· Hopes that Iran and the US will not escalate their conflict prompted gold prices to fall after surging earlier.

· Gold fell overnight, having surged past the key $US1,600 level for the first time in seven years in the last session, as markets wagered the United States and Iran will not resort to a further conflict, boosting risk-taking.

· Spot gold fell 0.2 per cent to $US1,552.28 per ounce, having earlier slipped to $US1,539.78 an ounce. US gold futures settled down 0.4 per cent at $US1,554.3 per ounce.

· "The return of risk appetite meant that safe assets such as gold have suffered from some profit-taking and it's possible that could continue for a little longer," Standard Chartered Bank analyst Suki Cooper said.

· Gold prices slid after having risen as much as 2.4 per cent early on Wednesday to break above the key $US1,600 level after Iran's retaliatory attacks on military bases housing US troops in Iraq.

· Concerns of a wider war in the Middle East subsided after US President Donald Trump refrained from ordering more military action on Wednesday and Iran's foreign minister diplomat said missile strikes "concluded" Tehran's response.

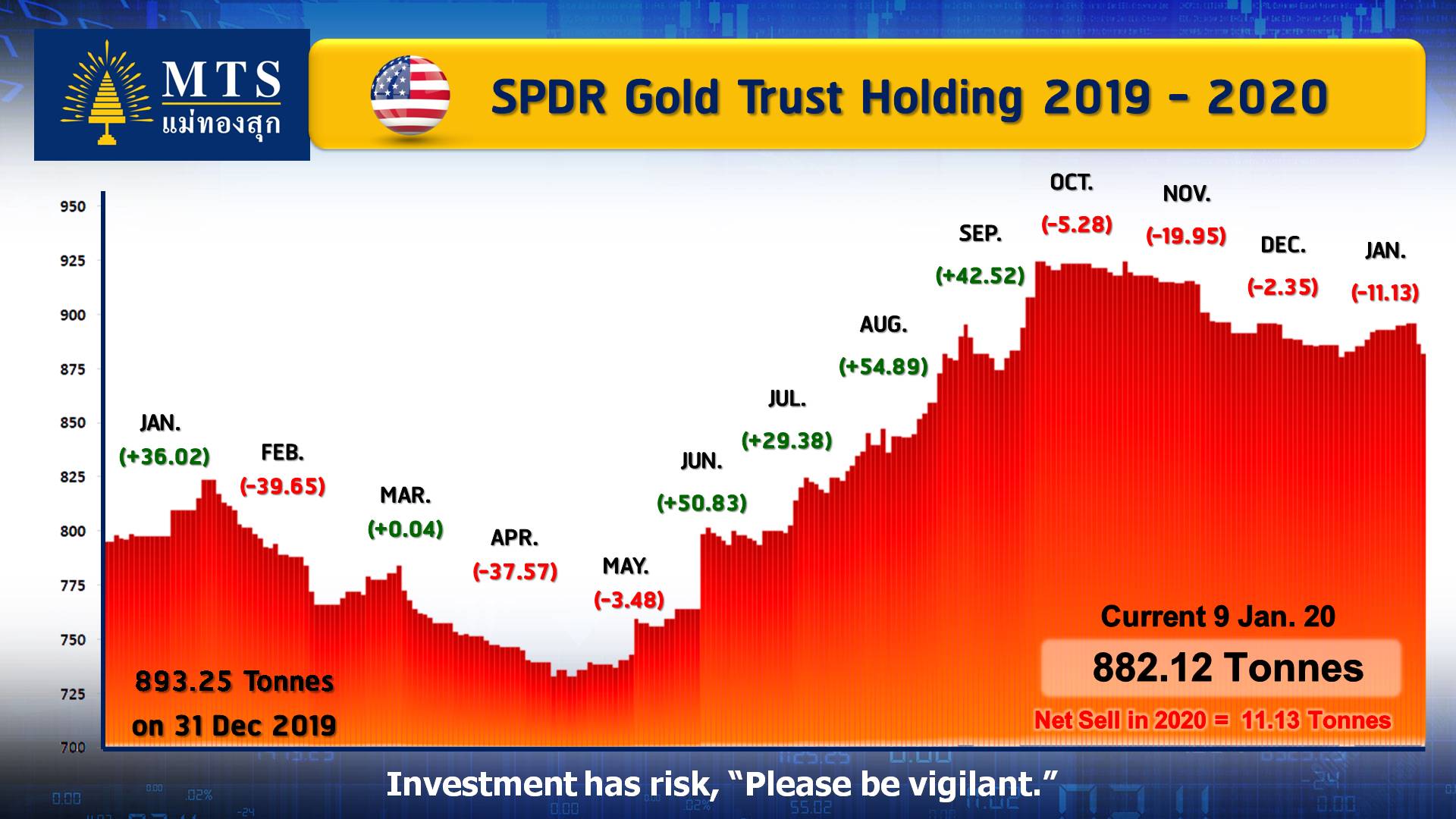

· Reduced demand for safe-haven bullion was also reflected in the holdings of the world's largest gold-backed exchange-traded fund SPDR Gold Trust, which dropped 1.05 per cent on Wednesday.

· "Gold will remain very twitchy on Iran-related headlines or rocket fire in Baghdad for some days to weeks," said Tai Wong, head of base and precious metals derivatives trading at BMO.

"Even if the de-escalation happens there should still be some risk premium helping gold hold above $US1,525 level where gold was trading before the US strike."

· As the United States and Iran backed away from conflict in the Middle East, US stock indexes hit record highs, while firming optimism about a US-China trade deal added to the upbeat mood.

· China's Vice Premier Liu He will sign a Phase 1 deal in Washington next week, the commerce ministry said on Thursday.

· Elsewhere, palladium hit a record peak of $US2,149.50 an ounce on sustained supply concerns, and was last down 0.4 per cent at $US2,096.06 per ounce.

· "The outlook for palladium remains bullish. There is simply not enough material around and being taken out of the ground," said BMO's Wong said.

"The demand is really inelastic because substitution (with platinum) is difficult and if you are an automaker you need the catalytic converters to sell cars, so you will pay what you need."

· Silver fell 1.0 per cent to $US17.90 per ounce, while platinum gained 1.2 per cent to $US964.82.

Reference: Business News