· Gold prices rose to their highest in more than two weeks on Monday as equities slipped on growing concerns that a China virus outbreak could impact that nation’s economy, prompting investors to dump riskier assets and look for safe havens.

Spot gold rose 0.6% to $1,579.42 per ounce by 0633 GMT. Earlier in the session, prices rose to their highest since Jan. 8 at $1,586.42.

U.S. gold futures climbed 0.5% to $1,579.50.

Asian stocks slipped as the coronavirus killed 81 people and infected more than 2,700 in China, with residents of Hubei province, where the disease originated, banned from entering Hong Kong amid global efforts to halt the rapid spread.

· Investors are “looking out for the new risk (coronavirus) coming into the markets and running for the exits in equity markets, that’s the cause for gold to move higher,” Stephen Innes, chief market strategist at AxiCorp, said.

“The virus is going to hurt the Chinese economy to a certain degree,” he added.

The outbreak has curbed Lunar New Year celebrations in China, when hundreds of millions of people would normally be travelling around the country, and also led the government to extend the holidays to Feb. 2 as a preventive measure.

Gold is considered a safe investment during times of political and economic uncertainty.

· “The continuation of the gold rally will rely on developments for good, or for ill, of the Wuhan virus situation,” Jeffrey Halley, senior market analyst, OANDA, said in a note.

“From a resistance point of view, the next level to watch is $1,600 an ounce.”

· Meanwhile, the yen rose on worries that authorities are struggling to contain the outbreak.

· Investors now await the U.S. Federal Reserve’s first policy meeting of the year scheduled on Jan. 28-29, where it is widely expected to keep rates unchanged.

Hedge funds and money managers cut their bullish positions in COMEX gold contracts in the week to Jan. 21, data showed on Friday.

· Silver rose 0.4% to $18.16, having earlier touched its highest since Jan. 8 at $18.32.

· Palladium dipped 1.7% to $2,387.19 an ounce, while platinum fell 0.5% to $996.15.

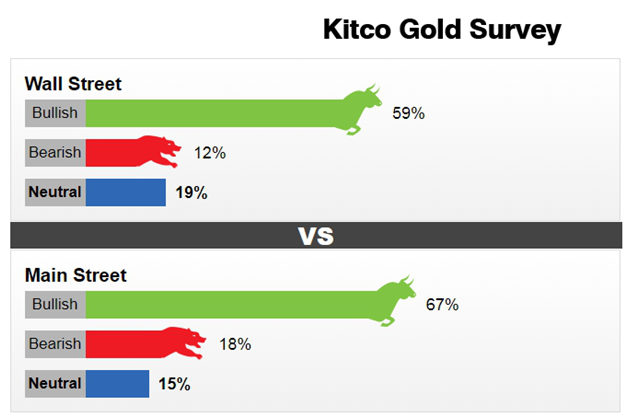

· The gold market is struggling to find momentum as it treads water around a critically important technical area; however, sentiment in the marketplace is still significantly bullish among both Main Street investors and Wall Street analysts.

According to comments from analysts in the Kitco News weekly gold survey, financial uncertainty, driven by the unknown impact of the rapidly spreading coronavirus will continue to supporting safe-haven demand for the precious metal.

Many economists are worried that the spread of the virus through China will lead to slower economic growth, which could have global implications.

“Gold typically rises on geopolitical risks and other surprising and uncontrollable risks. The coronavirus is likely to be a driving force for higher gold prices,” said Kristina Hooper, chief investment strategist at Invesco.

Adrian Day, chairman and chief executive office Adrian Day Asset Management, said that he is bullish on gold as sentiment and momentum are on gold’s side.

“Impeachment, a shaky stock market, clueless central banks; nothing in the current environment is negative for gold,” he said.

Not only is market uncertainty creating episodic momentum for gold prices, but the market has a strong floor as next week the Federal Reserve is not expected to shift from its firmly neutral stance on monetary policy.

“The Fed will remain on hold and that could weigh on the U.S. dollar, which is at critical resistance levels,” said Charlie Nedoss, senior market strategist with LaSalle Futures Group. “The current interest rate structure support gold very well.”

· Gold resumed its uptrend after a week of consolidation as it gained $14 to make a new closing high on the weekly timeframe . Chunk of the gains came from yet another fresh fear of a possible outbreak of an epidemic (caused by coronavirus) in China which could spillover worldwide, an event compared to the 2003 SARS virus case which also had the epicenter in China. The ongoing Impeachment hearings in the U.S added to the delight of the bulls as uncertainty forced minor risk off. Fundamentals are largely in favor of the bulls while technicals are steady keeping the trend intact. To watch this week – Fed meeting, Bank of England meeting, GDP figures and other important economic data.

On the chart –

Gold climbed higher majorly on fears of an epidemic as coronavirus kept the death toll active with cases spreading worldwide making another bullish candle after a minor consolidation. Fundamentally gold is looking stronger and stronger on weekly basis as the risks are constantly renewing (they never seem to stay put) pulling the technicals along which have turned bullish again after a little break. We have 2 scenarios –

1. Gold closed above the support, till this is held it can go to $1581. If this is crossed it can move towards $1597. And if this is taken out it can rally to $1616.

2. Short trades remain unattractive in a bullish environment except scalp trades.

· FX Street: Gold kick-starts the week with bullish gap-up to $1589 as coronavirus fuels risk aversion

Gold prices remain positive while taking rounds to $1,583, following the intra-day high of $1588.70 flashed at the week’s start, amid Monday’s Asian trading session. The yellow metal recently benefited from fears of China’s coronavirus outbreak while worries headlines from the Middle East as well as concerning the global trade add to the risk aversion.

Technical Analysis

Gold prices need to stay strong beyond $1,589 to aim for $1,600 and the monthly top surrounding $1,612, failing to do so can recall a 21-day SMA level of 1,555 back to the charts.

Reference: Reuters, Kitco, TradingView,FX Street