· Gold prices gained on Friday as markets awaited further developments on U.S.-China trade talks after Beijing said it would retaliate against Washington for passing a law in support of Hong Kong protesters.

However, the metal was on track for its biggest monthly decline since June 2018.

· Spot gold was up 0.4% at $1,463.59 an ounce as of 01:56 p.m. ET (1856 GMT). It has shed around 3.3% this month. U.S. gold futures settled 0.6% higher at $1,470.20 per ounce.

China warned on Thursday it would take "firm counter measures" in response to U.S. legislation backing anti-government protesters in Hong Kong.

· "(The signing of the bill) takes another step back at the possibility of a trade agreement with China, which really upset them quite a bit. That is why we saw equities come off and gold futures push up," said Phillip Streible, senior commodities strategist at RJO Futures.

Investors have been optimistic about an imminent "phase-one" trade deal between the world's two largest economies, lifting world stocks to record levels and dampening demand for safe haven assets such as bullion.

Gold, a hedge during times of financial or political uncertainty, pays no interest or dividends and costs money to store and insure.

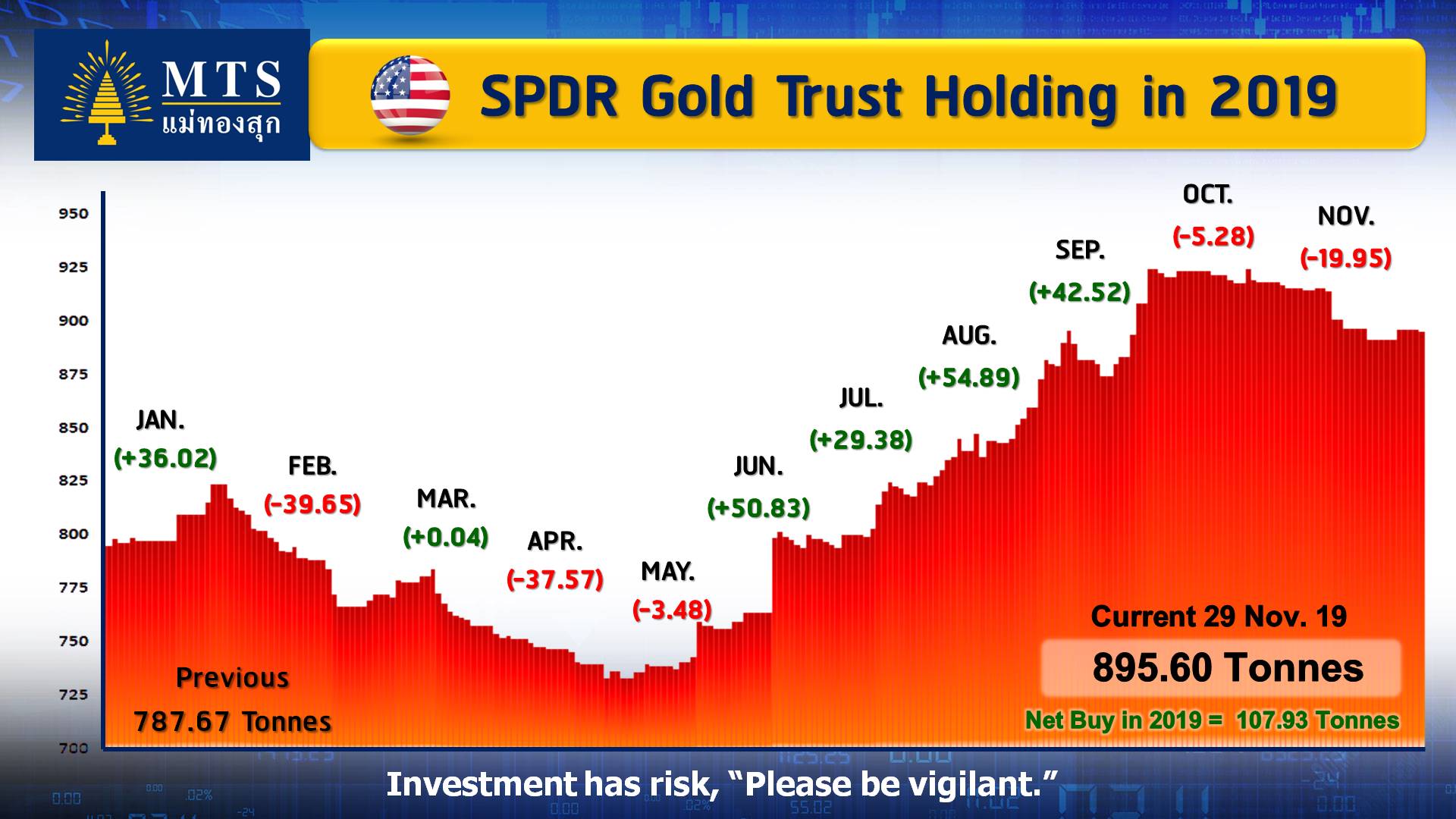

However, gold prices were still on track for their best year since 2010, having gained 13.5% so far in 2019. Uncertainties surrounding the long-drawn trade war and recessionary fears have provided support.

· "Gold has managed to hold above $1,450 since there is some bargain hunting. This is a good entry level for the ones who missed out previously," said UBS commodity analyst Giovanni Staunovo.

Investors are closely watching U.S. data for signs on the health of the world's largest economy, which could influence the U.S. Federal Reserve in its decision on further monetary easing.

Reduced expectations of further interest rate cuts by the Fed has weighed on spot gold prices, RJO Futures' Streible added. "We could go down to $1,425 by the end of the year."

· Among other precious metals, silver gained 0.8% at$17.01 an ounce. Platinum dropped 0.7% to $895.25 in the session, but extended gains for a third straight week.

Palladium was steady at $1,840.52 per ounce. The autocatalyst metal notched a fresh high of $1,844.50 earlier in the session and was on track for a fourth consecutive monthly gain.

Reference: Reuters