· The safe-haven yen held firm and riskier Asian currencies softened a little on Wednesday, as currency investors awaited the signing of the U.S.-China trade deal with trepidation.

The formal agreement is aimed at drawing a line under 18 months of tit-for-tat tariff hikes that have hurt global growth, but it will not end the trade dispute between the world’s two largest economy.

U.S. Treasury Secretary Steven Mnuchin said existing tariffs on Chinese goods would stay, pending further talks.

That pulled China’s yuan below Tuesday’s six-month peak and lifted the Japanese yen from a seven-month low, as traders reckoned on few further benefits from the agreement.

The yuan is the currency most sensitive to Sino-U.S. trade relations, and it retreated 0.2% to 6.8942.

The yen was nearly 0.1% firmer at 109.88. The euro was steady at $1.1132 and the Swiss franc held on to overnight gains to sit at 0.9672 per dollar.

The trade-exposed Australian and New Zealand dollars each eased, with the Aussie last 0.1% lower at $0.6898 and the kiwi a fraction weaker at $0.6612. Against a basket of currencies the U.S. dollar held at 97.339.

· China will release GDP growth data for 4Q19 next week. In line with the long-term trend, China's GDP growth in 3Q dropped to +6.0% (previously +6.2%). However, the growth slowed somewhat more than before during the first three quarters of 2019, under the negative impact of the trade conflict. Against this backdrop, China's government has taken considerable fiscal and monetary policy support measures.

Based on our model, we expect a further weakening of GDP growth momentum to +5.8% in 4Q19. However, the outlook for 2020 has improved, due to the signing of a Phase 1 agreement with the US expected next week, as well as the government stimulus measures taken in 2019. Lending has already responded to this with a sharp increase in momentum in 4Q19. Sentiment in the manufacturing sector has also found a bottom. The sustained strength of the renminbi against the US dollar since September 2019 shows that financial market confidence in China's growth prospects has also increased. Against this background, we expect China's growth momentum to accelerate slightly from 1Q20 onwards. An acceleration of China's growth should also have a positive impact on the growth of other emerging economies. In our opinion, this should also benefit the Eurozone's foreign trade.

· China fourth quarter growth seen hovering at 6.0%, more policy support expected: Reuters poll

The world’s second-largest economy is expected to have grown 6.0% in October-December from a year earlier, according to analysts polled by Reuters, unchanged from the previous quarter’s pace, which was the slowest since 1992 - the earliest quarterly data on record.

Forecasts by 65 analysts polled by Reuters ranged from 5.8% to 6.3% for the fourth quarter.

On a quarterly basis, growth likely stayed at 1.5% in Oct-Dec, also the same pace as in the preceding period, analysts said. The data will be released on Friday (0200 GMT).

Better-than-expected GDP readings could lift stocks and global commodity prices, and boost the yuan CNY=CFXS, which has already strengthened to multi-month highs in January on optimism over the U.S.-China trade deal.

· Germany will release a first estimate of GDP growth for the full year 2019 next week (January 15).

Triggered by the global trade conflict and structural problems in the automobile sector, we expect Germany's GDP growth to have fallen to +0.5% in 2019 (2018: +1.5%). However, as there are signs of an economic upswing on the global level, we forecast that GDP growth in Germany will accelerate to +1.0% in 2020.

· US labor market remains strong, with no signs of overheating

Overall, the figures in the December labor market report remained somewhat below market expectations. The number of newly created nonfarm payrolls amounted to 145,000, while the market had expected 160,000. In addition, the figures for the two previous months were revised downwards by a total of 14,000. The unemployment rate remained unchanged at the lowest level of 3.5%. Wage growth was weaker than expected. Average hourly wages rose by only 0.1% m/m, compared to the 0.3% forecast by the market. Although growth in the previous month was revised slightly upwards, the annual growth rate of 2.9% still remained well below market expectations of 3.1%.

Overall, the labor market remains strong without showing any signs of overheating. Although the new jobs created did not meet expectations, on average over the last two months employment rose by 200,000, which is significantly higher than the growth in the labor force. This means that the labor market is still becoming tighter. However, this is still not leading to any acceleration in wage growth. So there is no reason for the US Fed to intervene. As a result, the current figures should be digested quickly by capital markets.

