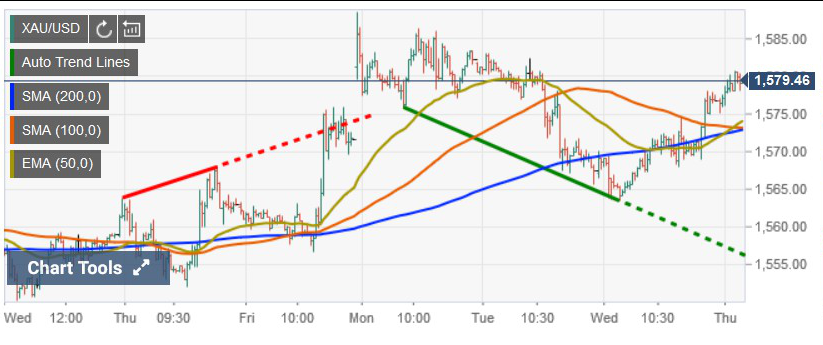

Technical Analysis

An ascending trend line from January 14 and 21-day SMA restrict the bullion’s near-term declines near $1,560 whereas $1,600 holds the key to the further upside.

· Palladium shed 0.8% to $2,2269.58 an ounce. The autocatalyst metal has gained nearly 18% so far this month, having hit a record high of $2,582.18 on Jan. 20, on supply worries.

Silver was up 0.3% at $17.59, while platinum was down 0.8% to $966.51.

Reference: Reuters, FX Street