· Gold prices fell on Monday as investors turned to riskier assets on signs of economic growth following reports of an expanding Chinese factory sector and as a rising dollar reduced demand.

Spot gold was down 0.3% at $1,459.94 per ounce, as of 0645 GMT. Prices earlier touched their highest since Nov. 22. U.S. gold futures shed 0.5% to $1,466.

An unexpected expansion in factory activity during November in China, the world's second-largest economy and biggest gold user, spurred investors into equity markets. This followed official government data on Saturday that also showed an expansion.

· "Positive data from China creates an optimism that the Chinese market is improving, that gives people confidence to invest in riskier assets, and in turn, reduces the safe-haven demand for gold," said Hareesh V, head of commodity research at Geojit Financial Services.

· Investor demand for gold was further pressured by the rising dollar, which makes dollar-denominated gold more expensive for buyers using other currencies.

The uncertainty around a resolution to the 17-month-old trade dispute between the United States and China has supported gold, with reports that a preliminary agreement has now stalled because of U.S. legislation supporting protesters in Hong Kong and Chinese demands that the United States roll back its tariffs as part of phase one deal.

· "Nothing particularly has really changed (on the trade front) from last week, the market remains in the dark about how things will progress. Investor appetite for gold is just waning a little bit on lack of direction," ANZ analyst Daniel Hynes said.

Gold has risen more than 13% this year mainly due to the trade dispute war driving demand for safe assets.

· "The fundamentals are still quite supportive, this lull is not going to last too much longer. Maybe into year end we will see gold prices recommit the uptrend we saw earlier this year," Hynes said, adding until then gold will trade between $1,450-$1,500.

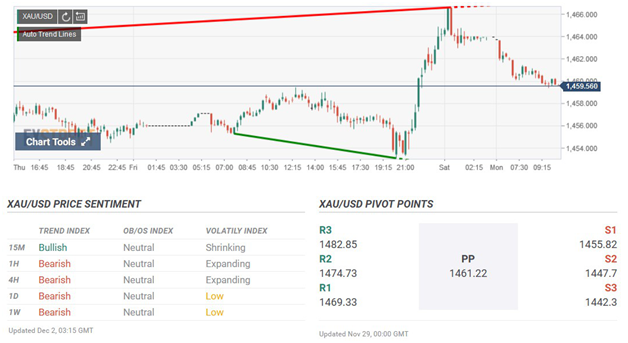

· Spot gold may test a support at $1,455 per ounce, a break below which could cause a fall to $1,440, according to Reuters technical analyst Wang Tao.

· Gold prices failed to sustain Friday’s upside break of 100-day Exponential Moving Average (EMA) while taking rounds to $1,462 amid Monday’s Asian session. That said, the bullion also seems to ignore the recent trade negative news from Axios.

Technical Analysis

Unless providing a sustained break of 100-day EMA level of $1,463.50 prices remain on the sellers’ radar. In doing so, $1,450 and the previous month low near 1,445 can be observed as immediate supports.

· Elsewhere, silver fell 0.6% to $16.93 per ounce, platinum shed 0.5% to $896 and palladium was down 0.2% at $1,838.15.

Reference: Reuters,FXStreet