· Gold prices retreated on Tuesday from near seven-year highs reached in the previous session as investors took profits in the absence of new developments in the tense situation between the United States and Iran.

Deficit-hit palladium meanwhile hit another record peak on the back of prolonged supply constraints in the market.

Spot gold was down 0.1% at $1,564.31 per ounce as of 1257 GMT, having fallen as much as 0.7% earlier in the session. It touched its highest since April 2013 at $1,582.59 on Monday.

U.S. gold futures were 0.2% lower at $1,566.00.

"There is nothing fundamental going on here, it is just a reaction to yesterday's price movement. Investors are looking at the other side of the coin and taking some profits," ABN Amro analyst Georgette Boele said.

The market seems a little more relaxed about the situation in the Middle East, she added.

With both sides exchanging threats of retaliation, a senior Tehran official said on Tuesday Iran had been considering 13 "revenge scenarios" in retaliation to the air strike.

Washington's decision to deny a visa to Iranian Foreign Minister Mohammad Javad Zarif had added to concerns, he said.

Zarif was expected to arrive in New York for a United Nations Security Council meeting on Thursday.

The surge in palladium prices is predominantly due to speculative buying, and the "higher the prices go, the sharper the correction will be", Commerzbank's Fritsch said.

Silver slipped 0.6 % to $18.03 an ounce, after touching a more than three-month high of $18.50 in the previous session, while platinum advanced 0.6% to $968.50.

Elsewhere spot palladium rose 0.6% to $2,042 an ounce, having touched an all-time peak of $2,047.24 earlier in the session.

· Gold price scales $1,600 after Iran attacks US military base

Gold futures jumped after reports of rocket attacks on a US military base in Iraq, hitting fresh six year highs.

Gold for delivery in February touched $1,613.30 an ounce, up $39 an ounce from the settlement price at the end of regular trading on Tuesday.

· UBS said the current backdrop is “quite supportive for gold,” looking for the metal to average around $1,600 an ounce this year, although analysts also offered some caution about the early-year gains. Heightened U.S.-Iran tensions on Monday sent gold to a roughly seven-year high, before the metal pulled back some. “Macro factors are boosting gold's appeal as a hedge against uncertainty and a diversifier for investor portfolios,” UBS said. “Seasonally, January also tends to be a strong period for gold due to a combination of physical demand in China ahead of the Lunar New Year holidays and investor allocations are built as portfolios are rebalanced at the start of the year. Our base case is for gold to trade through and average around $1,600 this year.”

· Gold could hit $1,600 an ounce if Middle East tensions continue or get worse, said TD Securities. The metal is consolidating early Tuesday but soared Monday on worries about a military conflict between Iran and the U.S. “The serious escalation in tensions between the U.S. and Iran, after a U.S. raid near [the] Baghdad airport killed General Qassem Soleimani — a politically important head of Iran's elite Islamic Revolutionary Guard Corps' Quds Force — drove investors towards safe havens and away from risk assets,” TDS said. There is a fear that that Iran will retaliate against U.S. interests, plus worries that there is now “a permanent increase in the Middle East tensions,” TDS said. This can lead to “sky-high” oil prices and slower global growth, signals which Monday prompted investors to send gold to its highest since April 2013, TDS said. “The risk of increasing geopolitical tensions and a potential negative supply shock originating from the oil market could well mean that gold can move north of $1,600 should tensions escalate further, which also would help to send the rest of the precious metals complex to new multi-year highs,” TDS said.

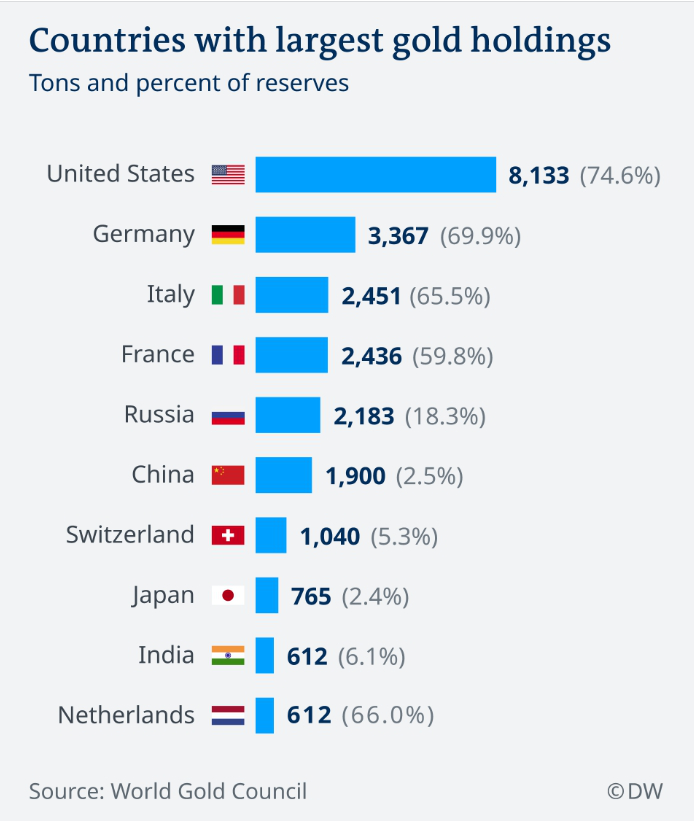

· "Gold has a long track record of being an effective store of value," Alistair Hewitt, Director of Market Intelligence at the World Gold Council, told DW. "Gold historically benefits from flight-to-quality inflows during periods of heightened risk and, by providing positive returns and reducing portfolio losses, gold has been especially effective during times of systemic crisis when investors tend to withdraw from stocks."

· There’s a golden opportunity in the precious metal right now, and it’s not going away.

That’s what two analysts are saying about gold after it hit its highest level since April 2013 on Monday. U.S.-Iran tensions have given a new kick to a rally that began in the last weeks of 2019. The price of gold was down slightly Tuesday morning.

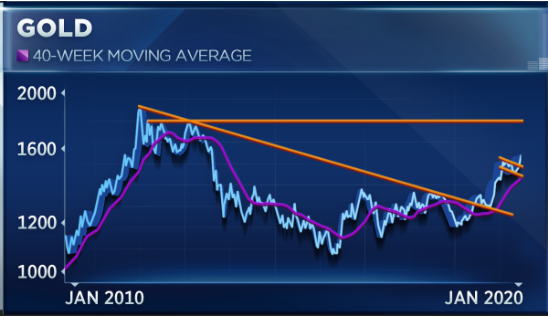

Piper Sandler chief market technician Craig Johnson thinks gold has another 12% to go. He notes that stocks have stabilized and were rising with gold — an “interesting” trend to note — and that charts of gold point to even more gains.

“I look at this chart of gold and it looks like to us we can trade as high as $1,760,” Johnson said Monday on CNBC’s “Trading Nation.” “I don’t think this trade is over for gold, and I would have a little slice of this in everyone’s portfolio.”

Reference: CNBC, Reuters, Kitco, DW, Mining