· U.S. President Donald Trump said he agreed with a comment by British Prime Minister Boris Johnson that a “Trump deal” should replace the Iran nuclear deal.

“Prime Minister of the United Kingdom, @BorisJohnson, stated, ‘We should replace the Iran deal with the Trump deal,’” Trump said in a posting on Twitter late on Tuesday. “I agree!”

Johnson, who has praised Trump as a great dealmaker, called on Tuesday for the president to replace the Iranian nuclear deal with his own new pact to ensure the Islamic Republic does not get an atomic weapon.

· US-CHINA TRADE DEAL

US and Chinese officials are expected to sign “phase 1” of their multi-sequential trade deal as part of a broad process of de-escalation as the economic conflict continues to weaken investment and the industrial sector. Significant progress on “Phase 2” will not likely be made until after the US Presidential election, according to Donald Trump. Palladium prices may rise if the commentary from officials strike an optimistic tone.

· The Bank of Japan cut its economic assessment for three of the country’s nine regions on Wednesday but remained cautiously optimistic that still-solid domestic demand could help offset a slowdown in exports and manufacturing.

All of the regions kept their assessment on private consumption unchanged, despite fluctuations in spending patterns around the Oct. 1 tax hike, likely backing the BOJ’s rosy view that solid domestic demand will offset external headwinds.

· Oil prices could plummet toward $40 per barrel if the Iranian regime collapses, according to the chairman of an energy research institute.

Johannes Benigni, chairman of JBC Energy, made the comments on CNBC’s “Capital Connection” amid continuing unrest in Iran. Demonstrations erupted on Saturday and have continued for three days since, following the government’s announcement that its military was responsible for shooting down a Ukrainian passenger plane.

Protesters reportedly chanted slogans including “they are lying that our enemy is America, our enemy is right here,” outside a university in Tehran.

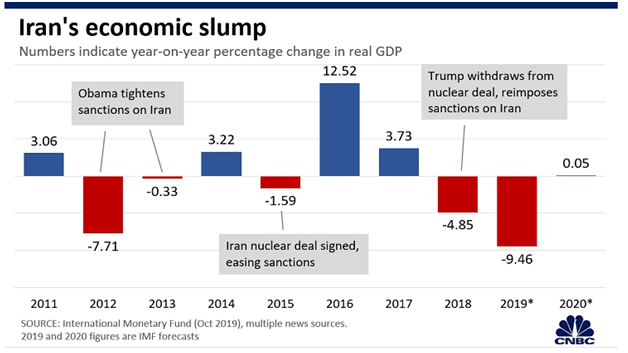

Iran’s economy has also been under immense pressure from U.S. sanctions that were reimposed after President Donald Trump withdrew from the 2015 nuclear deal.

JBC Energy’s Benigni said a change in leadership in Tehran would have a major impact on energy prices.

“For the oil market, it would mean that the likelihood of oil prices dropping towards $40 is very high,” he said on Tuesday.

· Oil prices could plummet toward $40 per barrel if the Iranian regime collapses, according to the chairman of an energy research institute.

Johannes Benigni, chairman of JBC Energy, made the comments on CNBC’s “Capital Connection” amid continuing unrest in Iran. Demonstrations erupted on Saturday and have continued for three days since, following the government’s announcement that its military was responsible for shooting down a Ukrainian passenger plane.

· Oil prices slipped on Wednesday on concerns that the pending Phase 1 trade deal between the United States and China, the world’s biggest oil users, may not boost demand as the U.S. intends to keep tariffs on Chinese goods until a second phase

U.S. Treasury Secretary Steven Mnuchin said late on Tuesday that tariffs on Chinese goods will remain in place until the completion of a second phase of a U.S.-China trade agreement, even as both sides are expected to sign an interim deal later on Wednesday.

Brent crude LCOc1 was down 16 cents, or 0.3%, at $64.33 per barrel by 0745 GMT. U.S. West Texas Intermediate crude futures CLc1 were down 15 cents, or 0.3%, at $58.08 a barrel.

Reference: Reuters, CNBC,FXStreet