· Gold prices rose on Thursday as investors bought the safe-haven metal on doubts about whether the United States and China will seal a trade deal after President Donald Trump signed a legislation supporting Hong Kong protesters.

Palladium retreated slightly after hitting an all-time peak of $1,836.61 earlier in the session.

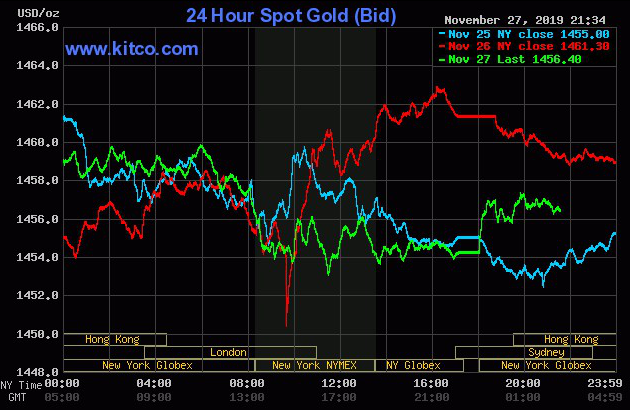

Spot gold was up 0.1% at $1,455.63 per ounce by 0659 GMT. U.S. gold futures rose 0.1% to $1,454.80.

· Trump on Wednesday signed a legislation into law that requires the State Department to certify, at least annually, that Hong Kong retains enough autonomy to justify favourable U.S. trading terms.

Beijing condemned the move and said it would take "firm counter measures."

· "With the latest developments of Trump signing the Hong Kong bill, there are doubts that there will be any deal, even a first phase," said Jigar Trivedi, a commodities analyst at Mumbai-based Anand Rathi Shares & Stock Brokers.

"Even though they've said they will sign a deal by year-end, they've not talked about the venue, or who will go to whom. So, I don't think the trade deal will be signed so easily and gold will be supported."

· Asian shares fell, while the safe-haven yen rose against the dollar on concerns that the protracted tariff dispute between the world's two biggest economies could become more complicated.

· Gold eased 0.5% in the last session on a raft of upbeat economic data from the United States. Economic growth picked up slightly in the third quarter, weekly jobless claims fell, while new orders for key U.S.-made capital goods increased.

· "Global growth concerns have definitely eased, but not gone," said John Sharma, an economist at National Australia Bank, adding gold would remain supported even if an interim deal is passed since the most complex issues, such as intellectual property, have been pushed down the road.

Gold, considered a safe store of value during economic or political uncertainties, has gained more than 13% this year, mainly due to the tariff dispute.

· Gold technical analysis: Impending bear cross favors drop to $1,445

Gold is currently trading at $1,457, representing a 0.20% rise on the day.

The moderate gain, however, could be short-lived as the impending bear cross between the 50- and 100-day moving averages is likely to invite stronger chart-driven selling.

At press time, the 50- and 100-day averages are located at $1,486 and $1,484, respectively. The bearish crossover looks set to happen in the next day or two.

The lower high at $1,475 established on Nov. 20 indicates the path of least resistance is to the downside.

· Technically, December gold futures bears have the overall near-term technical advantage as prices have been trending lower for 11 weeks. Gold bulls' next upside near-term price breakout objective is to produce a close above solid technical resistance at $1,500.00. Bears' next near-term downside price breakout objective is pushing prices below solid technical support at $1,425.00. First resistance is seen at this week’s high of $1,462.90 and then at $1,475.00. First support is seen at this week’s low of $1,449.60 and then at the November low of $1,446.20. Wyckoff's Market Rating: 4.0

· There was a lot of fear in the market because we were only a couple of months removed from gold's lowest price since 2016.

But I wasn't afraid...

In fact, I called for $1500 per ounce of gold in 2019. In August, it hit my target.

Now, the price has retreated a bit since, but I believe $1500 is only the beginning for gold.

I expect gold to take out its previous high of $1900. That's about a 30% gain from here. And I expect that to happen in 2020.

In fact, as I told Kitco News recently, from there I see it hitting $2200 – about a 50% rise from its current price of around $1470 per ounce.

Political dysfunction and ballooning deficits also set the stage for gold today. The three largest central banks in the developed world recently declared they'll do anything to stimulate their economies. That's central bank lingo for "create more money".

· Among other precious metals, palladium shed 0.1% to $1,831.69 per ounce.

The autocatalyst metal used in vehicle exhaust systems to reduce harmful emissions has risen about 45% this year on a supply crunch.

"Strong demand from China and sluggish supply growth have tightened palladium's physical market this year...," ANZ said in a note.

Platinum was flat at $892.95 per ounce and silver rose 0.1% to $16.96 per ounce.

Reference: Reuters, FX Street, Kitco